Gold traders face bind over bars from tarnished Russia By Reuters

[ad_1]

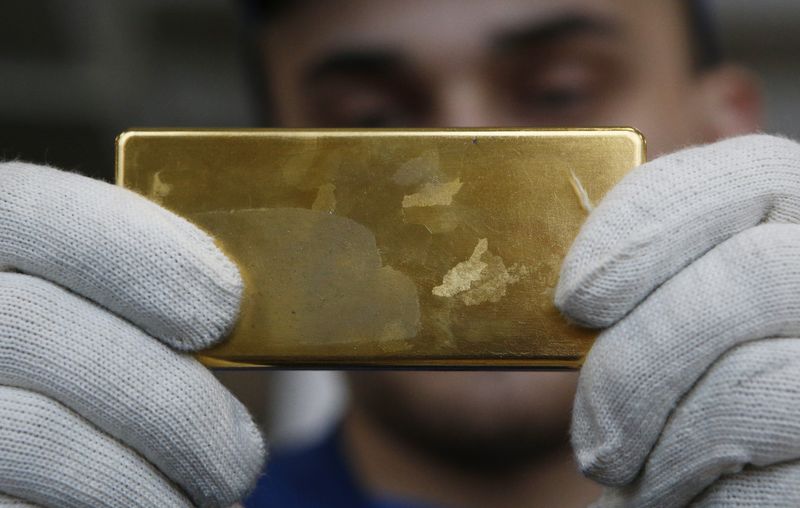

© Reuters. An worker reveals gold bar on the Prioksky Non-Ferrous Metals Plant in Kasimov, Russia February 14, 2017. Image taken February 14, 2017. REUTERS/Sergei Karpukhin

© Reuters. An worker reveals gold bar on the Prioksky Non-Ferrous Metals Plant in Kasimov, Russia February 14, 2017. Image taken February 14, 2017. REUTERS/Sergei Karpukhin2/2

By Peter Hobson

LONDON (Reuters) – Some traders need Russian gold off their books nevertheless it’s not that straightforward to take away.

A de facto ban on Russian bullion minted after Moscow’s invasion of Ukraine — instigated by the London market in early March — doesn’t apply to a whole bunch of tonnes of gold that has been sitting in business vaults since earlier than the battle began.

Fund managers trying to promote the steel to keep away from the deepening reputational threat of holding belongings linked to Russia of their portfolios may set off a pricey scramble to exchange it with non-Russian gold, in line with bankers and traders.

“This could solely serve to wreck traders. It would not harm the (Russian) regime,” stated Christopher Mellor at Invesco, whose fund has round 265 tonnes of gold, 35 tonnes of it produced in Russia with a market worth of round $2 billion.

The dilemma dealing with traders displays Russia’s heft within the international bullion commerce and its hub, the London market, the place gold price round $50 billion adjustments fingers each day in personal offers.

A fast selloff of gold from Russia — a prime three provider — would doubtlessly disrupt that commerce by undermining the precept that each one bars within the London buying and selling system are interchangeable no matter their origin, in line with three senior bankers at main gold buying and selling banks.

To buttress the market, two of the bankers informed Reuters they contacted shoppers and rival banks to inform them they might not dump Russian bullion minted earlier than the struggle.

The bankers stated they suggested their prospects and different merchants that they need to do the identical. They declined to be named as a result of confidential nature of the conversations.

“I made an effort to name shoppers. I informed them, should you demand that your Russian steel is swapped out, you will create an issue for your self. You do not need to create a scramble,” one stated.

He stated his telephone lit up with calls after the London Bullion Market Affiliation (LBMA), a commerce physique that units market requirements, eliminated all Russian refineries from its accredited listing on March 7, which means their newly minted bars may now not commerce in London or on the COMEX change in New York, the most important buying and selling venue.

“There was utter confusion. Funds have been saying they did not need any Russian bars of their holdings,” the banker stated.

THE BANK OF ENGLAND

Russia invaded Ukraine on Feb. 24 in what it has referred to as a “particular navy operation” geared toward demilitarising Ukraine and rooting out harmful nationalists. Kyiv and the West name this a baseless pretext for an aggressive land seize.

The Financial institution of England, which operates Britain’s largest gold vault, stated it thought of Russian gold bars made earlier than the battle in Ukraine eligible to commerce as a result of they’re nonetheless on the LBMA’s accredited listing, often known as the Good Supply Checklist.

“So far as the Financial institution of England is worried, any Russian refined gold produced after eighth March shouldn’t be London Good Supply. Any bars produced earlier than that stay acceptable, and we informed all our prospects this was the case. That is only a level of truth, so we haven’t any touch upon this,” the Financial institution of England stated in an emailed assertion.

