Tech sector tax windfall shores up Eire’s financial system in opposition to recession

[ad_1]

For a lot of the EU, the financial outlook is grim with fears of a recession mounting and authorities funds constrained. Then there’s Eire.

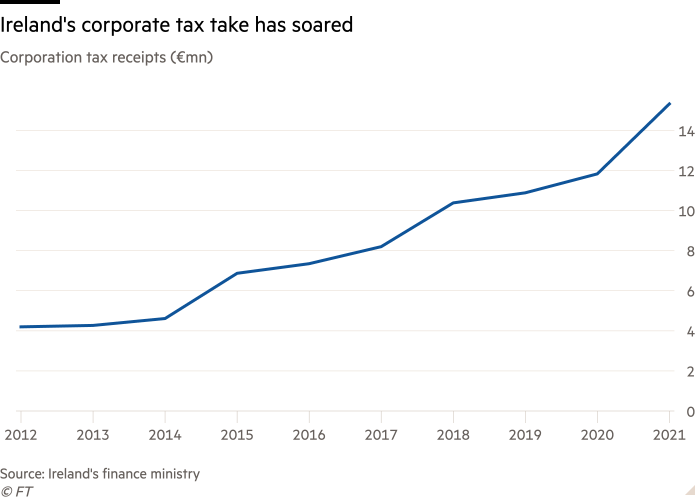

The republic is having fun with a €8bn company tax windfall after bumper pandemic-enhanced revenues from tech and pharmaceutical corporations. The tax take from corporations attracted by Eire’s 12.5 per cent company price has soared since 2015 and leapt an additional 30 per cent final 12 months in contrast with 2020.

Eire’s financial system expanded by 6.3 per cent over the second quarter, in opposition to an EU common of simply 0.6 per cent. So nice was the affect from multinationals that Eire’s numbers distorted EU figures, regardless of the nation of 5.1mn making up lower than 3 per cent of the region’s economy.

With employment and international funding additionally at document highs, “the financial system is even hotter than the climate,” stated Danny McCoy, head of employers’ confederation, Ibec, noting latest document temperatures.

But Ireland isn’t with out its issues. Costs rose by 9.1 per cent within the 12 months to June. Regular households really feel priced out of the housing market in Dublin and different cities.

“We’re not on dangerous wages,” stated Mark Murphy, 39, a regional supervisor at a charity, primarily based together with his spouse in West Cork, who delayed getting married and beginning a household to save lots of for a “very modest” residence across the €300,000 mark. “However now, the identical homes are €400,000 — we simply can’t get the credit score.”

Shopper spending contracted by 1.3 per cent within the first quarter in contrast with the earlier three months. Modified home demand, a measure of the dimensions of financial exercise that excludes some multinationals’ expenditure and is taken into account a greater indicator than GDP, fell by 1 per cent over the primary quarter.

Officers warn the company tax is susceptible to fluctuation. Half of company tax receipts of €15.3bn final 12 months got here from simply 10 corporations — amongst them Apple, Google, Intel, Meta, Amazon and Pfizer.

However for now the wholesome tax receipts give Eire a helpful cushion, with a really modest fiscal surplus anticipated if spending ranges are maintained, though Eire, following some EU neighbours together with Spain, is now contemplating an additional tax on power corporations within the 2023 price range on September 27.

Dermot O’Leary, chief economist at brokerage Goodbody, stated Eire had no must go down the “Robin Hood route” as a result of it might probably use the company tax windfall to fund almost €7bn of spending already introduced for the price range.

Even after stripping out the multinational sector, Eire’s home financial system contracted much less in 2020 and rebounded quicker in 2021 than the EU common, score company DBRS Morningstar stated.

Leo Varadkar, deputy prime minister, instructed an occasion final month to current document inward funding information: “The roles and income created by multinationals helped to maintain us out of recession when the pandemic hit and at the moment are giving us the monetary firepower to ease the price of residing disaster and keep away from recession as soon as once more.”

But when the world financial system experiences a downturn Eire’s multinational sector may very well be its Achilles heel. The specter of a recession within the EU and US is mounting. Any downturn would harm the earnings of corporations invested in Eire and feed by way of right into a decrease tax take.

The central financial institution stated corporate tax receipts, which have exceeded expectations for the previous seven years, have been €8bn increased than anticipated final 12 months and introduced in almost €9bn within the first half this 12 months alone.

The federal government has been reluctant to say whether or not or the way it will use the tax windfall within the price range however the central financial institution and Irish Fiscal Advisory Council have warned over reliance on a tax take that would show risky.

“There’s nothing on the horizon that implies that company tax revenues are going to quickly fall,” stated Seamus Coffey, a lecturer at College Faculty Cork and an professional on company tax. “However 5, six years in the past, there was nothing on the horizon that steered they have been going to rise.”

John Fitzgerald, a Trinity Faculty economics professor, says the worst-case situation of a drastic drop in company tax receipts could be a lack of 3 to 4 per cent of nationwide earnings — a giant hit to public funds.

Ibec cautioned that the Irish financial system confronted a “turning level”, and that “for Eire, as a small open financial system, shifts within the move of capital by way of the worldwide financial system can have an outsized affect on our development mannequin”.

The central financial institution has additionally warned that building of houses to sort out Eire’s chronic housing shortage is flagging. Varadkar calls Eire a “homeowning democracy” however think-tank the Financial and Social Analysis Institute lately forecast that one in three individuals now aged between 35 and 44 won’t personal a house by the point they retire.

Eire may keep fortunate. Though the federal government forecast that its choice to hitch an OECD world company tax accord setting a minimal 15 per cent price may lower revenues by €2bn, implementation has been delayed.

International direct funding is continuous to surge, with the variety of investments within the first half up 9 per cent on the identical interval in 2021, together with an 18 per cent soar in new names finding in Eire. Conall Mac Coille, chief economist at brokerage Davy, noticed “no actual cause” that taxes paid by international corporations investing in Eire would “collapse any time quickly”.

For now, Eire faces the issue of administering abundance. “We’re the equal of a family that’s simply received the lottery,” stated McCoy. “Are we the family mature sufficient to say ‘really, this luck may be put to work for future generations’? Or are we simply going to go daft for half this technology and have a lot remorse?”

Source link