Gasoline disaster raises recession threat for inflation-hit eurozone economic system

[ad_1]

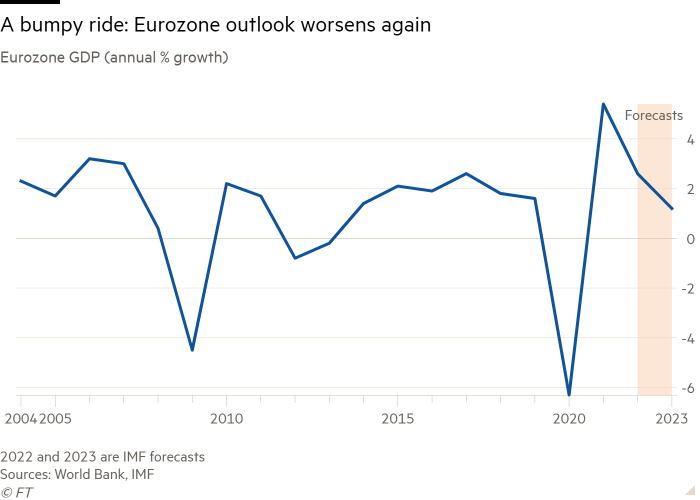

The eurozone is forecast to eke out progress fractionally above zero within the second quarter, however economists count on a gentle deterioration within the bloc’s economic system over the subsequent yr as recession dangers loom.

Eurostat’s first estimate of second-quarter gross home product, out on Friday, is anticipated to indicate an growth of 0.1 per cent from the earlier quarter, in response to a ballot by Reuters. That marks a pointy deterioration from 0.6 per cent progress over the earlier three months and could be the weakest efficiency since a surge in coronavirus infections and restrictions dragged the bloc into a brief recession at the beginning of 2021.

Russia’s invasion of Ukraine in February has despatched power and meals costs hovering, eroding the spending energy of customers whereas threatening to unleash an power disaster that leaves producers and households in need of fuel over the approaching winter. Political instability in Italy forward of elections in September provides to considerations concerning the bloc’s outlook.

“It’s like watching a automotive crash within the making, a slow-burn disaster,” mentioned Katharina Utermöhl, senior European economist at German insurer Allianz. “Not like within the pandemic, there’s unlikely to be a marked rebound subsequent yr.”

One vivid spot is tourism and hospitality. The eurozone economic system is more likely to get a lift from extra individuals benefiting from decreased coronavirus restrictions to go on holiday or eat out in restaurants this summer time, as they spend among the more money they saved throughout the pandemic.

However this enhance is more likely to be muffled by rising family nervousness over the upper price of residing. Most eurozone customers are feeling the pinch as a result of their pay has not saved tempo with inflation, now at a file excessive of 8.6 per cent, leaving them worse off.

“We’re solely forecasting a small enhance to progress from tourism, journey and lodging this summer time as the actual earnings squeeze beneficial properties tempo, dampening customers’ discretionary spending,” mentioned Veronika Roharova, head of developed Europe economics at Credit score Suisse.

Russian power group Gazprom mentioned this week that flows by way of its important Nord Stream 1 pipeline to Germany have been halved to about one-fifth of their regular ranges from Wednesday because of upkeep, intensifying considerations that Moscow is weaponising power provides to Europe. European fuel costs jumped 30 per cent within the first two days of this week. They’ve risen nine-fold previously yr.

A protracted discount in Russian fuel flows to Europe might depart the area unable to fill its storage amenities sufficiently earlier than this winter’s heating season, forcing provides to be rationed for heavy industrial customers.

A whole cessation of flows “might pressure power rationing, affecting main industrial sectors, and sharply cut back progress within the euro space in 2022 and 2023”, the IMF warned on Tuesday because it slashed its forecast for German progress subsequent yr by 1.9 share factors to 0.8 per cent, the largest downgrade of any nation. With no shut-off, the fund expects the eurozone to develop by 2.6 per cent this yr and 1.2 per cent subsequent yr.

The EU has set a goal for many international locations to chop fuel utilization by 15 per cent. The German authorities this week urged households and firms to avoid wasting much more and Berlin plans to let power firms move on 90 per cent of their larger prices to clients. “We’re in a critical state of affairs,” mentioned Robert Habeck, Germany’s economic system minister. “It’s about time that everybody understood that.”

Authorities measures to chop gas, electrical energy and public transport costs are more likely to have saved a lid on inflation. However client costs are nonetheless anticipated to have risen to a brand new eurozone file of 8.7 per cent in July in Eurostat figures printed on Friday.

Larger costs have been blamed for a string of gloomy financial information. These embody the primary fall in eurozone enterprise exercise for 17 months, as indicated by S&P World’s newest survey of buying managers, and the drop in German enterprise confidence to a two-year low, as measured by the Ifo think-tank’s month-to-month survey.

In the meantime, client confidence fell to a file low this month, in response to the European Fee’s month-to-month survey.

Banks are additionally squeezing the provision of loans to eurozone households and companies — a pattern that’s more likely to speed up after the European Central Financial institution raised rates of interest for the primary time in over a decade final week.

The worsening outlook has already prompted buyers to wager the ECB will cease elevating charges a lot sooner than they anticipated only some months in the past.

Germany’s 10-year bond yield — a benchmark for eurozone rates of interest — on Tuesday dropped beneath 1 per cent for the primary time since Might after falling from final month’s eight-year peak of 1.77 per cent.

“The window of alternative for the ECB to maintain elevating charges is closing because the economic system is weakening,” mentioned Spyros Andreopoulos, senior European economist at French financial institution BNP Paribas.

The nightmare situation for the ECB and governments alike could be stagflation, with an interruption to Russian fuel provides sending the eurozone into recession whereas the power disaster and a weaker euro proceed driving costs even larger.

On Wednesday, Goldman Sachs downgraded its forecast for the area, saying a technical recession of two straight quarters of unfavorable progress this yr was now extra more likely to occur than not, even when Russia didn’t utterly lower off power provides. A sharper downturn was probably “within the occasion of an much more extreme disruption of fuel flows, a renewed interval of sovereign stress or a US recession”.

Credit score Suisse’s Roharova predicted eurozone GDP would fall between 1 and a pair of per cent subsequent yr if Russian fuel was lower off, whereas inflation would stay properly above the ECB’s 2 per cent goal for at the least one other yr. “It’s doable that inflation stays elevated or falls solely step by step whilst progress weakens,” she mentioned.

Source link