Musk, Bezos, Zuckerberg Lose More Than $150 Billion Combined

[ad_1]

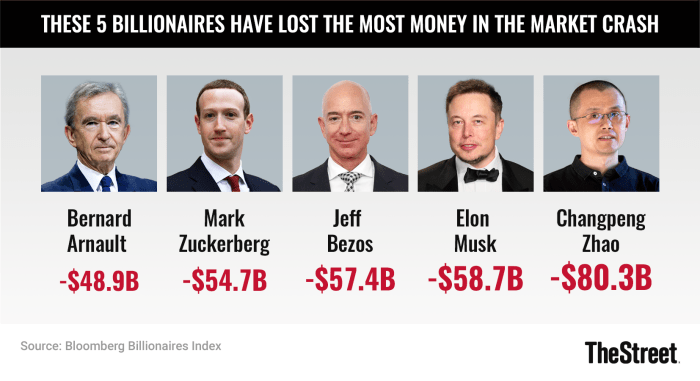

Five billionaires lost a total of $300 billion recently as their fortunes plummeted during the recent market downturn, according to the Bloomberg Billionaires Index, which is a daily ranking of the world’s richest people.

The billionaires who lost the most amount of net worth include the world’s three richest men, Elon Musk, Jeff Bezos and Bernard Arnault, who is the CEO of luxury goods retailer LVMH Moët Hennessy (LVMHF) . Meta Platforms (FB) – Get Meta Platforms Inc. Class A ReportCEO Mark Zuckerberg and Changpeng Zhao, CEO of Binance, a cryptocurrency exchange, saw their fortunes decline by $135 billion.

The selloff in the stock market cost Zhao $80.3 billion of his fortune while Musk, CEO of Tesla (TSLA) – Get Tesla Inc Report) lost $58.7 billion as of May 26. Former Amazon ( (AMZN) – Get Amazon.com, Inc. Report) CEO Bezos saw his net worth dip by $57.4 billion. Arnault’s fortune declined by $48.9 billion while Zuckerberg’s fell by $54.7 billion.

The correction in the market sunk the valuations of their companies. Amazon’s stock has fallen by 32.4% year-to-date while Tesla’s stock has declined even more at 36.7%.

Musk is now worth $211.8 billion while Bezos is worth $134.82 billion. French businessman Bernard Arnault, who is the CEO of luxury goods retailer LVMH Moët Hennessy, holds the number three spot with a net worth of $128.76 billion.

Zuckerberg’s fortune is worth $70.85 billion while Zhao’s wealth is now valued at $15.5 billion.

The cryptocurrency market’s value has fallen by more than $1.7 trillion since November, causing massive losses for investors owning digital currencies.

The reasons for the rapid selloff in the virtual currencies have been up for debate. These digital assets are impacted by fears of a recession, but widely reported scandals including the collapse of the stablecoin UST, or TerraUSD, and its sister token, Luna, have also contributed to its large dropoff.

Investors lost over $55 billion in this disaster, reminding them that the cryptocurrency industry remains a nascent one.

Scroll to Continue

While many investors have seen a large percentage of their fortunes dissipate as investors sold their holdings in equities, Buffett rose to the top.

He is one of three people in the top ten richest people globally whose net worth increased since January. The Oracle of Omaha is ranked number five on the index. His total net worth is $115 billion and he has gained $6.5 billion year-to-date.

Musk’s Woes

Musk, who is also CEO of SpaceX has faced a series of obstacles recently and he has complained often about it. On May 26, he tweeted that “Use of the word “billionaire” as a pejorative is morally wrong & dumb.”

The billionaire reportedly settled a sexual misconduct claim for $250,000 for allegedly exposing himself to a flight attendant on a private jet owned by SpaceX when he propositioned her in 2016, according to a report by Business Insider. He has denied these allegations.

“For the record, those wild accusations are utterly untrue,” Musk said about the allegations.

After offering $44 billion to takeover Twitter (TWTR) – Get Twitter, Inc. Report and make it a private company, Musk has claimed there are too many fake accounts on the social media platform. Even though he has a history of arguing with the Securities and Exchange Commission, on May 17 Musk sough to have the agency to investigate Twitter over the number of fake accounts.

This latest action could be a ploy by Musk to renegotiate the terms of the deal by seeking a lower price or back out of the deal completely.

He challenged Twitter’s board of directors and management since his acquisition offer on April 14 and said a little over a month later that the takeover deal is no longer on the table.

A letter from the SEC on May 27 questioned Musk’s original filing of his ownership stake in Twitter. The SEC’s Nicholas Panos sought information on why he did not make the disclosure within the required period. Musk’s “passive” 9.2% stake in the micro-blogging website increased by another 5% by March 14, which should have compelled him to file a 13-G statement with the regulatory agency by March 24.

A group of Twitter shareholders filed a class action suit against Musk earlier this week, claiming the billionaire manipulated shares lower in the company so that he could acquire more shares, saving $156 million.

Musk’s use of Twitter has also drawn the attention of the SEC in 2018 when the agency charged him with securities fraud related to a Tweet that he had ‘funding secured” to take the Tesla private.

[ad_2]

Source link