Enterprise capital’s silent crash: when the tech increase met actuality

[ad_1]

The enterprise capital world is within the grip of a silent crash.

In contrast to the inventory market, there aren’t any each day market indexes to broadcast the ache, and no particular person share costs for anxious tech workers to look at as their private wealth evaporates.

Actually, for lots of the traders and entrepreneurs who’ve simply lived by way of a historic increase in enterprise investing, it’s even doable to fake a crash isn’t taking place in any respect. Free guidelines that require solely sporadic writedowns, the estimated worth of personal firms, have made it straightforward for a lot of to show the opposite method.

Josh Wolfe, co-founder of Lux Capital, likens the response to “the basic 5 phases of grief”. “We’re in all probability someplace between anger and bargaining,” he says, referring to the feelings that observe denial. But traders and firm founders, Wolfe provides, are nonetheless resisting the total implications of a market downturn that may have a profound impact on the start-up economic system.

Solely firms with an pressing want for capital have been pressured right into a full reckoning with actuality, as traders placing in new cash demand an up-to-date valuation. Klarna, the Swedish purchase now, pay later firm, despatched shockwaves by way of the marketplace for non-public fintech firms earlier this month when it raised cash at a $5.7bn valuation — 87 per cent lower than its enterprise capital backers judged it was value a yr in the past.

But that savage worth lower merely echoed a flip that had already set in for related firms within the public markets. Shares in Affirm, a US purchase now, pay later firm that went public early final yr, have additionally fallen 87 per cent from a peak final November. Quick-growing fintech firm Block is down 78 per cent, after $130bn was wiped from its market worth.

Many extra should observe Klarna’s lead earlier than the total extent of the reset sinks in. Regardless of some indicators that persons are getting extra practical about valuations, “We don’t but have the total puking that’s required,” says Wolfe.

“Many firms are going to be in denial in regards to the change in valuations till they run out of capital,” provides David Cowan, a associate at Bessemer Enterprise Companions.

Enterprise Capital’s deferred date with actuality, when it comes, will probably be a watershed second for the start-up world. Buyers of all stripes have crashed the clubby world of VC lately in pursuit of firms promising increased progress charges than these out there on the general public inventory market.

A lot of that funding poured in final yr, because the valuations of personal start-ups had been hitting a peak. Hedge funds, non-public fairness corporations, sovereign wealth funds, company VCs and mutual funds between them provided two-thirds of all the cash that went into enterprise investing globally final yr, in accordance with knowledge supplier PitchBook.

If these bets bitter, it may result in a retreat by lots of the newcomers drawn to enterprise investing. And that, in flip, may ship a shock to a tech start-up world that has grown used to ever-increasing quantities of capital.

The largest funding rounds for US start-ups in 2021

Cruise — $2.75bn in January

Rivian — $2.65bn January

Rivian — $2.5bn in July

Robinhood — $2.4bn in February

The size of the latest enterprise increase has dwarfed that on the finish of the Nineteen Nineties, when annual funding peaked at $100bn within the US. By comparability, the amount of money pumped into American tech start-ups final yr reached $330bn. That was twice was a lot because the earlier yr, which was itself twice the extent of three years earlier.

The flood of cash into the non-public markets was matched by an equal flood into IPOs. Based on Coatue, certainly one of a brand new band of “crossover” traders that moved from the general public markets into the VC world, $1.4tn discovered its method into promising progress firms globally final yr, half of it within the type of enterprise capital and half by way of IPOs. That single-year surge, it calculated, was almost $1tn greater than the common of $425bn a yr raised over the earlier decade.

Worry of lacking out

Carried alongside by this immense tide of capital, many enterprise capitalists now admit their market was overcome by a race to take a position at virtually any worth — although most like to say their very own funds had been capable of sidestep the worst of the excesses.

“If there was one phrase to explain it, it was Fomo,” says Eric Vishria, a associate at Benchmark Capital. The “worry of lacking out” he factors to introduced a stampede on the peak of the market. It wasn’t simply the excessive costs traders had been ready to pay to not miss the boat: durations for conducting due diligence had been drastically shortened and protections that traders often construct in to guard their investments fell by the wayside.

The regular financial growth and relaxed monetary situations that adopted the monetary disaster greater than a decade earlier than had led many traders to view enterprise capital as a one-way wager, says Vishria. “During the last 12 years, the best reply for nearly each firm was simply to carry, and distribute [the shares] later,” he provides.

Essentially the most extremely valued non-public start-ups, based mostly on current fundraisings

ByteDance — valued at $140bn in December 2020

SpaceX — valued at $127bn in Might 2022

Shein — valued at $100bn in April 2022

Stripe — valued at $95bn in March 2021

“The incentives had been lined up for maintaining firms non-public and doing larger and larger rounds” of funding, provides Phil Libin, a enterprise investor and former CEO of note-taking app Evernote.

