Opinion: The Fed vowed to crush inflation with increased charges. Then the inventory market rallied. Here is why. (It is not excellent news.)

[ad_1]

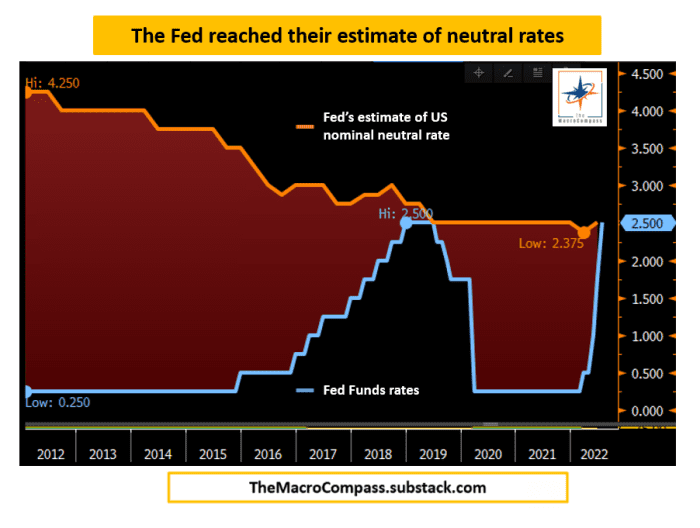

‘‘We at the moment are at ranges broadly according to our estimates of impartial rates of interest, and after front-loading our mountaineering cycle till now we can be far more data-dependent going ahead.’’

The Federal Reserve on Wednesday raised rates of interest by one other 75 foundation factors regardless of acknowledging that financial development is clearly slowing. The central financial institution, below Powell, reiterated that the trail of least resistance is well-represented by the so-called dot plot: Extra hikes forward — all the best way to a fed funds fee of three.75%!

And but, the inventory market has staged a humongous rally, led by essentially the most valuation-sensitive and risk-sentiment-driven asset courses: Nasdaq shares

COMP,

and crypto.

So … what the heck?!

All of it boils right down to how one single sentence was capable of have an effect on the likelihood distributions that buyers have been projecting for various asset courses.

Does it sound difficult? Bear with me: it’s not!

On this article, we are going to:

- Break down the FOMC assembly, and particularly talk about why that ‘‘one single sentence’’ spurred such a loopy rally.

- Assess the place this leaves us now: Is the music altering?

When the FOMC’s press launch was printed, it regarded like enterprise as typical: A well-telegraphed 75-bp hike with the one small shock represented by an unanimous vote regardless of clear acknowledgment that financial development is softening.

However not even quarter-hour into the press convention, the fireworks went off!

Specifically, when Powell stated: ‘‘We at the moment are at ranges broadly according to our estimates of impartial rates of interest, and after front-loading our mountaineering cycle till now we can be far more data-dependent going ahead.’’

This is essential for a number of causes.

The impartial fee is the prevailing fee at which the financial system delivers its potential GDP development fee — with out overheating or excessively cooling down. With this 75-bp hike, Powell advised us the Fed simply reached its estimate of a impartial fee and, therefore, from right here they aren’t contributing to financial overheating anymore.

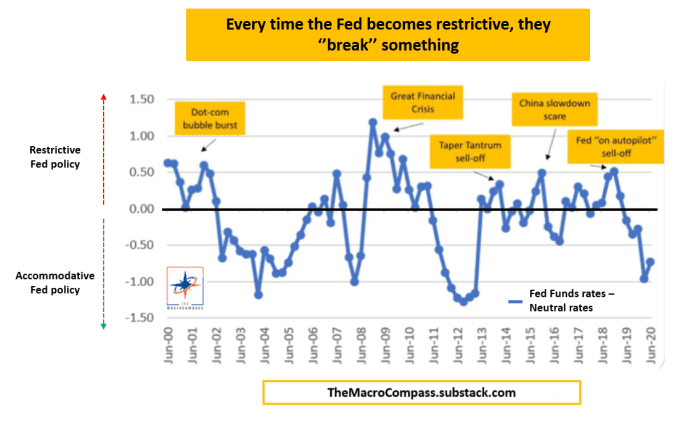

However that additionally means any additional will increase are going to place the Fed in an actively restrictive territory.

And the bond market is aware of that each time the Fed grew to become restrictive prior to now, they ended up breaking one thing.

Till Wednesday, you possibly can be utterly certain that the Fed would have simply pressed on the accelerator — inflation should come down; no area for nuance.

So journalists requested questions to seek out out one thing in regards to the ‘‘new’’ ahead steering. It went roughly like this:

Journalist: ‘‘Mr. Powell, the bond market is pricing you to minimize charges beginning in early 2023 already. What are your feedback?’’

Powell: ‘‘Laborious to foretell charges six months from now. We can be totally data-dependent.’’

Journalist: ‘‘Mr. Powell, because of the latest bond and fairness market rally, monetary situations have eased rather a lot. What’s your take?’’

Powell: ‘‘The suitable stage of economic situations can be mirrored within the financial system with a lag, and it’s arduous to foretell. We can be totally knowledge dependent.’’

