Traders promote stakes in buyout funds at a file tempo

[ad_1]

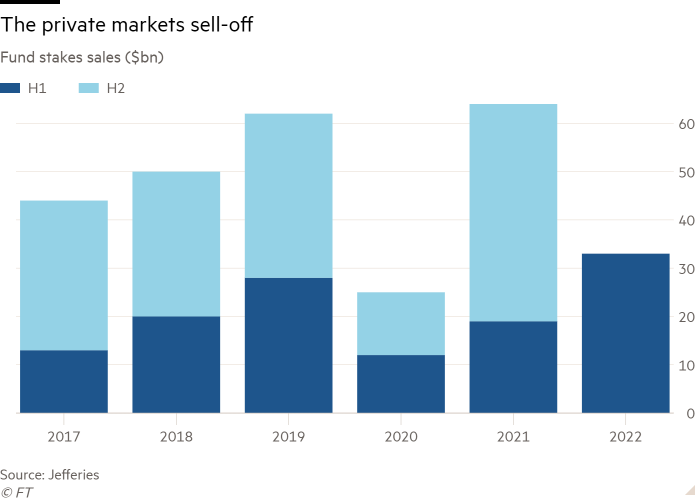

Traders are promoting stakes in non-public fairness and enterprise capital funds this yr on the quickest tempo on file, because the downturn in equities spreads to the non-public markets that boomed in the course of the period of low rates of interest.

Pension and sovereign wealth funds had been amongst those who offered $33bn value of stakes in non-public funds within the first six months of the yr, up from $19bn in the identical interval in 2021, in keeping with Jefferies, sometimes promoting them under their face worth.

The sell-off follows a decade of surging allocations to personal markets, which have grown in affect because the monetary disaster and canopy every part from buyout companies to enterprise capital and actual property funds.

It casts doubts on the power of those teams to maintain the fundraising that has reworked them into a significant pressure in world dealmaking.

Pension funds say the transfer to ditch stakes has been partly triggered by the steep decline in inventory markets, leaving their general portfolios too uncovered to buyout funds and different non-public investments whose worth has not been marked down in the identical approach.

“We’ve by no means had to do that earlier than, and we hoped we might by no means should do it,” mentioned the top of personal fairness at a pension fund that offered a few of its holdings in buyout funds at a reduction. “We’re additionally going to scale back the quantities we decide to new non-public fairness funds this yr and subsequent.”

On the identical time, pension funds that had dedicated cash to buyout companies have needed to really stump up the money much more shortly than anticipated over the previous two years due to the frenzy of dealmaking.

That has sparked fears of a funding squeeze, in keeping with a senior government at an endowment that invests in private equity, as some pension funds fear they could not have sufficient money readily available to fulfill future capital calls from the buyout funds they’ve dedicated to.

Traders “are desperately nervous that they’ll get themselves into a whole money crunch and have to begin promoting issues, in order that they’re attempting to get on prime of that” by promoting the stakes now, he mentioned.

“Distributions [money handed back to investors from successful deals] had been at an unimaginable tempo for the final 5 years” and buyers assumed this might proceed, enabling them to fulfill new calls on their funds, he mentioned. “As an alternative they’ve nearly fully turned off.”

In distinction to publicly traded securities that may be simply purchased and offered, investments in non-public funds are sometimes locked up for a couple of decade and their worth is set utilizing a technique of refined guesswork.

Nonetheless, the holders of those illiquid stakes can quietly promote them in a secondary market, both to different pension funds and sovereign wealth funds or to specialist teams referred to as “secondaries” companies. These area of interest funding teams are sitting on about $227bn, raised partly for such transactions, in keeping with Jefferies.

Whereas some buyers routinely promote their older stakes in non-public funds, nearly half of this yr’s transactions concerned a first-time vendor, Jefferies estimates. The quantity of such gross sales is all the time greater within the second half, placing this yr on monitor for a file if the sample is repeated.

On common, stakes in buyout, enterprise capital and actual property funds had been disposed of for simply 86 per cent of their face worth within the first half, the largest low cost because the interval of market turmoil firstly of the coronavirus pandemic, in keeping with Jefferies.

Stakes in enterprise capital funds had been offered at 71 per cent of their most up-to-date valuation, underlining how rising rates of interest and fears of a recession have curbed buyers’ willingness to again usually unprofitable start-ups.

Personal fairness teams sometimes estimate that an investor makes extra money in the event that they maintain the stake till the top of a fund’s life. However the vendor doesn’t essentially lose cash general as a result of the fund could have already got repaid sufficient from profitable offers to earn a optimistic return.

Promoting out of personal fairness: the way it works

Allocation guidelines

Many pension funds and different buyers have guidelines on the proportion of their complete property that may be allotted to personal markets

breaching limits

Some have breached that restrict for 2 causes. Buyout companies have referred to as on pensions funds’ commitments extra shortly than anticipated over the previous two years due to their wave of dealmaking. On the identical time, the decline in inventory markets has left funds with an extreme weighting to personal markets

lowering publicity

So, they should reduce publicity to personal funds to get again to their goal

going through a crunch

Typically the necessity is much more acute, as a result of the pension fund or different investor dangers a money crunch. Throughout a buyout fund’s typical 10-year life, its managers ask the pension funds for cash after they purchase portfolio firms, and hand a refund to them after they promote them — referred to as “capital calls” and “distributions” respectively

recycling money

Some buyers had been planning to make use of the cash from new distributions to fund new capital calls. However as dealmaking has halted this yr, distributions have dried up. Capital calls may nicely fall too, as buyout teams strike fewer offers, however some buyers nonetheless must unlock money by promoting stakes in older funds

a technique out

However they’ve dedicated to the non-public fund for a decade, an illiquid funding. The one approach out is to rearrange privately to promote their stake within the fund to a different investor — both a pension and sovereign wealth fund or a specialist second-hand purchaser

a deal is finished

If agreed, the client takes on the vendor’s curiosity within the non-public fund. It’s on the hook for future capital calls and entitled to future distributions

Source link