Wildly Costly After Q2 Earnings Surge

[ad_1]

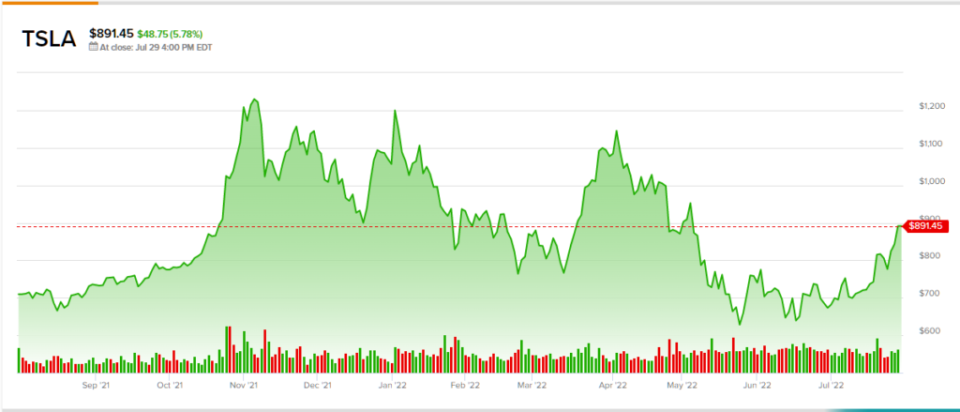

Shares of Tesla (TSLA) are beginning to actually warmth up once more, up greater than 30% in July. Fueling the bounce was Tesla’s spectacular second-quarter beat and the aid rally skilled by the broader tech sector. Although the 57% earnings pop was spectacular, the valuation stays extremely stretched. Additional, buyers could underestimate the potential for a steep slide because the world economic system tilts right into a recession.

Not to remove from the unbelievable efforts of Elon Musk and firm, however 12.1 instances gross sales is simply too excessive a value for an automaker that faces a wave of hungry rivals over the approaching decade.

Current feedback from the Federal Reserve following one other 75 bps price hike have been soothing to buyers proudly owning high-multiple development shares. Whereas the assembly might spark a aid rally in probably the most beaten-down names, Tesla’s long-term roadmap might show very bumpy.

Few corporations, particularly automakers, are immune from the consequences of an financial contraction.

Tesla Inventory Clocks in One other Spectacular End result

Tesla is making beating on earnings a behavior. The most recent beat was powered by increased common promoting costs and robust car deliveries. Demand for Tesla’s scorching line of EVs would not appear to sign {that a} recession is on the horizon. Whether or not Tesla’s quarterly energy bodes effectively for the prosperous client (who’s much less rattled by inflation) stays to be seen.

In any case, Tesla seems to be to have the momentum of a freight prepare as we head right into a interval of financial sluggishness. Whether or not Tesla’s gross sales momentum can carry it via this recession is the million-dollar query.

Tesla stays the king of EVs, placing it on the precise aspect of a robust secular electrification pattern that would span a few years to come back. After such quarterly energy, it definitely appears that secular tailwinds are stronger than financial headwinds.

A robust model, a powerful lineup of autos, and top-of-the-line applied sciences have been differentiating elements that would act as some form of moat across the agency’s share of financial income within the red-hot EV market.

Revenues and margins appear to be on the uptrend. As Tesla’s Superchargers proceed rolling out throughout the nation (after which the world), an rising variety of customers will likely be keen to go electrical with their subsequent car buy.

Tesla Inventory: Well worth the Premium Worth Tag?

Regardless of the highly effective secular traits, I don’t view Tesla’s moat as impenetrable. Tesla stands out as the EV chief immediately, but it surely’s unsure whether or not Elon Musk’s empire can retain the throne 10 years from now. As conventional automakers go electrical and turn out to be extra tech-like, Tesla inventory could face a substantial valuation a number of contraction.

Alternatively, the electrifying automakers — suppose Ford (F) — is perhaps rewarded with a considerable a number of growth. I might argue that the previous case is extra possible. The argument for Tesla’s premium a number of has been that the agency is a tech firm that makes autos somewhat than an auto firm with cool tech.

Positive, Tesla has intriguing applied sciences working behind the hood, however are such options and performance replicable by different automakers who’re beckoning in high tech expertise? In all probability. The enjoying area is sure to even via the last decade, and I might argue that Tesla could not have the ability to widen the lead over its rivals.

Tech titan Apple (AAPL) has been rumored to be entering into the auto enterprise for fairly a while now. At the moment, the rumor mill is pointing to an all-electric and autonomous car that will launch within the latter a part of this decade.

As one of the crucial progressive expertise corporations on the planet, a transfer into the auto business might weigh closely on Tesla’s financial moat. Apple has the model and tech to outdo virtually any rival it chooses to combat over market share.

All it took was one easy change in its iOS working system to wreak havoc on social media corporations. Apple’s advert enterprise is comparatively small immediately, however the transfer could lay the inspiration for a much bigger push sooner or later, maybe as soon as the metaverse goes mainstream.

Apple’s entry into auto represents a high risk for Tesla, and I do not suppose the risk is factored in at present valuations. Positive, Apple’s a few years away from launching a automobile, however when it does, Tesla’s finest days could fall into the rear-view mirror.

Wall Road’s Tackle Tesla

Turning to Wall Road, Tesla has a Average Purchase consensus score based mostly on 18 Buys, 6 Holds, and seven Sells assigned prior to now three months. The typical Tesla value goal of $872.28 implies a modest 3.5% upside potential. Analyst value targets vary from a low of $73.00 per share to a excessive of $1,580 per share. (See TSLA inventory forecast on TipRanks)

Takeaway: The Valuation Is Too Excessive Relative to the Dangers

Tesla is doing virtually all the pieces proper lately. As we transfer right into a recession, it might be harder to proceed blowing away the outcomes. Additional, aggressive threats are poised to extend meaningfully over the following six years. Auto rivals and tech corporations might discover themselves respiratory down Tesla’s neck. That does not bode effectively for the wealthy a number of.

To search out good concepts for EV shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The knowledge contained on this article represents the views and opinion of the author solely, and never the views or opinion of TipRanks or its associates, and needs to be thought-about for informational functions solely. On the time of publication the author didn’t have a place in any of the securities talked about on this article.

Source link