Scammers prey on fears over the price of dwelling disaster

[ad_1]

This text is the most recent a part of the FT’s Financial Literacy and Inclusion Campaign

When Wayne Chapman obtained a textual content informing him of fraudulent exercise on his present account final September, his first thought was to ring his financial institution.

However earlier than he might accomplish that, somebody had referred to as him. They informed him they had been from the fraud squad and had noticed uncommon exercise on his account.

“In the event that they’d requested me about my account quantity I might have twigged sooner — they had been simply saying ‘there are folks attempting to entry your cash’,” says Chapman, a automobile mechanic. “However as quickly as I stated ‘Can I take your title and name you again,’ their tone modified solely.”

The scammers took £2,000, though TSB, Chapman’s financial institution, refunded the total quantity.

The UK faces an “epidemic of fraud”, in line with monetary providers commerce physique UK Finance and greater than 140,000 calls have been made to a rip-off helpline because it was arrange in September by Cease Scams UK, an industry-led collaboration.

Through the pandemic, criminals tailored their strategies to take advantage of victims’ fears over coronavirus, and at the moment are discovering new avenues of assault in the price of dwelling disaster. But campaigners and the monetary providers {industry} are involved that flagship insurance policies proposed to beat fraud are being delayed by political uncertainty on the coronary heart of presidency.

“Customers desperately want protections match for the digital age,” says Rocio Concha, director of coverage and advocacy at shopper group Which?, including that the web security invoice had the potential to cease tens of millions of kilos of scams yearly. “The authorities should decide to passing this vital laws. Any backtracking can be an unforgivable betrayal of rip-off victims.”

The state of scams

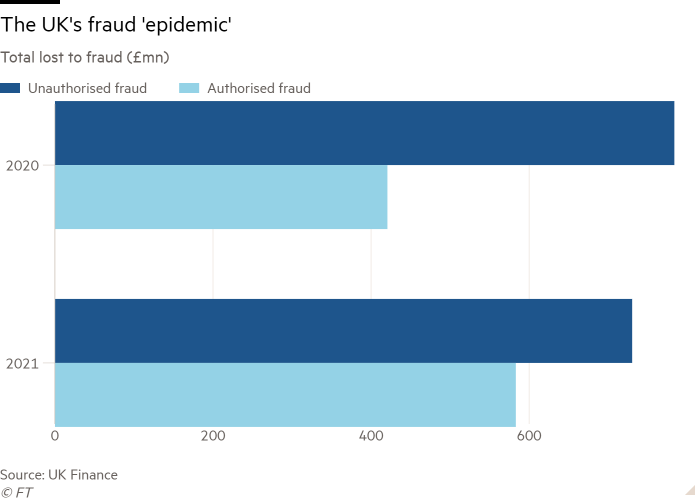

Fraud rose from £1.2bn in 2020 to £1.3bn final 12 months, in line with a latest UK Finance report on scams, but this modest improve was not evenly distributed throughout various kinds of rip-off. So-called “authorised push fee” (APP) fraud, during which victims are conned into transferring cash into scammers’ accounts, leapt by 40 per cent to greater than £580mn by worth of losses.

“Since Covid-19 hit, we’ve seen the next price of APP fraud due to a tightening on card spending, and we anticipate additional progress,” says Paul Davis, director of fraud at TSB.

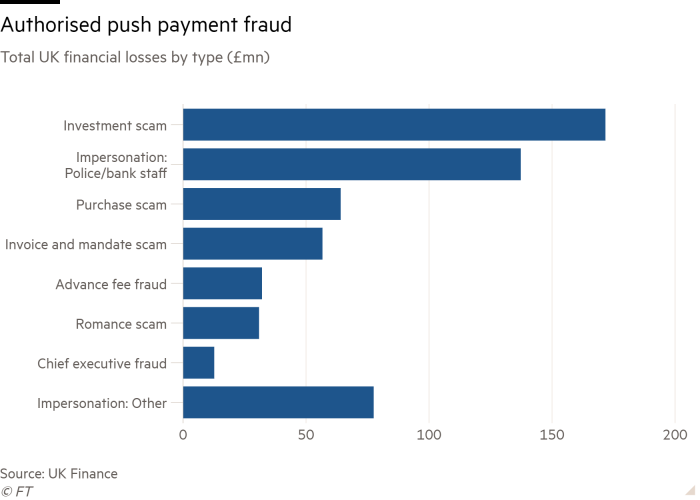

Impersonation scams — the kind of fraud skilled by Chapman during which scammers faux to be police, financial institution employees or from the tax authority — have additionally seen a major improve. Losses rose by 15 per cent in 2021 to £96.6mn.

“They had been very intelligent. They weren’t asking for issues just like the account quantity however they had been describing what they had been doing,” says Chapman. “I believed — they’ve bought the small print, they should be the financial institution.”

Ultimately, he smelled a rat. “They stated that they’d patch you thru to a enterprise supervisor, however after a short time I began pondering that their voices had been acquainted, like they had been sitting round a desk. At that time, once I requested they didn’t need to give me their title.”