For firm founders and workers, in addition to the enterprise corporations that backed them and the restricted companions that provided the capital, it seemed like a gravy practice. As valuations ratcheted increased, firms arrange share-trading programmes for workers and executives to money in, and traders had been capable of mark up their valuations with every new spherical of capital.

In consequence, in accordance with Vishria, the enterprise capital business turned bloated. Many firms stayed non-public far longer than was normal for a start-up, drawing on non-public traders reasonably than shifting to the inventory market. The dimensions of enterprise funds exploded as traders put ever-larger quantities of capital to work. And funding self-discipline was loosened, with VCs spreading their bets broadly throughout complete sectors reasonably making an attempt to single out the small variety of massive winners that had historically offered the lion’s share of the business’s income.

The brand new traders that set the tone as enterprise investments ballooned included SoftBank’s Imaginative and prescient fund, which ploughed $100bn into the market. Tiger International, which unfold its bets broadly, at one stage held extra stakes in $1bn start-ups than some other investor. Each have since disclosed shattering losses: the Imaginative and prescient Fund registered a one-year lack of $27bn loss in Might, the identical month it emerged that Tiger had misplaced $17bn.

On the peak of the increase, traders raced to again all the things from electrical car firms like Rivian, which raised greater than $5bn final yr, to fringe tech bets that gambled on important scientific breakthroughs to generate a return, reminiscent of nuclear fusion.

“The inbound [interest] was insane,” with two or three unprompted presents of financing every week, says Jeremy Burton, a former prime Oracle government who now heads a non-public software program firm referred to as Observe. These approaches have stopped, he provides — a mirrored image of the deep chill that has fallen over the enterprise market as entrepreneurs and traders look ahead to actuality to sink in and a brand new consensus about valuation ranges to take maintain.

Excessive-risk initiatives

The surfeit of capital pushed new fields of science ahead at a sooner tempo. They included applied sciences like quantum computing and driverless automobiles, “moonshot” initiatives that had been as soon as thought-about too dangerous or long run even for enterprise capital funds, which generally take a seven- to eight-year view. Vital headway has been reported by start-ups in each fields, although the actually transformative breakthroughs that enterprise traders hoped for stay out of attain.

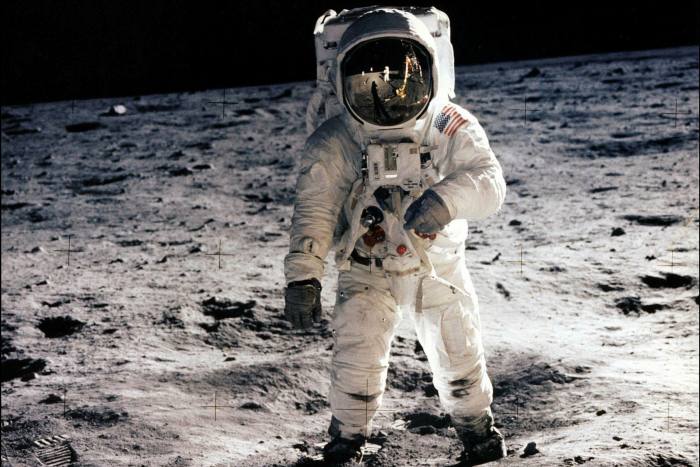

That treasure chest additionally helped to open up dangerous new sectors of the economic system to personal start-ups. The sum of money flowing into business area start-ups, as an illustration, doubled final yr to greater than $15bn, in accordance with BryceTech. In the midst of the final decade, annual investments had been round $3bn a yr.

Non-public funding has backed a flurry of novel rocket applied sciences, satellite tv for pc techniques and earth imaging providers. However start-ups have additionally ventured on to the frontier of area exploration, says area analyst Laura Forczyk. With Nasa planning a return to the moon, non-public firms hoping to trip in its wake are already plotting lunar actions that vary from mining to constructing cloud computing centres.

“There’s much more business exercise” in areas of area exploration and analysis that had been as soon as thought-about the province of governments, says Forczyk. If the cash dries up, she says, “I don’t know if it’s going to be sustainable.”

Again on Earth, enterprise traders have been left reassessing bets in fields that had been as soon as thought-about among the many hottest fields for start-ups. Howard Morgan, chair of New York enterprise agency B Capital, singles out the tech business’s varied makes an attempt to revolutionise the transport sector as one reason behind remorse. The driverless automobile and electrical scooter firms his agency invested in now not appear to be they’re about to vary the world, he says.

