Savana raises a contemporary spherical of capital to digitize banks’ providers – TechCrunch

[ad_1]

Malvern, Pennsylvania–based mostly Savana, an organization constructing monetary software program merchandise for legacy banks, immediately introduced that it raised $45 million. A portion of the capital — $10 million — was debt, whereas the remainder was a Collection A fairness tranche led by Georgian Capital Companions.

CEO Michael Sanchez advised TechCrunch that the proceeds can be put towards basic progress and supporting Savana’s go-to-market and product improvement initiatives.

Savana was based in 2009 by Sanchez, who beforehand served because the president of the worldwide division of FIS. Previous to FIS, he launched Sanchez Laptop Associates, a provider of core banking techniques.

The issue Savana solves pertains to structure, Sanchez tells TechCrunch. Regardless of banks’ digital transformation efforts, many haven’t made the swap efficiently, he ardently claims.

To his level, a 2022 survey discovered that — amongst banks and credit score unions who imagine they’re no less than three-quarters by a transition to digital — lower than 25% have seen a significant improve in income. Furthermore, solely 11% of finance executives say their group has modernized techniques to the purpose the place they’ll simply incorporate new digital applied sciences, according to Deloitte.

“At the moment’s shoppers desire digital-only banking. This alteration in shopper habits has been underway for numerous years and accelerated by COVID-19 shutdowns, which led shoppers to finish on a regular basis duties, akin to looking for groceries, depositing their checks, or managing their payments, all on-line,” Sanchez mentioned in an electronic mail interview. “Regardless of appearances that banks have all made the transformation to digital, the vast majority of banks aren’t prepared for this main change in shopper habits … This can be a main drawback for banks attempting to remain aggressive in an atmosphere with tons of fintech strain.”

Savana purports to resolve this drawback by a mix of templates, APIs and integrations engineered to automate back-office and core banking processes. The corporate’s platform offers a “course of structure” for service spanning varied banking and buyer channels, ostensibly rushing the time to marketplace for merchandise and guaranteeing service requests get addressed rapidly.

A glimpse at Savana’s service administration dashboard. Picture Credit: Savana

Extra particularly, Savana makes an attempt to decouple third-party elements of banking techniques and summary them into APIs that encapsulate not solely the elements, but additionally the foundations, workflows, automations and integrations required to carry out enterprise duties. The APIs function a library of buyer and account servicing features which might be reusable and complementary to Savana’s enterprise content material administration system, a repository of a financial institution’s content material associated to prospects and accounts. Past this, Savana presents a low-code UI framework to construct inside and customer-facing apps that interface with the aforementioned APIs.

“By pre-configured processes and integrations, [bankers using Savana] achieve a real-time, holistic view of all buyer accounts, playing cards, communications, and extra, whereas prospects profit from higher, extra personalised service,” Sanchez continued. “It eliminates course of silos by automating processes between techniques and other people and eliminates the necessity for a number of, siloed distributors. [The] turnkey, end-to-end platform is pre-configured with tons of of APIs enabled.”

In fact, Savana doesn’t stand alone available in the market for banking modernization instruments. Amount just lately raised $99 million at an over $1 billion valuation for its suite aimed toward serving to banks higher compete with fintech corporations. There’s additionally MANTL and Bankjoy, two startups creating expertise to make it simpler for individuals to open accounts digitally at neighborhood banks and credit score unions. One fintech that competes virtually immediately with Savana is London-based 10x Future Technologies, which helps bigger, established banks construct each next-generation providers and instruments to assist their older providers work extra effectively.

The competitors is prone to develop fiercer as financial headwinds attain gale pressure. Deloitte reported final week that fintech funding decreased to $52.9 billion in H1 2022, down 24% from $69.6 billion in H1 2021. Financial institution tech distributors particularly suffered, observing a 14% lower within the first half of 2022 in comparison with the identical interval final 12 months.