Equally alarming are funding scams, which have elevated by nearly 60 per cent to £171.7mn in 2021 and now make up the largest share of APP fraud. These could be extremely subtle, transferring throughout platforms and gaining customers’ belief, with many centered on cryptocurrency investments. One sufferer within the US was approached on an investing-related Fb web page in 2021.

“We began chatting forwards and backwards over the following few weeks, they began telling me about actually cool stuff within the cryptocurrency market,” says the person, who requested to not be named, including that he had not beforehand been interested by digital property.

Ultimately he was invited to a gaggle on Telegram, the messaging app, which maintained the phantasm of monetary recommendation, though on reflection he says the site visitors was more likely to have come from bots or “sockpuppets”, accounts showing to be these of separate people, however that are managed by one scammer.

“You simply see folks daily posting encouragement to different prospects and footage of their supposed beneficial properties — it’s all staged,” he says. “Everybody has glowing critiques till you look a bit deeper, and these are the identical folks speaking again and again, utilizing the identical sort of speech patterns.”

The group claimed to supply merchandise together with a 90-day managed funding, in addition to a “particular ETF” which it claimed was provided to solely the most effective prospects. He was inspired to spend money on cryptocurrencies, which the group stated was essential for safety functions.

The issues began when he went to withdraw the funds and was informed he needed to pay a 20 per cent fee — which, as a consequence of “regulatory legal guidelines” couldn’t merely be taken from funds within the account.

“That’s the final hurrah — the final bit of cash they attempt to extract. When you ship them the fee, they kick you out of the channel, block you and you haven’t any extra entry to them,” he says.

In whole he misplaced round $20,000 to the scammers, who went so far as to run a faux Instagram account of an actual monetary influencer and despatched the sufferer a doctored photograph of his driving licence.

He misplaced a further $5,000 to a different funding rip-off on Telegram, which provided extra beneficial properties in return for inviting different folks to affix.

“The day [for cashing out] hits and the web site is completed. You message them on Telegram and so they say everyone seems to be attempting to withdraw on the similar time [so] give us three enterprise days,” he says. “That buys them time to cowl their tracks.”

Using cryptocurrencies by fraudsters to spirit away cash is unsurprising, says Mark Steward, government director of enforcement and market oversight on the Monetary Conduct Authority.

“Cryptocurrency scams are a few of the most reported in the mean time,” he says. “We regulate these corporations’ anti-money laundering programs, however we don’t regulate the merchandise.”

The problem will not be restricted to the UK. In line with knowledge from the US Federal Commerce Fee, nearly 40 per cent of the $1.1bn misplaced to fraud on social media within the 15 months to March 2022 was associated to digital property.

Not all such scams are subtle. Squid Coin, a token named after, however solely unrelated to the hit Netflix present Squid Recreation, value traders greater than $3mn regardless of pink flags, together with apparent spelling errors.

Davis at TSB says the lender had been blocking funds to cryptocurrency exchanges for greater than a 12 months due to the excessive incidence of scams. “We couldn’t make it previous the 20 per cent fraud price — it was off the size,” he says.

One alternate which was utilized by scammers to steal £50,000 from a shopper requested TSB to take away its block. When Davis requested it to look into the fraud declare, he says he heard nothing again. “I simply don’t suppose a whole lot of them care about buyer safety.”

CryptoUK, the UK commerce affiliation for digital property corporations, didn’t reply to a request for remark.

Value of dwelling

Banks and others have additionally warned of a rise in crimes which appear calculated to play on shoppers’ insecurities as the value of dwelling continues to rise, with annual inflation at a 40-year excessive of 9.4 per cent.

“Scammers proceed to ruthlessly exploit the price of dwelling disaster and the uncertainty brought on by the struggle in Ukraine,” says Simon Miller, director of coverage and communications at Cease Scams, an anti-fraud group whose members embody lenders, telecoms corporations and a few Huge Tech corporations.

One such space is an increase prematurely charge fraud — during which prospects searching for a mortgage are informed they need to pay a charge to entry credit score, however by no means see the cash they want.

“We’re very a lot involved a couple of sudden improve prematurely charge scams — as much as 90 per cent — that we’ve seen, though it’s nonetheless comparatively small volumes,” says Liz Ziegler, retail banking director of fraud and monetary crime at Lloyds Banking Group.

The FCA on Thursday stated it had relaunched a marketing campaign warning the general public about mortgage charge fraud, after inquiries to its name centre over this sort of rip-off jumped by 36 per cent in June 2022, in contrast with the identical month final 12 months.

Scams exploiting the monetary stress of hovering power payments have additionally been on the rise. Analysis by on-line safety firm McAfee discovered scams naming one of many “massive six” power corporations had been up 10 per cent within the first three months of the 12 months in contrast with the identical interval final 12 months, with a 27 per cent year-on-year rise in January alone.

Criminals usually ship potential victims an e mail pretending to be from an power provider, inviting them to assert a refund as a consequence of a “miscalculation” on their invoice. In doing so, prospects are invited to submit private info equivalent to their financial institution particulars, which might then be utilized by the scammer to steal cash.