One firm B Capital invested in, scooter firm Chicken, was valued at almost $3bn in the beginning of 2020. After going public late final yr, and taking the whole quantity of out of doors capital it has raised to just about $900mn, Chicken is now value simply $142mn.

“We’ve realised perhaps the world isn’t prepared for as lots of these items as we thought,” says Morgan.

Requested which sectors are prone to show the most important disappointments, most enterprise traders checklist the identical handful: the ultrafast supply firms, like Gopuff and Gorillas, which have got down to deliver prospects their grocery gadgets in as little as 20 minutes; fintechs that launched into an costly marketing campaign to construct massive client companies; and blockchain-based ventures which were caught up within the crypto crash.

In a current presentation to its personal traders, Coatue depicted the tumbling valuations it expects within the tech world as a sequence of dominoes which are solely simply beginning to topple. It predicted that massive losses would unfold, beginning with unprofitable web firms and reaching deeper into the crypto and fintech sectors, earlier than consuming into extra solid-seeming sectors like software program and semiconductors.

If predictions like these are appropriate, then traders who put the majority of their newest funds to work on the peak of the market could possibly be dealing with the kind of unfavourable returns that haven’t been seen because the dotcom crash on the flip of the century.

In enterprise, timing is all the things. The median enterprise fund that was raised in 1996, when the primary web increase was simply gathering steam, returned 41 per cent a yr over its life, in accordance with Greenwich Associates, which tracks fund efficiency. However the median fund raised in 1999, on the peak of the bubble, went on to endure a lack of 3 per cent a yr.

A repeat of that efficiency may drive away lots of the new traders who’ve just lately been drawn to the market. But even when some, like SoftBank and Tiger International, find yourself being much less important forces in future, a number of VCs predicted that the massive traders who backed these corporations will search for different autos to put money into, that means that competitors for investments will stay excessive.

Resetting expectations

For many tech start-ups, in the meantime, the world has simply modified drastically.

With a considerable amount of money nonetheless sitting in current enterprise funds, start-ups with confirmed companies which are at no instant danger from a weakening economic system can nonetheless sit up for elevating cash on beneficial phrases. Elon Musk’s non-public area firm, SpaceX, was valued at $125bn in its newest spherical of funding in June, up from $74bn in April final yr.

However most others have little alternative however to regulate their objectives. The increase in capital-raising has left many with loads of money within the financial institution to get by way of two or three years of a funding drought. But uncertainty about when capital will subsequent be freely out there, and on what phrases, has fostered an inevitable warning.

Begin-ups that shook Silicon Valley

WeWork

Peak valuation $47bn in 2019. Final valuation in 2020: $2.9bn

Theranos

Peak valuation $9bn in 2015. Closed in 2018

Klarna

Peak valuation $45.6bn in 2021. Final valuation $6.5bn in July 2022

Uber

Valuation at IPO $82.5bn in 2019. Present value: $44.3bn

Instantaneous supply firm Gopuff, which raised $3.4bn earlier than the enterprise wave crested, is among the many many well-capitalised start-ups which have moved in current weeks to put off employees and shut amenities to preserve money.

Based on one Gopuff investor, the essential unit economics of its enterprise — the quantity of income it will possibly generate on every order, relative to what that order prices — are sound. However, this investor added, the costly race for progress that was as soon as the aim of start-ups like this now not is sensible when capital turns into constrained.

An identical calculation is being made throughout the start-up world. Payback durations are shortening. Hyper-growth is now not the order of the day.

In recent times, traders turned accustomed to seeing profitable software program start-ups tripling their revenues within the early years, says Burton at Observe. With the reset in expectations, he provides, “I’m unsure that also holds.” When his firm will get previous its early part of product improvement and is able to ramp up its advertising spending, he’s already anticipating a much less frenetic sprint for progress: “It could be extra measured or extra economical progress, reasonably than progress at any price.”

“There’s no query, progress at any worth is gone for the following few years,” provides Morgan.

For enterprise traders, it might sound like an enormous step again after the go-go years which are coming to an finish. But there’s a cause for the equanimity many profess: a reset brings with it the possibility to pay decrease costs for future investments, to again start-ups that present better monetary self-discipline, and to face much less competitors from rival start-ups funded by deep-pocketed interlopers like SoftBank.

Vishria at Benchmark sums up the hope: “All of the pretenders and the speculators will get worn out. We’ll have the believers and the builders.”

It’s an interesting imaginative and prescient that many enterprise traders — by definition among the many skilled world’s biggest optimists — subscribe to. However it’s nonetheless removed from clear how lengthy it should take the enterprise capital market to reset, or what number of of at the moment’s traders and start-ups will nonetheless be standing when it does.

Source link