Kenyan insurtech Lami raises $3.7M seed extension led by Harlem Capital – TechCrunch

[ad_1]

Proper from the launch of its first product in 2020, Kenyan insurtech Lami Technologies got down to enhance insurance coverage penetration in Kenya and the remainder of Africa. They started on this path by constructing and distributing an end-to-end digital insurance coverage platform and API that allowed companies in several sectors to create tailor-made insurance coverage options for his or her prospects.

With its API platform gaining floor within the insurance coverage area, the startup can also be planning to supply tech options that can digitize brokers and brokers too, serving to them streamline their operations — to succeed in a large buyer base and promote on-line. These plans additionally embody enabling the digitization of conventional insurers as innovation continues to form the business.

Talking to Techcrunch, Lami’s founder and CEO, Jihan Abass, additional introduced plans to supply extra insurance coverage product strains, whereas additionally revealing that the startup has made an entry into Egypt and Nigeria. All this in opposition to the backdrop of a $3.7 million seed extension raised in a spherical led by Harlem Capital — which invests in minority and girls founders.

Different traders that participated within the spherical consists of early-stage VC agency Newtown Companions, Peter Bruce-Clark, a companion at New York’s research-driven enterprise capital firm Social Influence Capital, Caribou Honig and Jay Weintraub of InsureTech Join, a networking platform for insurtech innovators, and senior members from Exotix Advisory, a company finance and mergers and acquisition boutique targeted on rising markets. The latest funding adds to the $1.8 million seed funding the insurtech raised last year.

Talking about its progress methods, Ms. Abass affirmed the agency’s plans to constantly innovate as they discover new methods of accelerating insurance coverage penetration throughout the continent – which presently stands at under 3%.

“On the know-how facet we need to cater to your complete insurance coverage ecosystem. So, it’s not solely the digital platforms that need to promote insurance coverage merchandise, but additionally to assist present gamers be extra environment friendly of their distribution of merchandise, permitting them to play a job in growing the insurance coverage penetration stage. This consists of brokers and brokers – we’re wanting into how we are able to empower them to promote extra insurance policies,” she mentioned, whereas including that Lami is utilizing the funding to rent, fast-track its enlargement plans and to drive underwriter partnerships.

Explaining their funding in Lami, Harlem Capital principal Gabby Cazeau mentioned: “We consider the subsequent wave of fintech will embed monetary services like insurance coverage right into a buyer’s buy expertise. Lami’s method to serving folks via strategic companions in e-commerce and finance is one of the best ways to construct belief with customers and ship insurance coverage in a seamless, accessible solution to Africans throughout the continent.”

Lami co-designs merchandise with its underwriting companions, presently 25 in quantity, who assist use its API to facilitate the distribution of insurance coverage merchandise by way of a B2B2C method.

Lami Applied sciences, which has expanded to Nigeria and Egypt, plans to supply extra insurance coverage product strains. Picture Credit: Lami Applied sciences

The startup’s API permits entities like banks to supply digital insurance coverage merchandise to their prospects. Lami has additionally built-in its API with over 15 entities in varied sectors, together with logistics, e-commerce, banking and fintech.

Amongst Lami’s companions is purchase now pay later startup Lipa Later, which it helps via insurance coverage in opposition to fee default for the financed merchandise. The insurtech works with Sendy too to allow freight carriers in East Africa (Kenya, Uganda and Tanzania) to entry transit insurance coverage on per-trip foundation, and likewise with Kwara to make insurance coverage merchandise accessible to the over 60,000 SACCO (credit score union) members. Different shoppers are e-commerce platform Jumia, retail B2B and end-to-end distribution platform, MarketForce, and Stanbic Financial institution Insurance coverage – which makes use of Lami’s know-how to energy bancassurance merchandise.

Lami entered the market in January 2020, with a shopper going through product, Griffin insurance coverage, arguably the primary digital automotive insurance coverage platform. It then pivoted to supply a product agnostic API platform that powers digital insurance coverage merchandise. This has helped it develop its portfolio to 85,000 from 70,000 insurance policies on the finish of 2021, and quadrupled the premiums underwritten to $800,000 final 12 months — the corporate predicts that it will develop to over $2 million this 12 months.