However Sanchez isn’t involved — even regardless of Savana’s comparatively small buyer base of about 10 consumer banks and fintechs. Sanchez mentioned that “numerous entities” will go dwell with Savana between now and the tip of 2022, though he wouldn’t say what number of — or what to anticipate on the income entrance.

“Savana’s digital supply platform is the primary and solely expertise resolution to assist banks overcome the operational challenges of assembly evolving buyer expectations,” Sanchez boldly claimed. “The banking trade goes by unbelievable transformation. Digital banking is rapidly evolving from simply being outlined by a shopper cellular banking app, to an end-to-end digitally enabled enterprise. Getting all the suitable items in place from the core to the client is the brand new crucial for banks aspiring to be digital banking enterprises.”

Whatever the power of Savana’s platform, it’ll must contend like all vendor with the challenges that banks face in implementing new applied sciences. According to a research by the Financial Authority of Singapore, it takes six to eight months for a financial institution to analysis, vet and develop a prototype with a fintech. One of many largest obstacles holding banks again is the upfront funding in expertise — Forbes reports that it might probably quantity to 10% of a financial institution’s annual expenditure.

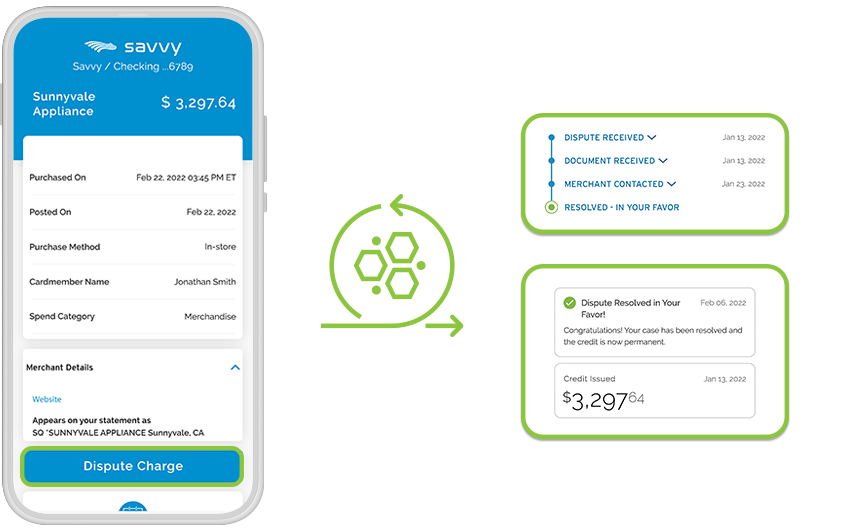

Resolving chargebacks and different disputes by the Savana platform. Picture Credit: Savana

Sanchez argues that Savana has a bonus in its expertise constructing digital techniques for banks and monetary establishments. For example, Mike Wolfel, the corporate’s president and CTO, previously led the design of course of automation techniques throughout mortgage origination and serving, company administration and finance as a guide.

A lot of Savana’s opponents have specialists in finance amongst their ranks, too. However — broadly talking — there is likely to be one thing to Sanchez’s level. One poll of monetary providers executives discovered 70% imagine a scarcity of abilities or inadequate coaching stays the most important barrier to a brand new digital initiative inside their group. In different phrases, outsourcing stays interesting.

“Based on the Digital-First Banking Tracker, practically 50% of immediately’s shoppers desire digital-only banking,” Sanchez mentioned. “It is going to be important for banks to improve their expertise infrastructure to fulfill … evolving expectations. Making certain a frictionless buyer expertise would be the distinction between the banks that thrive and people that don’t survive.”

So far, Savana has raised $54.2 million in capital. (The corporate beforehand closed a seed spherical in April 2010 and a small enterprise spherical in February 2020; the Collection A is its first spherical for the reason that latter.) Its headcount stands at 200, which Sanchez expects will develop to almost 400 individuals by the tip of the 12 months.

Source link