Oil and fuel majors: time for a transformative clear vitality deal?

[ad_1]

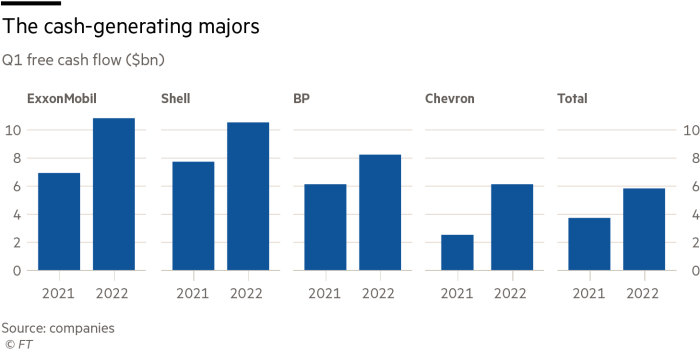

The world’s largest oil and fuel corporations are producing extra money than ever whereas spending comparatively little of it.

European supermajors BP, Shell and TotalEnergies have every pledged to grow to be inexperienced companies over the following three many years however are nonetheless investing solely a fraction of their capital on renewable energy.

With every anticipated to report one other set of bumper earnings over the following week, bankers are asking whether or not they is perhaps tempted to turbocharge their transition methods with an enormous acquisition.

The businesses haven’t stopped shopping for. In April Shell acquired Indian renewable energy group Sprng Power from Actis for $1.55bn; in Might Whole took 50 per cent of a US wind and photo voltaic farm developer for $2.4bn; and in June BP stated it had gained a 40 per cent stake in an enormous Australian renewables mission for an undisclosed sum.

Even US rival Chevron — a relative laggard on local weather commitments — spent $3.15bn in February on the sustainable fuel-focused Renewable Power Group.

However the offers are tiny in contrast with the tens of billions that will be wanted to strike a transformative deal for a “inexperienced vitality main” resembling Germany’s RWE or Denmark’s Orsted.

Within the first yr of the Covid-19 pandemic, as oil costs crashed and the worth of renewables corporations soared, such a deal appeared close to not possible. In October 2020 Orsted’s market capitalisation surpassed $70bn, as Shell’s fell beneath $90bn and BP’s dropped to $51bn, its lowest since 1997.

This yr, the rally in oil and fuel costs has helped Shell’s shares leap 30 per cent, pushing its valuation again to over $185bn. Orsted’s market cap, in distinction, is right down to $46bn, its shares having dropped about 3 per cent since January.

Nevertheless, Jim Peterkin, head of oil and fuel at funding financial institution Credit score Suisse, stated that whereas the time for such offers would come, it was nonetheless a way off.

“I do assume there’s going to be a consolidation over time however which may be 10 years away, not one yr away,” he stated.

Regardless of the shift in relative valuations, larger investor help for these corporations extra closely weighted in direction of renewables meant the likes of Orsted and RWE continued to commerce at a lot larger multiples than the previous oil and fuel majors, Peterkin added.

“The multiples haven’t modified,” he stated, so large-scale acquisitions of renewable corporations had been “nonetheless dilutive”.

Shell chief government Ben van Beurden informed the Monetary Instances he had been holding again from large offers to present Shell extra time to raised perceive the renewables sector.

“In some unspecified time in the future in time, I might anticipate there to be a time for big, inorganic [growth], however you don’t wish to begin in case you are a relative newcomer on the block,” he stated. “We’ve been loads of massive issues earlier than that didn’t work out, or that we didn’t resolve to do . . . and right now I’m congratulating myself for not having accomplished it.”

If Shell had been to make an enormous transfer, he added, the variety of power customers the goal firm had can be extra necessary than the variety of energy property.

Others within the trade level to a scarcity of viable targets for a blockbuster acquisition.

“Sure it is smart however there’s no apparent deal to accomplished,” stated one senior funding banker. “There will not be that many targets that will be actually transformative and the larger ones, like RWE or Orsted, aren’t actually executable.”