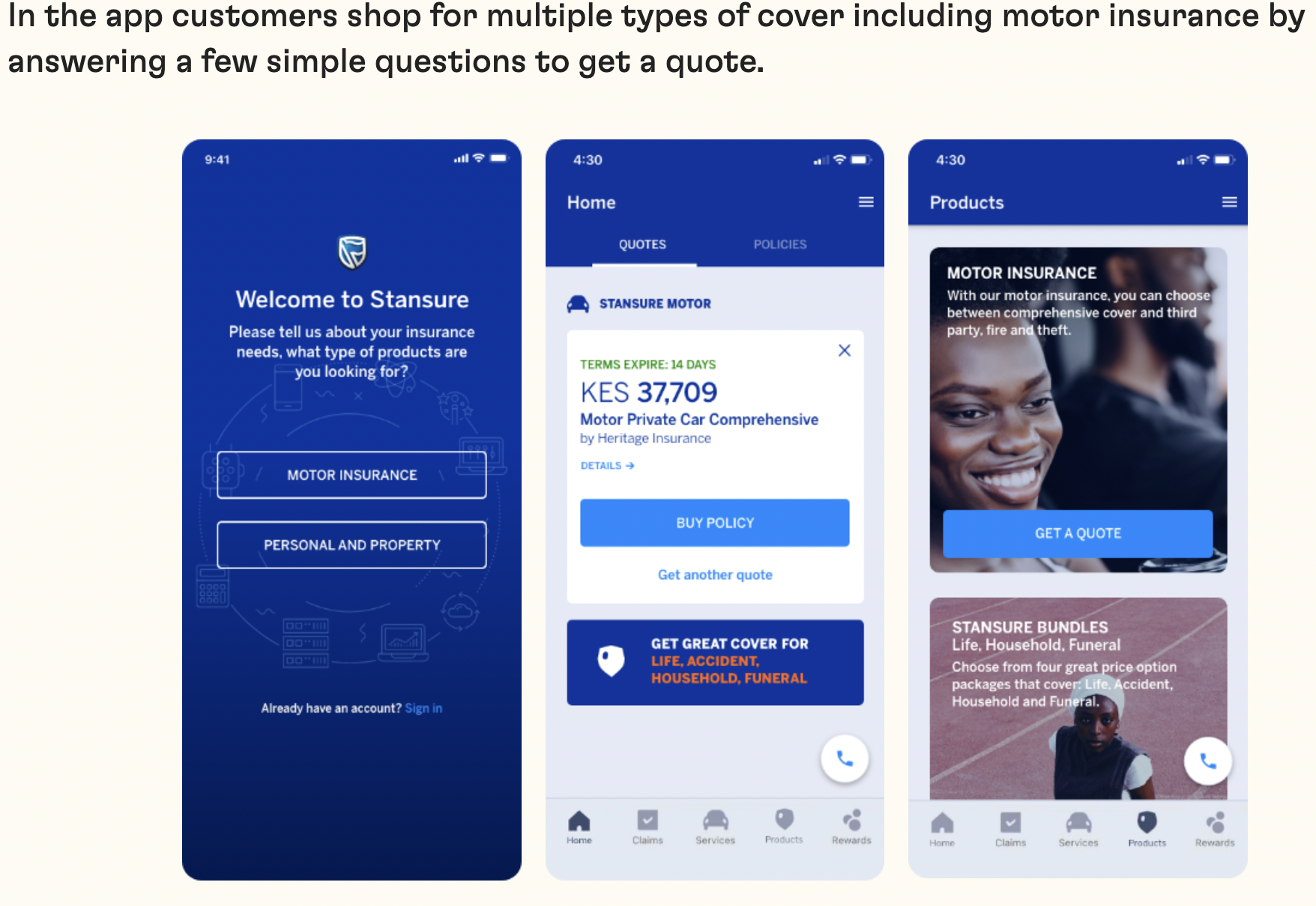

Stanbic Financial institution makes use of Lami’s SaaS platform to energy its bancassurance merchandise. Picture Credit: Lami Applied sciences

The anticipated progress will largely be fueled by growing partnerships and product strains, and the aggressive enlargement plans it launched into this 12 months when it entered Malawi and the Democratic Republic of Congo (DRC) after buying Bluewave. The acquisition helped Lami to faucet Bluewave’s clientele and applied sciences that allow entry to micro-insurance merchandise via numerous channels like USSD and WhatsApp chatbots.

Abass anticipates extra progress alternatives with extra partnerships from tech-enabled companies and as extra insurance coverage corporations digitize.

“Insurance coverage corporations have realized that they can not depend on conventional distribution channels any longer; they should additionally diversify for their very own monetary wellbeing. After which additionally with regards to digital platforms, I believe they’ve additionally realized that it’s a simple method for them to diversify their income streams,” mentioned Abass.

“The panorama has actually remodeled since we launched our first product two years in the past. Individuals are extra open to digital distribution channels. We anticipate to see important progress on the B2B2C facet. That is the place we see plenty of alternative as we develop into different markets.”

Source link