To hammer residence the purpose that pre-invasion Russian gold was meant to be handled the identical as gold from different locations, some banks informed shoppers for whom they saved gold that they must pay additional to dump Russian bullion as a result of it might breach their current contracts, the 2 bankers, a 3rd banker and two gold-owning funding funds stated.

The bankers’ conversations with shoppers and rivals, which haven’t beforehand been reported, spotlight the function performed by a handful of gamers within the London gold market, the place trades occur in bilateral offers.

Twelve banks dominate buying and selling within the London gold market and 4 of them — JPMorgan (NYSE:), HSBC, ICBC Normal Financial institution and UBS — function vaults. Anybody buying and selling bullion depends on their companies, straight or not directly, to settle trades.

JPMorgan, HSBC, ICBC Normal and UBS declined to remark when requested about how they dealt with investor requests to promote their holdings of Russian gold.

The LBMA, which is made up of gold refiners, merchants and banks, shouldn’t be a regulator, and depends on market individuals to uphold its guidelines.

The big amount of Russian gold within the London market and Russia’s quickly rising pariah standing within the wake of the Ukraine invasion, nonetheless, put the banks in a tough spot, in line with attorneys and market consultants.

“I feel you are seeing the banking neighborhood making an attempt to navigate a really complicated state of affairs,” stated Peter Hahn, emeritus professor on the London Institute of Banking & Finance.

“The Monetary Conduct Authority (FCA) ought to query the follow to know whether or not the actions have been, typically, for the advantage of market individuals … and whether or not the follow was clear to market individuals.”

The FCA is the British regulator answerable for overseeing banks the place they commerce monetary merchandise or devices within the London gold market. It declined to remark.

A spokesman for the LBMA stated the affiliation was “anecdotally” conscious that some house owners and merchants of Russian gold have needed to swap it out or to not take care of Russian gold sooner or later.

Requested what the LBMA considered this, the spokesman stated that it “maintains a impartial stance supplied the environment friendly operation of the market is unaffected.”

The spokesman declined to touch upon bankers’ efforts to stop a sell-off of Russian gold. He stated that the LBMA “doesn’t distinguish between various kinds of good supply gold”.

POTENTIAL LOSSES

The bankers’ actions seem to have labored.

Good supply gold bars minted in Russia earlier than the invasion haven’t traded at a reduction to the remainder of the market, in line with merchants. Bigger traders — together with some change traded funds (ETFs) with Russian gold price greater than $1 billion — don’t seem to have bought up.

“Our ETFs usually are not in a position to get all Russian metals off their books at brief discover,” stated a spokesperson for Zürcher Kantonalbank.

“The potential losses wouldn’t be suitable with our fiduciary responsibility to our shoppers and its sale is at present not doable as a result of present state of affairs.”

Zürcher Kantonalbank’s present ETF inventory of about 160 tonnes of gold comes primarily from Swiss refineries and the share of Russian gold is negligible, in line with the spokesperson.

A widespread and fast clearout of Russian gold from investor portfolios may push its worth down by wherever from $1-$40 an oz in comparison with non-Russian gold, individuals within the trade stated.

No less than $12 billion price of Russian gold is saved in vaults in London, New York and Zurich, in line with a Reuters evaluation of information from 11 massive funding funds. The entire quantity is probably going considerably bigger however there are not any publicly out there figures to quantify it.

If Russian gold traded at a reduction of $5 an oz, the price to funds of changing $12 billion price of steel can be round $34 million.

A Reuters evaluation of funding knowledge reveals that the share of Russian gold in eight massive ETFs really rose to 7% on common in mid-July from 6.5% in mid-March.

Some gold market individuals have pushed forward with promoting their Russian holdings however they’ve tended to have much less to dump.

Britain’s Royal Mint, for instance, stated it had Russian bars price round $40 million in its ETF and removed them by mid-March.

Others are attempting to cut back their Russian holdings over time, asking the banks which retailer their gold to step by step reduce their allocation or refusing to simply accept Russian gold bars in new deliveries.

Asset supervisor Abrdn stated it had requested its financial institution to cut back its Russian holdings. In mid-March, Russian gold accounted for 10% of the roughly 45 tonnes held in its Aberdeen Normal ETF. By mid-July, that proportion had fallen to 9.8%.

These searching for a quicker exit, in the meantime, have been left in a bind.

“Everybody has the identical drawback. Everybody desires to resolve it, nobody is aware of how,” stated a supply at a serious funding fund.

(The story refiles to make clear that the FCA oversees banks buying and selling monetary merchandise or devices within the London gold market)

Source link