Poland’s mortgage vacation for households threatens financial institution earnings

[ad_1]

As inflation soars and recession looms in Poland, a break from mortgage funds can be a much-needed reprieve for Jakub Rdzanek and his spouse.

The couple have seen their month-to-month house mortgage payments soar greater than 70 per cent because the begin of the 12 months, because the nation’s central financial institution has raised rates of interest to fight rocketing costs.

“Our mortgage has all of the sudden change into terrifying,” mentioned Rdzanek, who purchased their Warsaw flat final August.

The Rdzaneks are unlikely to be the one family respiration a sigh of aid after the Polish authorities positioned a moratorium on mortgage repayments final Friday.

The transfer will enable debtors to droop funds for eight months, cut up between this 12 months and subsequent. However whereas the Polish authorities is granting mortgage holders a credit score vacation, banks are warning that it’s going to wipe out their earnings.

Lenders additionally declare that the rightwing authorities is gifting debtors the mortgage vacation to spice up its possibilities of successful a nationwide election subsequent 12 months. The end result may hinge upon whether or not Poland’s economic system manages to climate the double blow of hovering inflation and the war in Ukraine.

It’s not simply japanese Europe that’s searching for to ease the ache; governments around the globe are dealing with the problem of curbing excessive inflation by raising interest rates, as the price of residing disaster casts a shadow over the worldwide economic system.

Banks have been a goal for different governments. Hungary not too long ago introduced a €2bn windfall tax on lenders and vitality firms, whereas Spain mentioned it’ll tax banks €1.5bn a 12 months. Romania can also be contemplating aid from mortgage funds for households which can be hardest hit by inflation.

“This concept is clearly beginning to catch on elsewhere, so it’s one thing we have to watch,” mentioned Simon Nellis, managing director of European banks analysis at Citigroup. “That is clearly a priority for financial institution fairness holders.”

In contrast to the Romanian proposal, Poland’s coverage shouldn’t be means examined. Some Polish regulators had urged the federal government to restrict the scope of the moratorium. “There are additionally wealthy individuals who don’t want this exemption,” the governor of the Nationwide Financial institution of Poland, Adam Glapiński, mentioned at a information convention final month.

Glapiński additionally questioned whether or not the legislation went “in a special path” to the central financial institution’s financial tightening efforts. Poland raised its benchmark rate of interest in July for the sixth consecutive month to six.5 per cent, after inflation hit a 25-year-high.

Some bankers have even advised the federal government has launched a campaign towards them. Jarosław Kaczyński, the chief of the primary authorities celebration, Regulation and Justice, not too long ago proposed a windfall tax on banks that didn’t pay sufficient curiosity on deposits.

Polish banks have been on monitor to report sturdy earnings, however they’re now estimating a mixed value of about 20bn zlotys if all eligible mortgage holders skip month-to-month funds. The moratorium applies solely to mortgages contracted in zlotys.

Poland’s two largest banks, PKO and Pekao, which account for 40 per cent of the home mortgage market, can be hardest hit by the change. However the Polish arms of international lenders Santander, ING, Commerzbank and BNP Paribas may even endure.

Commerzbank anticipates that 60 to 80 per cent of the mortgage holders of its Polish subsidiary, mBank, will take the credit score vacation. The financial institution is contemplating authorized motion towards the Polish authorities. “Sadly, the brand new laws in Poland causes appreciable one-off burdens,” mentioned Bettina Orlopp, Commerzbank’s chief monetary officer.

Nellis at Citi expects some banks to take the difficulty to court docket, regardless of the poor report of earlier makes an attempt to pressure governments to vary coverage on mortgages. “The federal government is getting concerned and retroactively altering contracts, which appears to be like a bit naughty,” he added.

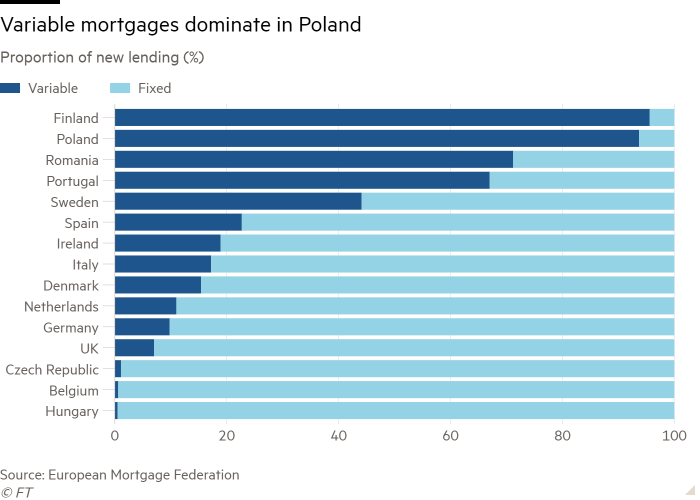

Poland’s housing market is extremely uncovered to price fluctuations as a result of the overwhelming majority of Polish mortgages carry a floating somewhat than a hard and fast price. In Romania, variable mortgages characterize greater than 70 per cent of latest lending, main the federal government in Bucharest to suggest mortgage holidays.

Some economists are warning that Poland’s credit score vacation may show counterproductive as financial tightening already threatens to push the economic system right into a technical recession in coming quarters.

“Banks might change into extra selective in providing financing,” mentioned Marcin Kujawski, senior economist on the Polish subsidiary of BNP Paribas. The moratorium, he warned, “might result in tighter credit score insurance policies, in addition to extra entrenched inflation, which probably may require extra rate of interest hikes than would in any other case be the case.”

In one other transfer, the federal government is searching for a brand new interbank lending price as early as January.

Nonetheless, banks are warning towards fast-tracking a reform of the Warsaw Interbank Provided Price, just like that undertaken to take away the scandal-tainted Libor price, which took years to return into impact. BNP Paribas is amongst banks warning that altering Poland’s price may result in worldwide lawsuits.

“It is a large reform, it means repricing all of the portfolios and likewise all of the hedging devices,” mentioned Przemysław Paprotny, who leads the monetary providers apply of PwC in Poland. “We now have to do not forget that Polish banks are hedging out the rate of interest and foreign exchange threat — and that is contracted with worldwide events.”

However regardless of the uproar within the banking sector, Paprotny mentioned the stability sheets of Polish banks have been stable sufficient to face up to the moratorium. “We don’t foresee any dramatic scenario that might name for discussions about speedy capital injections,” he mentioned.

The Polish banking market remains to be entangled in a decade-long court docket battle over who ought to bear the associated fee for Polish homebuyers who opted for mortgages in Swiss francs within the early 2000s, when Switzerland had far decrease charges than Poland. Following the 2008 monetary disaster, the price of these mortgages surged, consistent with the Swiss franc’s appreciation towards the zloty.

Agnieszka Accordi, an audit accomplice at PwC, mentioned reviewing how debtors finance their houses is smart within the context of Swiss mortgages. Poland, she mentioned, ought to search to “shut the dialogue about whether or not clients perceive what they’re paying for.”

When Rdzanek and his spouse purchased their Warsaw flat final summer time, their actual property agent suggested them to make use of a variable price for his or her mortgage.

“It’s a call that I remorse for positive,” he mentioned. The administration charges charged by his financial institution had additionally risen sharply in current months.

Even at a time of intense political polarisation in Poland, the moratorium was overwhelmingly authorized in parliament, backed by a leftwing opposition that desires to share the credit score for serving to customers somewhat than banks.

Source link