Supporters of the Metropolis level to poor exhibiting in US IPO market to persuade corporations to remain put

[ad_1]

Bankers and change officers within the UK are utilizing a vicious current sell-off in US-listed teams to spice up their efforts to advertise London listings and persuade star corporations to not go public abroad.

European personal boards and shareholders have been more and more drawn to the US by the promise of upper valuations and an investor base that has extra appreciation of fast-growing however lossmaking corporations.

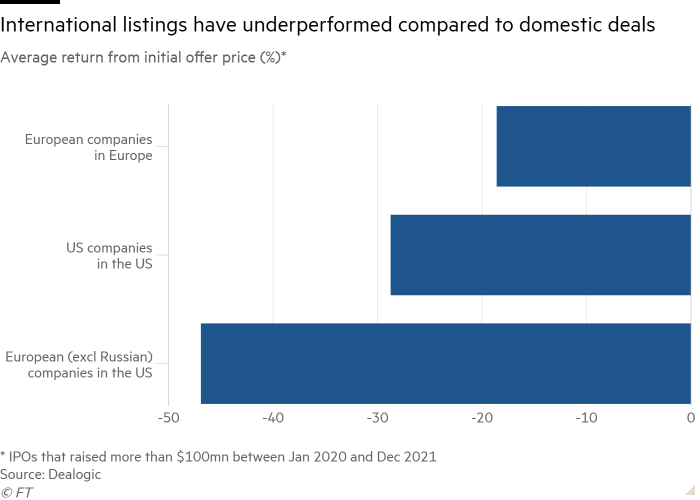

Nevertheless, knowledge from Dealogic and evaluation by the Monetary Occasions present that enormous European companies, excluding these from Russia, that listing within the US have constantly underperformed in comparison with home US listings and friends that stay in Europe, and have been notably badly hit by the current inventory market downturn.

European corporations that raised greater than $100mn within the US for the reason that begin of 2020 have fallen a median of 47 per cent from their supply worth, in contrast with a 29 per cent decline amongst home US listings and a 19 per cent fall for home European offers.

Whereas rising rates of interest, the warfare in Ukraine and recession fears have all however closed IPO markets on each side of the Atlantic, the information have been seized upon within the UK, the place convincing extra high-growth corporations to go public has develop into a longer-term precedence from the best ranges of presidency down.

“There was a story over current years that the US delivered superior valuations on a like-for-like foundation, even when the proof didn’t help it,” mentioned Charlie Walker, head of fairness and stuck earnings capital markets on the London Stock Exchange. “That view is definitely altering now.”

Observers level to a number of attainable causes for the underperformance, together with a scarcity of help from passive buyers as a result of overseas corporations are excluded from massive indices such because the S&P 500, and a perception that domestically centered US buyers usually tend to promote “non-core” overseas shares during times of volatility.

The size of the US market also can make it more durable for corporations to face out and appeal to consideration from buyers and analysts. Luxurious trend web site Farfetch and Soho Home proprietor Membership Collective Group, for instance, can be comfortably massive sufficient to affix the UK’s FTSE 250 index however are thought of small-cap teams within the US.

“There are situations the place a US itemizing makes excellent sense . . . [but] you want one thing greater than a valuation-driven argument alone and need to be assured you’ll get pleasure from a profitable itemizing there for the long run,” mentioned Aloke Gupte, co-head of fairness capital markets for Emea at JPMorgan Chase.

The downturn in fairness markets for the reason that begin of the 12 months has drawn specific consideration to the underperformance of worldwide listings, however the pattern predates this. Of the 43 European corporations that raised greater than $100mn within the US between 2012 and 2019, solely seven — together with Ferrari and Covid-19 vaccine maker BioNTech — are nonetheless listed and buying and selling above their IPO worth.

Nonetheless, supporters of London face an uphill battle to reverse years of poor notion concerning the Metropolis’s investor base and perspective.

One govt at a extremely valued personal British firm mentioned: “The conversations we’ve had have at all times been pushing us US-wards. The UK simply doesn’t have the expansion investor base to compete with the US, not but anyway.”

A London-based enterprise capital govt mentioned they might encourage extra portfolio corporations to listing within the US after the poor reception for high-profile companies similar to Deliveroo, which was condemned as “the worst IPO in London’s history” final 12 months.

Outgoing prime minister Boris Johnson earlier this 12 months joined ministers in personally lobbying Japanese conglomerate SoftBank to listing chipmaker Arm within the UK as an alternative of the US, although current political turmoil in Britain has broken efforts.

“Loads of the individuals who need to champion London appear to be extra occupied with flag-waving,” mentioned one London-based adviser who has labored on a number of worldwide IPOs. “If the dialogue was ‘come to London, you’ll get much less volatility and a greater valuation and a superb platform to construct the enterprise’, it could be totally different, however we don’t assist ourselves.”

Endava, a London-based group that gives know-how consulting and outsourced software program improvement, has been an exception to the pattern of poor efficiency amongst most worldwide listings. Regardless of being hit badly by the overall sell-off in know-how shares this 12 months, the corporate’s shares are nonetheless greater than 400 per cent greater than their IPO worth on the New York Inventory Alternate in 2018.

Mark Thurston, Endava chief monetary officer, mentioned the itemizing choice was not pushed by valuations, however by a perception that US buyers had a greater understanding of Endava’s enterprise and can be extra supportive of a dual-class share construction that gave extra voting energy to its founder. British regulators have lately loosened guidelines over dual-class shares, however many massive funding funds within the UK stay sceptical of corporations that use them.

“[Endava chief executive John Cotterell] was fearful that if we didn’t management the corporate by means of tremendous voting rights we might be snapped up — there’s a protracted legacy of UK-listed tech companies disappearing when some international mammoth comes over the horizon,” Thurston mentioned.

Arm was listed in London till it was purchased by SoftBank in 2016. It developed amongst a cluster of tech corporations round Cambridge that additionally included Autonomy, Domino and CSR. By 2017, all 4 had been taken over or have been majority managed by abroad corporations.

The adviser who talked about authorities “flag-waving” mentioned that “if you’d like the UK to have international companies you’ve bought to allow them to exit and be international” as an alternative of strong-arming corporations to listing within the UK, however the LSE’s Walker mentioned “when an organization lists within the US, it’s usually step one in that firm changing into American”.

He added: “Headquarters and incorporation can transfer over time to be able to acquire inclusion within the US indices and the thoughts of administration then strikes with them,” with the UK shedding out on long-term tax revenues, employment and mental property improvement.

Thurston mentioned the “gravitational pull” of changing into a home US firm was actual. He mentioned Endava has no short-term plans to vary its construction however mentioned it was prone to occur in some unspecified time in the future because it continues to develop and strikes in direction of producing a majority of revenues in North America.

“The tech market within the US is simply so massive, it’s a extra attention-grabbing place to be when it comes to the shareholders you appeal to, the number of questions you get, as a result of they’ve a complete gamut of companies they’ll take a look at,” he added. “We’re usually English — fairly low ego and understated about issues . . . however we’ve got very massive ambitions.”

Source link