Gold-To-Silver Ratio Rises To Highest Degree Since 1990

[ad_1]

America entered a recession in 1990, which lasted 8 months by means of March 1991.

The top of that recession marked the height of the gold/silver ratio and as we await Thursday’s Q2 GDP print to verify a technical recession, the gold/silver ratio is again up at these ranges – ex-COVID’s gold spike, that is ‘most cost-effective’ that Silver has been relative to Gold since February 1991…

In easy phrases, as SchiffGold.com recently noted, traditionally, silver is extraordinarily underpriced in comparison with gold. Sooner or later, you must count on that hole to shut.

In the summertime of 2019, the sliver-gold ratio climbed to just about 93:1 and on the onset of the pandemic, it rocketed to over 100:1. However because the Fed slashed charges and launched its huge quantitative easing program, gold rallied and took silver with it. Silver sometimes outperforms gold throughout a gold bull run. This was the case throughout the pandemic. As gold pushed above $2,000 an oz., a 39% achieve, silver rallied to just about $30 an oz., a 147% enhance.

In the meantime, the silver-gold ratio fell from over 100:1 to simply over 64:1, near the excessive finish of the historic norm.

With that unfold widening once more, we might be organising for one more large rally in silver.

Traditionally, as Mining.com details below, the ratio between gold and silver performed an essential position in guaranteeing cash had their acceptable worth, and it stays an essential technical metric for metals buyers at the moment.

This graphic charts 200 years of the gold-to-silver ratio, plotting the pivotal historic occasions which have formed its peaks and valleys.

Whereas gold is primarily viewed as an inflation and recession hedge, silver can be an industrial metallic and asset. The ratio between the 2 can reveal whether or not industrial metals demand is on the rise or if an financial slowdown or recession could also be looming.

The Historical past of the Gold-to-Silver Ratio

Lengthy earlier than the gold-to-silver ratio was allowed to drift freely, the ratio between these two metals was mounted by empires and governments to manage the worth of their currency and coinage.

The earliest recorded occasion of the gold-to-silver ratio dates again to 3200 BCE, when Menes, the primary king of Historic Egypt set a ratio of two.5:1. Since then, the ratio has solely seen gold’s worth rise as empires and governments grew to become extra accustomed to the shortage and issue of manufacturing for the 2 metals.

Gold and Silver’s Historic Beginnings

Ancient Rome was one of many earliest historical civilizations to set a gold-to-silver ratio, beginning as little as 8:1 in 210 BCE. Over the a long time, various gold and silver inflows from Rome’s conquests induced the ratio to fluctuate between 8-12 ounces of silver for each ounce of gold.

By 46 BCE, Julius Caesar had established a normal gold-to-silver ratio of 11.5:1, shortly earlier than it was bumped to 11.75:1 underneath emperor Augustus.

As centuries progressed, ratios all over the world fluctuated between 6-12 ounces of silver for each ounce of gold, with many Center Japanese and Asian empires and nations usually valuing silver extra extremely than Western counterparts, thus having a decrease ratio.

The Rise of the Mounted Ratio

By the 18th century, the gold-to-silver ratio was being redefined by the U.S. authorities’s Coinage Act of 1792 which set the ratio at 15:1. This act was the premise for U.S. coinage, defining cash’ values by their metallic compositions and weights.

Across the similar time interval, France had enacted a ratio of 15.5:1, nonetheless, neither of those mounted ratios lasted lengthy. The expansion of the economic revolution and the volatility of two world wars resulted in huge fluctuations in currencies, gold, and silver. By the twentieth century, the ratio had already reached highs of round 40:1, with the beginning of World Struggle II additional pushing the ratio to a excessive of almost 100:1.

Just lately in 2020, the ratio set new highs of greater than 123:1, as pandemic fears noticed buyers pile into gold as a safe-haven asset. Whereas the gold-to-silver ratio then tumbled to round 65:1 in Q1 2021, runaway inflation and a possible recession has put gold in the spotlight once more, sending gold hovering relative to silver.

Currently, as SchiffGold.com notes, most analysts consider the Fed will proceed its battle towards inflation and financial coverage will proceed to tighten. Because of this, gold and silver have each seen important promoting strain regardless of an excessive inflationary atmosphere and a whole lot of proof that the economy is tanking.

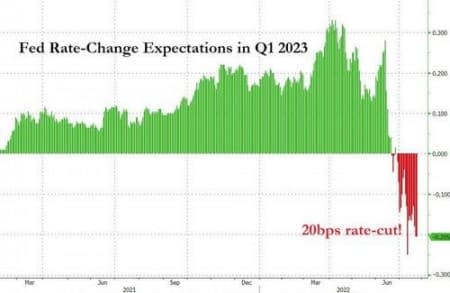

The big question is whether the Fed will keep tightening even because it turns into extra obvious we’re in a recession? Traditionally, the Fed has been fast to hurry in and prop up a lagging economic system. Fee cuts and a return to QE would virtually actually pour extra gasoline on the inflation hearth.

Finally, the markets will determine this out, and gold and silver ought to rally.

The supply and demand dynamics also look good for silver even with a looming recession. Funding demand skyrocketed final yr and provide is down. Industrial demand is rising pushed by the expansion of the green energy sector. Governments are more likely to hold that gravy prepare working even throughout an financial downturn. Mine output was hit arduous by shutdowns because of the coronavirus pandemic, however silver manufacturing was already on the decline with mine output dropping for 4 straight years.

Now will be the good time to make the most of silver on sale.

By Zerohedge.com

Extra Prime Reads From Oilprice.com:

Source link