HKD, AMTD, WTF? The inventory you have not heard of that is up 30,000% in 2 weeks

[ad_1]

We’re going to determine the primary most essential factor proper out of the gate, earlier than we get into this example: That is about as excessive threat as shares get. This inventory simply IPO’d, is predicated out of the country, and has run 30,000% in two weeks on very low quantity. Translation: Please don’t learn this and conclude, “Wow, what an awesome inventory that I ought to positively purchase!” — That’s completely NOT what we’re saying right here.

Okay, disclaimer is over. Let’s have a look at what’s occurring in (HKD) .

AMTD Digital (HKD): What do they do?

AMTD Digital is a Hong Kong based mostly funding banking firm that has created a digital platform known as “AMTD SpiderNet”. AMTD calls SpiderNet a “metaverse” ecosystem and presently it’s largely utilized by fintech start-ups and web influencers. Oh, what’s that? That sounds imprecise you say? No worries, check out AMTD’s website to clear up your whole confusion.

If the italics weren’t clear sufficient: we’re being sarcastic — the web site’s clarification of SpiderNet is extraordinarily imprecise.

What can be gleaned from the web site is:

- AMTD offers funding banking and asset administration providers to shoppers on a global foundation

- AMTD Digital raised $125M in its New York IPO — the biggest itemizing by a Chinese language firm in 2022

- It owns the SpiderNet platform

That’s actually all the web site explains. After digging by means of a number of press releases, we have been capable of decide that the SpiderNet platform intends to supply capital and know-how to digital startups, in addition to present networking providers to different digital startups. In flip, SpiderNet collects a price from its members, which is the place it will get nearly all of its income.

Briefly: AMTD Digital is a Hong Kong based mostly fintech play which basically offers loans and providers to startups in alternate for charges.

Does it justify AMTD Digital shortly turning into the twenty sixth largest inventory in the US by market cap? Let’s get just a little extra details about the inventory earlier than we make that judgment.

Scroll to Proceed

Prepared to start out buying and selling the technicals? Attempt Rebel Weekly. Ride the waves of market momentum with two actionable trade ideas designed to capture technical break outs and break downs — delivered to your inbox every week.

The Rise of AMTD Digital Stock

Since this tweet was released, HKD has risen to the 13th largest market cap stock, overtaking (WMT) – Get Walmart Inc. Report.

That is the juicy stuff. Other than the corners of FinTwit and Wallstreetbets, AMTD Digital is comparatively unknown. We’re going to shine the sunshine on it:

- At its debut, AMTD Digital had a fairly excessive price-to-earnings ratio of 18 — greater than the common Chinese language fintech ratio of ~5.

- At the moment buying and selling at $2,555.30, the P/E ratio has risen to a whopping 13,160.

- The market cap is presently 386,745M — putting it slightly below (XOM) – Get Exxon Mobil Corporation Report in dimension, and above corporations like Walmart, (DIS) – Get The Walt Disney Company Report, and McDonalds.

- In response to a latest submitting, AMTD Digital has solely 51 staff.

- AMTD Digital is owned by AMTD Thought Group (AMTD), which has additionally had a comparatively swift rise.

- Throughout its second yr of operation (2020), AMTD Digital’s income grew greater than 10X.

- Following that spectacular progress, annual income slowed considerably, falling to 17% in 2021.

- In 2022, income progress has fallen to simply 4% in accordance with its most recent SEC prospectus.

- AMTD Digital operates with comparatively excessive margins — 88% in the latest fiscal yr.

- Nonetheless, included in that revenue margin calculation is the positive factors from its fairness investments.

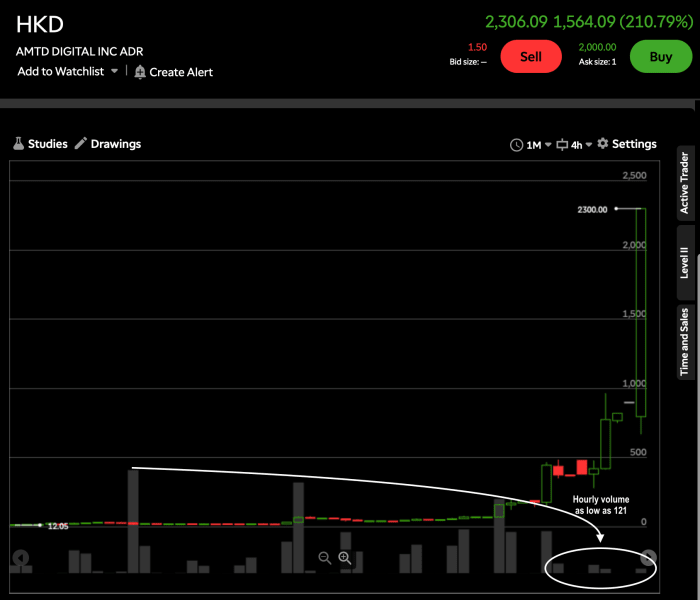

- AMTD Digital’s meteoric run has been in opposition to a backdrop of declining quantity which was already low to start with.

Summarizing AMTD Digital (HKD)’s Mysterious Run

If we have been going to present the shortest abstract potential of AMTD’s latest motion, we’d say that nothing about this run makes conventional “sense”.

- The low quantity does make sense given the large run.

- The P/E ratio is absurdly excessive in comparison with its sector, and even the remainder of the market.

- The market cap doesn’t make sense on condition that AMTD Digital is an organization that few individuals have ever heard of, and can also be (for now) the sixteenth largest inventory by market cap buying and selling in the US.

- The income slowing from 10X to simply 4% doesn’t justify the run, both.

If it looks like we’re being essential: We’re. Try to be too. The inventory market is usually a profitable device for accrual of wealth, however it can also trap investors and traders who aren’t careful about their investments. Usually, if one thing appears too good to be true, it in all probability is. In different phrases, as Market Rebel Co-Founder Pete Najarian usually says, “Self-discipline Dictates Motion” — and disciplined merchants do their analysis.

Trade smarter. Start hunting for unusual option activity today.

[ad_2]

Source link