Frontier soars on lacking Spirit as high industrial gainer, earnings sink Upwork

[ad_1]

Justin Sullivan/Getty Photographs Information

The week noticed Federal Reserve mountain climbing rates of interest by 0.75 share level for the second consecutive time to fight inflation, however the market reacted positively when Fed Chair Jerome Powell tried to strike a hawkish/dovish steadiness.

In the meantime, Frontier gained on lacking out an acquisition of Spirit, and earnings turned the deciding issue for the decliners on this week’s record.

For the week ending July 30, 10 out of the 11 sectors within the S&P 500 gained. The SPDR S&P 500 Belief ETF (SPY) was within the inexperienced for the second week in a row (+4.28%). Nonetheless, YTD, the ETF is -13.26%. The Industrial Choose Sector SPDR (XLI) additionally noticed positive factors (+5.74%) for the second week straight. YTD, XLI is within the pink -9.61%.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +22% every this week. Nonetheless, YTD, just one out of those 5 shares are within the inexperienced.

Frontier Group (NASDAQ:ULCC) +30.22%. Frontier inventory surged +20.50% on July 28 after JetBlue introduced a deal to purchase Spirit Airways for $3.8B. A day previous to this, Spirit had terminated its merger settlement with Frontier. The identical day Frontier additionally reported its quarterly outcomes, which noticed Q1 revenue beating analysts estimates. SA contributor Dhierin Bechai wrote that Frontier outcomes have been affected by larger than anticipated prices.

The SA Quant Score on the shares is Buy, which takes under consideration components resembling valuation and profitability, amongst others issues. The common Wall Road Analysts’ Score can also be Buy, whereby 3 out of 6 analysts provides the inventory a Sturdy Purchase. YTD, the inventory is up +6.71%, the one one amongst this week’s high 5 which within the inexperienced for this era.

Encore Wire (WIRE) +26.65%. The Texas-based firm’s inventory gained all through the week, probably the most on July 26 +10.61%, the day after it reported Q2 outcomes. The inventory surged to its six-week excessive as revenue grew +12.6% Y/Y. The SA Quant Rating and the common Wall Road Analysts’ Score, each have a Strong Buy score on the inventory. YTD, the inventory has declined -3.24%.

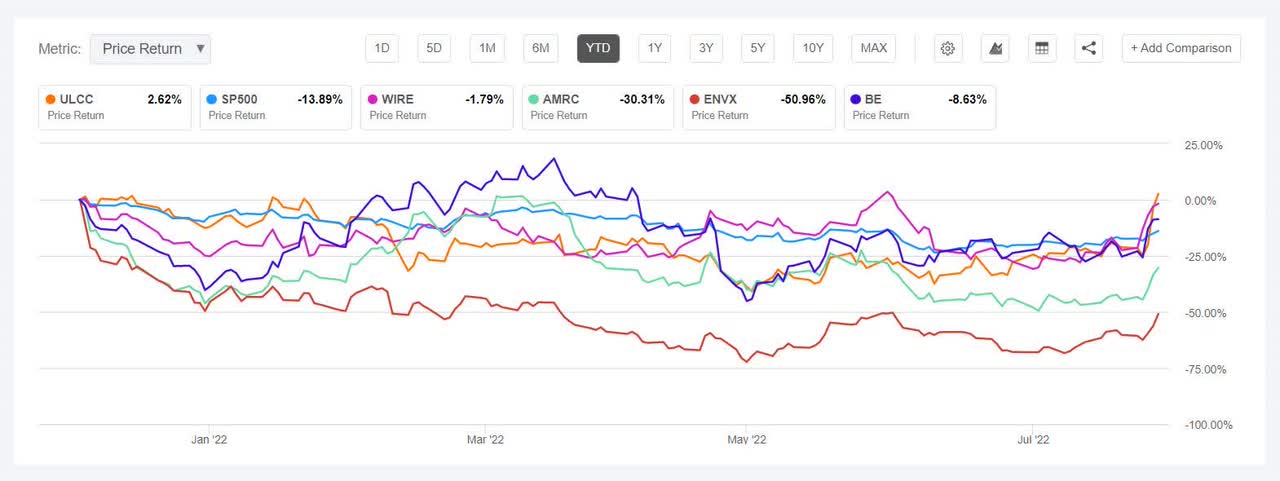

The chart beneath reveals YTD price-return efficiency of the highest 5 gainers and SP500:

Ameresco (AMRC) +26.06%. The Framingham, Mass.-based renewable vitality options supplier gained probably the most on July 28 (+10.72%) this week. Nonetheless, the inventory was among the many worst 5 performers in Q2 (-44%) and YTD, has shed -29.74%. The SA Quant Score on the inventory is Hold, with Profitability having an element grade of D and Development with A- issue grade. The score is in distinction to the common Wall Road Analysts’ Score of Buy, whereby 8 out of 12 analysts tag it as a Sturdy Purchase.

