EV consumers have much better credit score than ICE buyers

[ad_1]

All of the tales about smart sorts who waited in line or jumped by hoops to pay big worth premiums on a brand new electrical car?

Name them outliers for now, as a brand new research verifies that EV consumers much less prone to tackle outsized ranges of debt than these buying conventional gasoline-powered automobiles.

The research, from the credit score big TransUnion, with S&P World Mobility, and mixing the previous’s credit score information with the latter’s car registration and forecasting, couldn’t be extra complete in measurement and scope. The mammoth-scale information crunch checked out roughly 33 million U.S. shoppers who purchased new automobiles from 2019 to 2021.

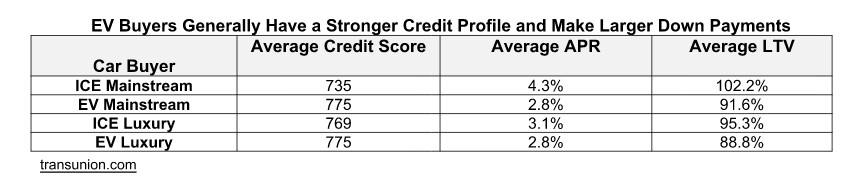

All in, EV consumers had such higher credit score that they jumped the divisions between mainstream and luxurious sectors. What TransUnion thought-about to be EV mainstream consumers had a better common rating than internal-combustion-engine (ICE) luxurious consumers—775 versus 769, respectively.

EV vs. ICE credit score profile – TransUnion

A large distinction in credit score scores interprets to an enormous distinction within the phrases of the mortgage and, finally, what the client can afford. In keeping with TransUnion, a credit score rating of 735—the common for an ICE mainstream purchaser—corresponded with a median APR of 4.3%, whereas the 775 common for an EV mainstream purchaser meant 2.8%. That linked to a median mortgage to worth charge—the share of the overall mortgage quantity versus the car worth—of 102.2% for the ICE mainstream purchaser versus 88.8% for EV consumers.

Sure, meaning EV consumers are additionally making larger down funds.

And the lower-risk credit score profile appeared to transcend the elements that historically go into credit score rankings. Even evaluating EV and ICE consumers with the identical credit score rating, the EV consumers had decrease “severe delinquency charges.”

2023 Hyundai Tucson Plug-In Hybrid

TransUnion hasn’t supplied a breakdown on the way it divided the mainstream and luxurious markets. However it was clear that it filtered out consumers of plug-in hybrids and was constructed on the expectation that the marketplace for totally electrical automobiles will develop from about 5% at present to about 40% by 2031.

“Whereas Tesla dominates the market at present, it’s predicted to fall beneath 20% of market share by 2025 as new makes enter the EV house,” the research mentioned.

Working round a worth rift that most likely received’t final

At the moment, there’s a gigantic price rift between ICE automobiles and EVs that provides EVs a backside line nearer to luxurious fashions—maybe as a result of lots of them are luxurious fashions. In keeping with Kelley Blue E-book, the common new automotive in America now prices greater than $48,000, whereas the common price of an EV is round $67,000. With electrical automobiles and ICE fashions expected to reach a price parity by mid-decade, it’s an anomaly that possible received’t final.

The conclusions about credit score threat and demographics confirms anecdotal feedback that a lot of executives have made concerning the consumers of their mass-market electrical car fashions. Hyundai executives have, for example, famous that the Ioniq 5 electric SUV is drawing early consumers who may have afforded a way more costly luxurious car.

2022 Hyundai Ioniq 5

As a complement to the large-scale information itself, the companies did a survey of about 1,500 U.S. car house owners concerning which EV consumers have been most enthusiastic about, plus purchasing and finance preferences.

The survey discovered {that a} greater charge of EV buyers do analysis on automobiles and financing on-line—with double the speed (32% versus 16%) finishing financing on-line.

Which means EV house owners are way more prone to perceive—and wish to perceive—what they’ll afford forward of hands-on purchasing.

Is low-risk habits all the time a constructive to dealerships?

That mentioned, it stays debatable as to which entities like dealerships, captive credit score corporations, or separate lenders see this as a constructive—and, to the purpose, whether or not these with pristine credit score are the almost definitely to both generate essentially the most revenue for the dealership or to be repeat consumers. Sellers usually run on a specific proportion markup versus the majority charge negotiated for consumers in sure threat swimming pools, pre-negotiated with the lenders.

In the meantime, these with higher credit score scores usually tend to cross-shop, and to be extra conscious that there’s a markup, whereas these with decrease credit score may additionally maybe be extra prone to impulse-buy—and go for car look choices or equipment that the super-sensible, top-credit sorts may not.

Honda future dealership design for promoting EVs – 2022

The TransUnion conclusions even lay out opportunities for dealerships that some makes are presently leaving on the desk: “Greater than half of EV house owners/considerers want to finance their subsequent EV dwelling charging station,” it says.

For years, dealerships have been hesitating about placing the extra time and sources into selling and supporting EVs, however to us, this research underscores but one more reason why they may very well be focusing extra consideration on them.

Source link