He did it. He completely ditched ahead steering.

And what occurs whenever you achieve this? You give markets the inexperienced gentle to freely design their likelihood distributions throughout all asset courses with none anchor — and that explains the big danger rally — in addition to the leap within the broader S&P 500

SPX,

Let’s see why.

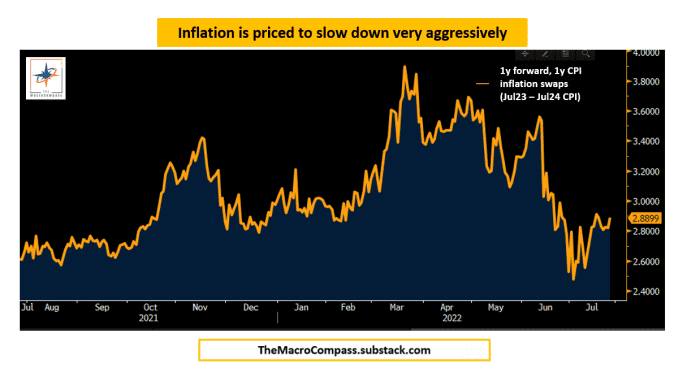

If the Fed is so data-dependent, and there may be mainly one knowledge they care about, all of it boils right down to how inflation will evolve within the close to future — and the bond market has a really robust opinion about that.

Utilizing CPI inflation swaps, I calculated the one-year ahead, one-year inflation break-evens — mainly, the anticipated inflation between July 2023 and July 2024, which is represented within the chart above and sits at 2.9%.

Do not forget that the Fed targets (core) PCE, which tends to traditionally be 30-40 bps under (core) CPI: Primarily, the bond market expects inflation to sluggish very aggressively and roughly hit the Fed’s goal within the second half of 2023 already!

So if the Fed is just not almost on autopilot anymore, and markets have a robust opinion on inflation and development collapsing, then they will additionally value all different asset courses round this base case state of affairs. It begins to be extra clear now, proper?

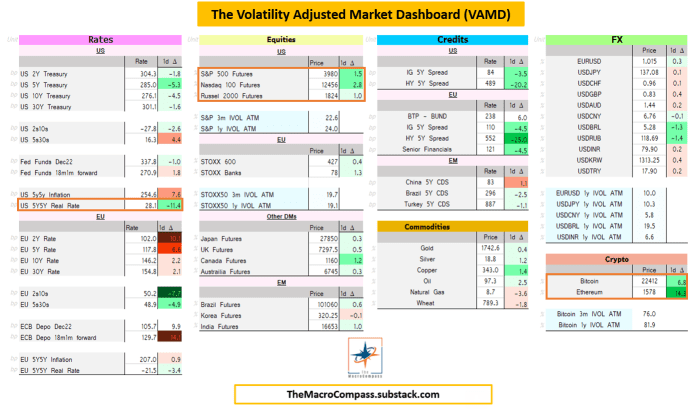

That is what my Volatility Adjusted Market Dashboard (VAMD — right here’s a short explainer) confirmed quickly after Powell enunciated that one single sentence.

Reminder: The darker the colour, the larger the transfer in volatility-adjusted phrases.

Discover how I highlighted three movers, however let’s begin from U.S. actual charges.

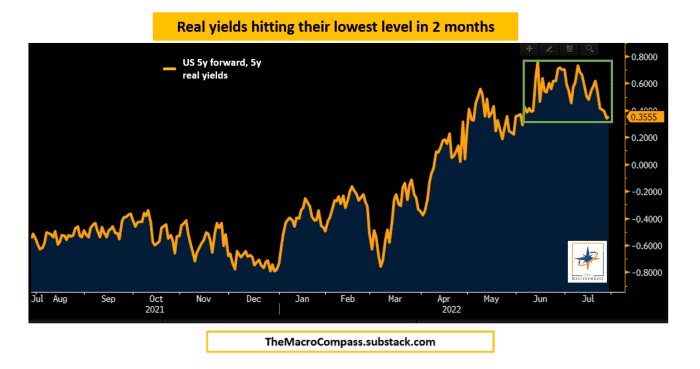

If the Fed isn’t going to blindly preserve mountaineering charges however be extra data-dependent, contingent on their view that CPI will shortly come down, merchants have a inexperienced gentle to cost a extra nuanced tightening cycle and, therefore, nonetheless count on restrictive actual yields however much less so than earlier than.

And, certainly, five-year ahead, five-year U.S. actual yields rallied 11 bps and hit their lowest stage in over two months.

When actual yields decline, valuation-sensitive and risk-sentiment-driven asset courses have a tendency to outperform.

That’s as a result of the marginal inflation-adjusted return for proudly owning money USDs (risk-free actual yields) turns into much less enticing and the (actual) discounting fee for long-term money flows turns into a lot much less punitive.

Thus, the incentive to chase danger belongings is bigger — truly, following this narrative one might argue that ‘‘the riskier, the higher.”

