Europe’s lenders put together for all times outdoors destructive territory

[ad_1]

Europe’s lenders have endured a painful decade ready for rates of interest to rise.

However simply as central banks lastly begin to transfer, the long-awaited earnings windfall is being threatened by looming recession and fears that cash-strapped governments may hit lenders with new taxes.

Final week, the European Central Financial institution raised rates of interest for the primary improve since September 2011, by half a proportion level to zero. That adopted extra aggressive hikes at the Federal Reserve and the Financial institution of England in makes an attempt to regulate inflation that’s forecast to quickly break into double digits.

“The world must relearn banking,” UBS chief govt Ralph Hamers instructed the Monetary Instances. “The eurozone being in destructive territory for eight years, Switzerland being in destructive territory for seven years now, the place folks didn’t worth deposits, financial savings accounts.”

Bankers “which have joined us over the previous seven years right here in Switzerland, they’ve by no means labored for a financial institution in a constructive price setting”, he added.

The parallel developments of useful price rises and dangerous shopper and company misery have break up opinion on how Europe’s banks will fare after a decade that has seen their earnings stagnate and their share costs dramatically underperform their US friends.

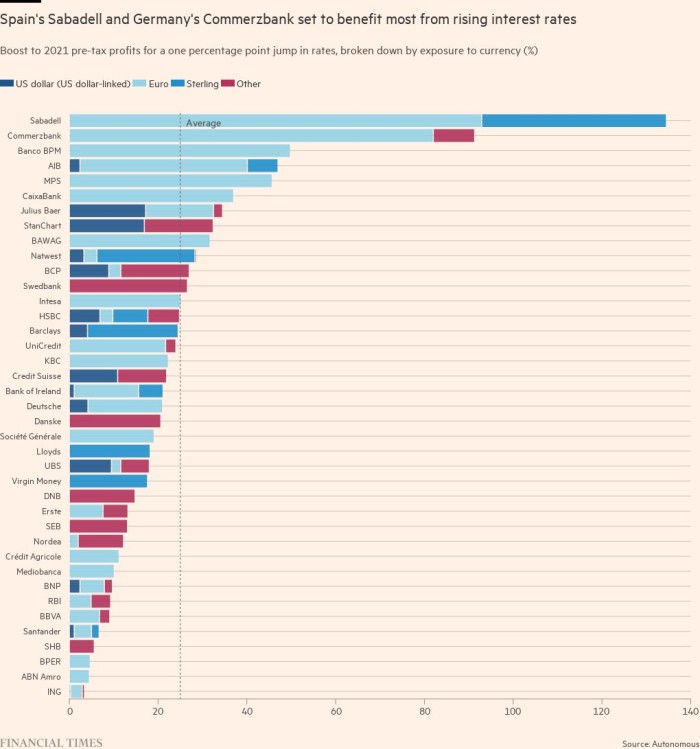

Many are bullish for the primary time in years. The speed hikes had been hailed as a “sport changer” for the sector by Morgan Stanley analyst Magdalena Stoklosa. Larger base charges imply better earnings as internet curiosity earnings (NII) improves, a measure of the distinction between what a financial institution pays for deposits and expenses for loans.

“We predict Eurozone price hikes are . . . the most important structural catalyst for European banks,” mentioned Stoklosa. She predicts the “cheap” sector “sits on 52 per cent upside” to its present depressed inventory market valuation.

These with massive steadiness sheets and mortgage books stand to learn probably the most. HSBC, for instance, sits on a world deposit surplus of $700bn and has estimated {that a} 1 proportion level soar in charges would generate an extra $5bn of NII yearly — equal to a tenth of final 12 months’s $50bn of income.

Lloyds Financial institution estimates {that a} one proportion level base price rise provides £675mn to its earnings within the first 12 months.

Rising charges and the resultant market volatility are additionally good for funding banks. Barclays, BNP Paribas and Deutsche Financial institution have generated billions in income by means of their massive buying and selling arms as shopper exercise has surged.

On Thursday, Barclays mentioned income from fixed-income buying and selling jumped 71 per cent to £1.5bn within the second quarter. Equally, Deutsche Financial institution reported a 32 per cent quarterly rise and Goldman Sachs posted a 55 per cent acquire in the identical enterprise earlier within the month.