Orsted is majority-owned by the Danish authorities, the banker added, whereas successful acquisitions of listed German companies resembling RWE are uncommon.

Whole has been probably the most energetic of the supermajors in putting offers. The French group made roughly $6bn in low-carbon investments between 2010 and 2020, the identical as BP and Shell mixed, in keeping with Bernstein analysts. Funding financial institution RBC Capital Markets values Whole’s low-carbon enterprise at $35bn, in contrast with $24bn for Shell’s and solely $12bn for BP’s.

Bankers say Whole has been extra keen than its opponents to pursue partnerships with renewables corporations reasonably than outright acquisitions. Final yr it purchased a 20 per cent stake in Adani Green Energy for $2.5bn at an nearly 40 per cent low cost to the Indian group’s market capitalisation.

In Might Whole acquired 50 per cent of US group Clearway Power Group from International Infrastructure Companions. With Clearway proudly owning 42 per cent of its listed subsidiary Clearway Power Inc, the deal offers Whole entry to a pipeline of 25 gigawatts of wind, photo voltaic and storage initiatives throughout the US.

Whole restricted the amounted of money it was required to pay to $1.6bn by investing within the mum or dad firm reasonably than the listed entity and promoting GIP a stake in its SunPower enterprise in the identical deal.

“That to me is what good M&A appears to be like like for an vitality main going ahead,” Peterkin stated.

Whole chief government Patrick Pouyanné, who tends to shun bankers, preferring to barter offers resembling that with Clearway straight, informed the FT that the problem for the previous oil and fuel majors was make renewables sufficiently worthwhile.

“Our DNA is that we love the volatility of uncooked supplies of petrol, of fuel . . . we all know there might be low factors however there are excessive factors too,” he stated. “A utility isn’t that, these are those who settle for a return stage that’s regulated and managed.”

In consequence, corporations resembling Whole might want to purchase or develop renewable vitality companies the place no less than some portion of the facility produced will not be topic to regulated tariffs. “If I’ve, say, 70 per cent of my park below regulated tariffs, I’ve 30 to 40 per cent of manufacturing outdoors it, I could make some huge cash,” Pouyanné stated.

For now, the supermajors are but to point out whether or not they can run renewables companies profitably — not to mention, for the needs of profitable M&A, extra profitability than their present house owners.

To approve a deal, shareholders in an oil and fuel firm would have to be satisfied that it may run an organization resembling RWE’s property higher than they’re being run presently, stated the pinnacle of 1 renewables-focused personal fairness group.

Many trade insiders stay sceptical of the power of oil and fuel corporations to make the leap.

One suggestion is that by bringing their buying and selling expertise to the facility market, the European supermajors may enhance the returns at renewables initiatives below their administration.

BP, Shell and Whole’s buying and selling functionality stands out, even within the oil trade, and all three have constructed massive energy buying and selling companies. Entry to Whole’s energy buying and selling capabilities was pitched as a element of the latest Clearway deal.

If the European supermajors can use this benefit to ship “double-digit returns” from creating and proudly owning renewables property, it could go a protracted technique to convincing shareholders to again an even bigger acquisition in future, stated Peterkin.

Till then, most within the sector anticipate the most important offers to stay within the $1bn-$5bn vary, which means billions of {dollars} 1 / 4 will proceed to circulation again to shareholders within the type of buybacks and dividends.

Shell has accomplished $8.5bn of share buybacks already this yr and van Beurden has stated shareholders ought to anticipate extra.

Analysts consider the UK-headquartered group will report one other document quarterly revenue determine on Thursday of $11bn. RBC predicts an additional $7.5bn in share buybacks within the second half the yr.

“Perhaps in a yr’s time after extra buybacks and extra dividends, there might be a extra critical dialogue about what else to do with the cash,” stated Peterkin.

Further reporting by Sarah White in Paris

Source link