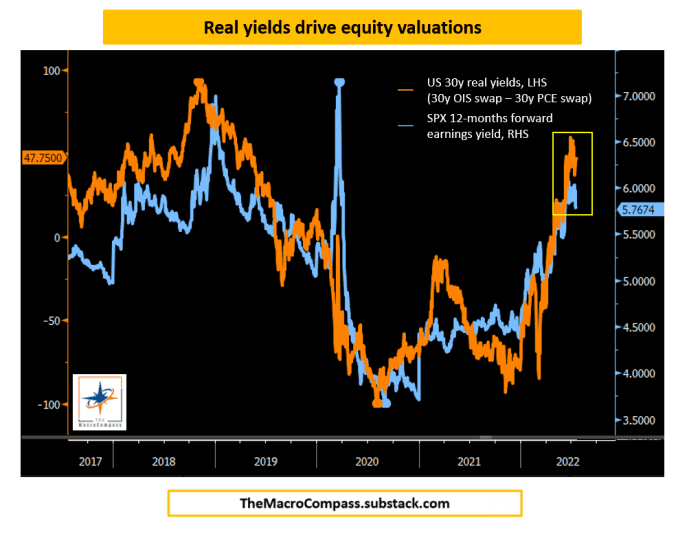

Here’s a chart exhibiting the very tight relationship between actual yields and fairness market valuations.

So guess who the 2 primary characters of the loopy market rally have been? U.S. tech and crypto.

However let’s now reply the actual query: On this big puzzle referred to as world macro, are all of the items falling into the suitable place to totally help this narrative?

Maintain your loopy horses

Briefly, the loopy market rally was spurred by Powell ditching the Fed’s ahead steering and kickstarting ‘‘full data-dependency’’ season. Given the bond market’s robust opinion on inflation going ahead and no autopilot by the Ate up a tightening cycle, buyers went forward and repriced all different asset courses accordingly.

If the Fed isn’t going to blindly hike us right into a recession, and contingent on inflation slowing shortly as priced in, then:

- Fewer hikes now, fewer cuts later (curve steepening)

- Decrease actual yields (Fed received’t preserve coverage ultra-tight for too lengthy)

- Threat-sentiment-driven asset courses can rally

So does the brand new narrative cross the worldwide macro consistency check?

Not likely. Not but.

And for 2 primary causes.

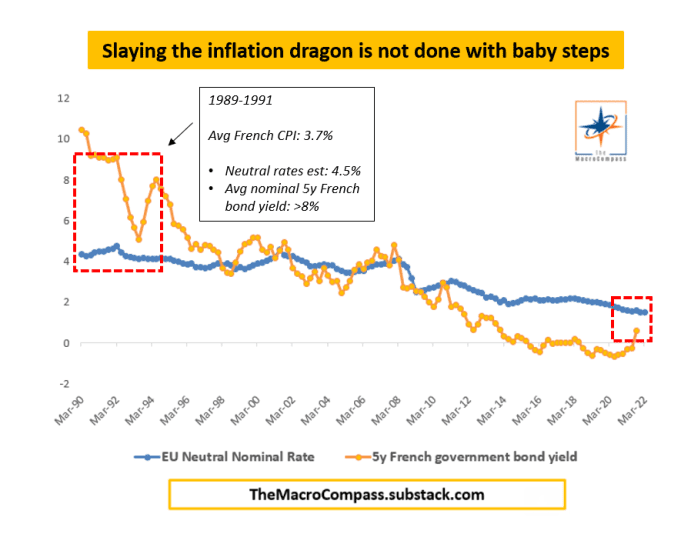

1. That is an important inflation struggle that central bankers have engaged in over 35 years, and historical past suggests a ‘‘mildly’’ restrictive stance received’t be sufficient.

Slaying the inflation dragon is mostly not finished with child steps, and that’s been true throughout totally different jurisdictions and historic circumstances.

For example: The final time inflation was stubbornly excessive in France, the central financial institution needed to deliver nominal yields (orange) all the best way to eight% and preserve them there for years to deliver down CPI — approach above my estimate of the prevailing impartial fee (blue) at 4.5%.

Assuming the Fed will be capable of engineer considerably decrease inflation whereas already taking the foot off the fuel pedal appears very optimistic.

2. Ditching ahead steering will increase volatility in bond markets even additional, and a unstable bond market is an enemy for danger belongings.

Let’s assume the subsequent inflation print is worse than anticipated in absolute phrases, momentum and composition.

A totally data-dependent Fed should take into account a 100-bp hike in September: Very prone to generate mayhem in markets over again.

Whereas ditching ahead steering is perhaps the suitable financial coverage technique amid these unsure occasions, when there isn’t a anchor for bond markets, implied volatility can have a tough time falling.

And increased volatility in one of many largest, most liquid markets on the earth typically requires increased (not decrease) danger premia in every single place else.

To sum all of it up: The Fed can’t, and received’t, cease till the job is completed. And the job can be finished solely when inflation has been killed — with probably huge collateral harm inflicted on the labor market and the broad financial system too.

So: Maintain your horses.

Alfonso Peccatiello writes The Macro Compass, a free e-newsletter on monetary training, macro insights and funding concepts. He was head of investments at ING Germany. Observe him on Twitter.

[ad_2]

Source link