Enovix (ENVX) +23.56%. The Fremont, Calif.-based lithium-ion battery maker’s inventory was again among the many high 5 gainers after two months. The shares elevated probably the most on July 29 (+12.31%), nevertheless YTD, greater than 50% inventory worth has been worn out (-51.17%). The SA Quant Score on the inventory is Hold, with Profitability having an element grade of D- and Valuation with an F issue grade. Nonetheless, the common Wall Road Analysts’ Score differs and provides the inventory a Strong Buy score, with an Common Value Goal of $24.75.

Bloom Vitality (BE) +22.46%. The San Jose, Calif.-based firm, which gives energy era platform, soared amongst photo voltaic and inexperienced vitality shares after Senator Joe Manchin and Majority Chief Chuck Schumer announced a shock deal that features $369B for “vitality and local weather change.” The common Wall Road Analysts’ Score on BE is Buy, contradicting an SA Quant Score of Hold. YTD, the inventory has declined -7.75%.

This week’s high 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -10% every. YTD, 4 out of those 5 shares are within the pink.

Upwork (NASDAQ:UPWK) -17.95%. The Santa Clara, Calif.-based firm, which gives a web based work market, noticed its inventory plunge on July 28 (-16.68%) a day after its Q2 regardless of Q2 beat on ambiguous outlook. The inventory was among the many high 5 decliners two weeks in the past however was among the many greatest 5 gainers (on this section) for June.

The SA Quant Score on the inventory is Hold, with Profitability having an element grade of D+ whereas Valuation having an element grade of F. The score is in distinction to the common Wall Road Analysts’ Score of Buy, whereby 4 out of 11 analysts give it a Sturdy Purchase score. YTD, UPWK had declined -45.67%.

Stanley Black & Decker (SWK) -15.88%. SWK fell after Q2 results missed analysts expectations, and the New Britain, Conn.-based firm lower its FY22 outlook and introduced implementation of a value discount program geared toward saving $1B by year-end 2023. YTD, the inventory has fallen -48.40%.

The SA Quant Score on the inventory is Sell, with Profitability having an element grade of D+ and Momentum having a D- issue grade. The common Wall Road Analysts’ Score differs and tag it as Buy, whereby 6 out of 19 analysts give the inventory a Sturdy Purchase score.

The chart beneath reveals YTD price-return efficiency of the worst 5 decliners and XLI:

Hayward (HAYW) -13.81%. The Berkeley Heights, N.J.-based pool tools maker was within the decliners’ record for the second week in a row. HAYW slumped after Q2 revenue and GAAP EPS missed analysts’ estimates. YTD, the inventory has shed -55.51%, probably the most amongst this week’s worst 5. The common Wall Road Analysts’ Score is Buy, which is in distinction to the SA Quant Score of Hold.

TransUnion (TRU) -10.43%. The Chicago-based firm’s inventory too was hit by disappointing quarterly outcomes. Q2 revenue got here beneath analysts’ expectations and TransUnion guided its Q3 and FY22 outlook beneath consensus. The corporate, which gives danger and knowledge options, additionally noticed a downgrade at BofA Securities on related considerations. YTD the inventory has declined -33.18%. The SA Quant Score on TRU is Hold, differing with the common Wall Road Analysts’ Score of Buy.

FTI Consulting (FCN) -10.16%. The inventory shed -9.05% on July 28 after Q2 adjusted EPS missed estimates, regardless of income beating expectations. Nonetheless, YTD, the inventory has gained +6.61%, the one one amongst this week’s decliners to be within the inexperienced for this era. The Washington, D.C.-based firm was the perfect performing industrial inventory (on this section) in Q2. The common Wall Road Analysts’ Score is Strong Buy, whereas the SA Quant Score is Buy.

Source link