Cease complaining about audit fines and enhance your work, UK regulator tells corporations

[ad_1]

Accountants ought to cease complaining about additional scrutiny and fines for audit failures and enhance the standard of their work, stated the pinnacle of the sector’s UK watchdog, which imposed document monetary sanctions on the trade final yr.

Auditors have confronted heavy criticism lately after failing to lift the alarm in a collection of company failures, corresponding to retailer BHS and outsourcer Carillion. The following clampdown led to senior executives complaining that the Monetary Reporting Council’s extra sturdy method was making the profession unattractive to recruits.

However Sir Jon Thompson, the watchdog’s chief government, stated he had no sympathy with them over the extent of fines imposed. “It’s no good complaining in regards to the fines,” he stated in an interview with the Monetary Occasions. “The answer is fully in [the audit firms’] arms. Do a superb audit and also you don’t get in hassle with us.”

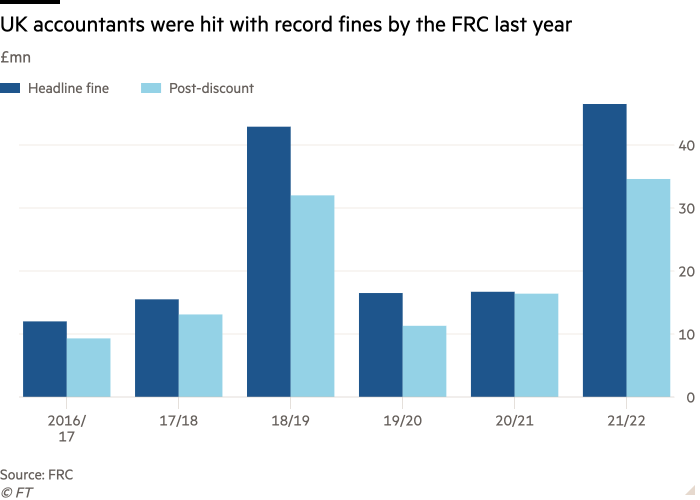

His feedback got here after figures printed final month confirmed that the FRC imposed a record £46.5mn of fines on accounting corporations and companions within the 12 months to March. Fines after reductions for co-operation additionally reached a brand new excessive of £34.6mn.

An trade tribunal final month handed KPMG its largest-ever UK fine — £14.4mn — for intentionally deceptive the regulator throughout inspections of its audits of collapsed outsourcer Carillion in 2017 and UK-listed Regenersis in 2015.

The FRC has stepped up enforcement motion because it was branded a “ramshackle home” in a assessment of the regulator in 2018 by Sir John Kingman, the chair of insurer Authorized & Common, and has nearly doubled in measurement since then, using about 400 workers.

Many of the sanctions lately have been towards the Massive 4 — Deloitte, EY, KPMG and PwC — which have monopolised the marketplace for giant firm audits and been criticised for poor-quality work.

However extra lately the watchdog has switched a few of its focus to mid-tier accounting corporations, which it hopes will finally compete with the Massive 4 for work on giant firm audits, and their smaller rivals.

The FRC’s newest high quality inspections discovered that greater than 80 per cent of audits at three of the Massive 4 have been good or required solely restricted enchancment. However final month, it criticised work by BDO and Mazars, two of the three primary challengers to the Massive 4, as “unacceptable”. Each corporations stated on the time they have been disenchanted with the findings and have been investing to enhance their auditing.

However consecutive years of poor inspection outcomes at each corporations, which have expanded their audit practices considerably, have led to senior auditors privately questioning whether or not the midsized gamers can face up to the regulator’s calls for as they attempt to compete to audit giant listed firms.

Underlining that time, they stated, was the truth that the opposite primary challenger, Grant Thornton, had the perfect inspection outcomes of all the highest seven corporations after closely reducing again the variety of giant firms it audits since poor ends in 2019 and a collection of fines.

“The FRC’s huge stick method has promoted audit high quality . . . however the query is do they only persevere with this or do they now have to alter their method somewhat bit?” stated a senior determine within the accounting trade. “In any other case they’re by no means going to get any new entrants into the market.”

However Thompson, who took over in 2019 after heading HM Income & Customs, stated that auditors’ complaints in regards to the FRC criticising their scores within the inspections was “like blaming the physician for saying you’re unwell”.

However he acknowledged that there was a trade-off between bettering audit high quality and serving to to construct up potential rivals to the Massive 4, which might assist be certain that firms have been nonetheless capable of finding auditors if one of many dominant gamers have been to break down or exit the market.

“We’re going to must make some selections about what’s extra vital. And to be frank about it, our board’s view is that audit high quality is extra vital on the minute,” he stated.

Thompson’s pledge to prioritise high quality issues over competitors follows a collection of fines and investigations into smaller firms that sit beneath the mid-tier of BDO, Grant Thornton and Mazars. Not less than seven smaller audit corporations have been penalised or investigated previously 18 months.

Taking motion towards smaller corporations is within the public curiosity, stated Thompson, citing the FRC investigations into King & King, the excessive avenue agency that signed off the accounts of firms within the enterprise empire of Sanjeev Gupta, which is the main focus of a fraud investigation.

A part of the issue was that the largest corporations have been “de-risking” by dropping purchasers whose audits they deem harder or whose administration is immune to scrutiny, Thompson added. These firms are left with a alternative between a small audit agency or being unable to find an auditor in any respect.

Some auditors really feel the FRC ought to have anticipated this downside. “This example could have been an unintended consequence but it surely was actually not unforeseeable,” stated a senior Massive 4 auditor.

The regulator final yr dismissed accountants’ request for leniency on greater danger audits. The FRC would really like probably the most succesful auditors to test the accounts of upper danger firms however is reluctant to decrease its requirements to encourage them to take action, stated Thompson.

As a substitute of resigning, auditors needs to be extra keen to qualify their opinion on the accounts and do extra to encourage firms’ administration to enhance their governance, he stated. “It’s unbelievably uncommon to discover a certified audit. Auditors will resign fairly than give a crucial audit opinion.”

Though legislative reforms to interchange the FRC with the extra highly effective Audit, Reform and Governance Authority “may have been completed faster” and have but to be handed, the watchdog was now “fairly shut” to the regulator envisaged by Kingman in his scathing assessment 4 years in the past. Arga is just not anticipated to be created earlier than April 2024.

Source link