David Lindberg, chief government of retail banking at NatWest, says one other regarding development was the rising variety of money mule scams during which criminals encourage customers to allow them to switch ill-gotten cash through their accounts to cowl their monetary tracks.

“It’s not turning into a mastermind or organising an operation,” he says. “It’s somebody getting in touch, saying ‘simply put this cash in your account’. It’ll be a £1,000 and so they’ll depart £100. It doesn’t really feel like a criminal offense.”

Nonetheless, it’s normally the mules who’re caught, he says. Banks are then legally obliged to shut their account and report them to the authorities.

Katy Worobec, managing director for financial crime at UK Finance, says a lot of these caught up in cash mule schemes don’t realise the implications or risks, and are drawn in by commercials on social media providing straightforward cash.

Attempting to determine these recruiting mules required shut collaboration with the social media platforms on which their fraudulent messages are hosted, she provides.

“We need to attempt to work with the web platforms that are permitting these issues to be hosted,” she says. “Can they use their algorithms to search out these scammers earlier than they recruit folks?”

Delayed motion

The position of social media corporations in scams has lengthy been some extent of rivalry throughout the monetary providers sector, with some platforms accused of not doing sufficient to fight scammers.

“We’ve seen a traditional trickle down impact,” says Steward. “As soon as Google was not permitting these rip-off adverts to look on its paid-for promoting pages, you noticed immigration to different websites, together with Microsoft and numerous search engines like google, and a rise on websites run by [Facebook owner] Meta.”

Digital financial institution Starling pulled its promoting from Meta platforms on the finish of 2021 over fraud. Final month, Starling chief government Anne Boden says she nonetheless felt Meta had not achieved sufficient to guard shoppers.

“We now have an enormous downside right here,” she says. “And it’s not simply older folks or the weak who’re being tricked and scammed into gifting away their life financial savings.”

Meta stated selling monetary scams was towards its insurance policies and it was dedicating “important assets” to serving to fight it.

“We not too long ago began rolling out a brand new course of that requires all monetary providers advertisers to be authorised by the FCA to allow them to run adverts concentrating on customers within the UK,” it stated.

Microsoft declined to remark.

There have been hopes that this might change with the online safety bill, a wide-ranging piece of laws that may drive platforms to take care of dangerous content material.

Whereas the invoice has generated appreciable concern over its probably chilling influence on free speech and alternatives for encryption, it might make massive tech corporations chargeable for combating free and paid-for rip-off promoting on their platform.

The invoice was as a consequence of have been debated in July, however its studying has been paused till a minimum of early September, when MPs return from their summer time recess.

“Trade wants certainty to have the ability to make investments to assist maintain folks protected. The delay to the invoice has solely created uncertainty,” says Miller at Cease Scams UK. “That’s unhealthy for enterprise and unhealthy for shoppers. The one folks that may profit from the uncertainty are the scammers.”

Worobec at UK Finance says the {industry} wanted to stay vigilant to make sure the invoice succeeded. “We have to maintain a climate eye on it to see that it doesn’t get weakened in any form or kind,” she says, including that she supported extra collaboration between corporations in numerous sectors quite than ready for laws additional down the road.

Banks and others are additionally calling for clearer steerage on knowledge coverage, to make sure they’ll entry info with out falling foul of competitors or privateness guidelines.

“We’d like clearer laws that recognises the necessity for the banking and different sectors to share knowledge extra readily within the pursuit of financial crime,” says Lindberg at NatWest.

The federal government says it remained dedicated to cracking down on the scammers who goal the British public, including that “tackling fraud requires a unified and co-ordinated response from authorities, legislation enforcement and the personal sector, together with on-line platforms, to higher shield the general public and companies”.

Fraud is essentially not a home subject, says Steward.

“The way in which that fraudsters function is that they’ll proceed to innovate,” he says. “We’d like a world consensus surrounding this, the identical manner that main markets have securities rules for monetary markets.”

How you can keep away from turning into a rip-off sufferer

Search for pink flags in emails, texts or social media messages, equivalent to spelling and grammatical errors in addition to a messy format and impersonal greetings. You also needs to verify whether or not the observe has come from a well-known quantity or firm, although scammers usually try and spoof these credentials.

Impersonation scams are more and more widespread. Be cautious of any calls from supposed figures of authority, particularly financial institution employees or police, which require you to offer monetary particulars, particularly in the event that they try and rush you.

Look out for offers which might be too good to be true, equivalent to funding portfolios which is able to give fast, high-end returns.

Scammers can masquerade as influencers, professionals and even fellow traders to lure victims, and might create elaborate on-line constructions resembling skilled operations. The Monetary Conduct Authority’s web site has a list of real corporations whose particulars you may verify.

Don’t transfer cash for folks you don’t know. That is referred to as cash muling, and might result in prosecution even if you’re unaware you might be transferring unlawful funds.

When searching for loans, keep in mind that real corporations is not going to ask for an upfront fee earlier than releasing the funds.

For those who stay doubtful after an sudden or probably fraudulent name, contact the Cease Scams UK service on 159, which might get you thru to your financial institution.

Source link