“Whether or not you’re an asset supervisor or a company, a protracted sustained charges pattern means you have to rebalance your portfolio extra usually, which has pushed revenues meaningfully for us and the business,” mentioned Ram Nayak, co-head of funding banking at Deutsche.

Such optimism from analysts and traders has not been seen for years. Hamstrung by anaemic earnings, misconduct scandals and better capital necessities, main European and UK banks have traded properly beneath the e-book worth of their belongings. Few persistently make a return on fairness better than 10 per cent, seen because the naked minimal by traders.

After the monetary disaster, the area was sluggish to restructure and has fallen far behind Wall Avenue in funding banking. The dearth of money to put money into know-how has left banks weak to competitors from fintech start-ups and big technology companies resembling Apple, Google and Amazon.

Nevertheless, an finish to years of ultra-low or destructive charges “turns their core franchise from a lossmaking prospect to impartial,” mentioned Financial institution of America analyst Alastair Ryan. Primarily based on the present projections for additional hikes, BofA expects that inside a 12 months EU banks might be producing a much-needed further €17bn in NII earnings each quarter.

Again to the Seventies?

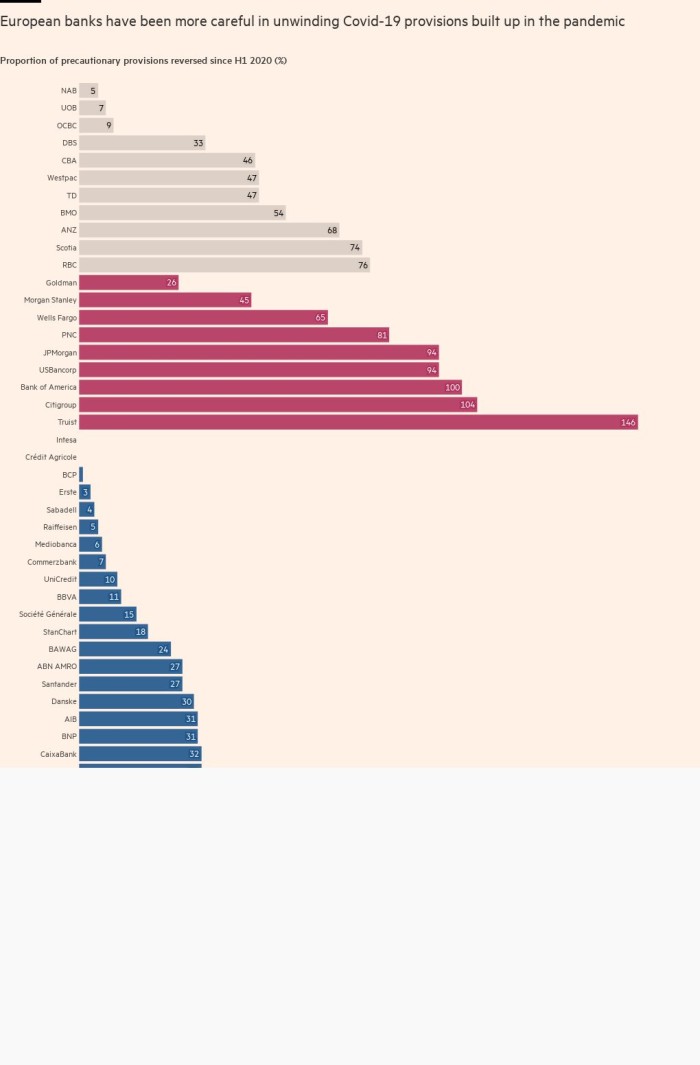

However at the same time as optimism mounts, a giant query stays unanswered: how a lot of the rate of interest windfall might be eaten by greater mortgage losses. Shoppers face an acute value of dwelling disaster and small companies are starting to battle with decrease spending and snowballing inflation quickly after world Covid-19 lockdowns.

Some consider the sector can cope, because it did throughout the worst of the pandemic.

“Even with slower lending, we anticipate the recurrent income profit of upper rates of interest to considerably exceed the one time influence of upper provisions,” BofA’s Ryan mentioned.

Others are much less sanguine.

“It’s not simple to forecast the influence of provisions and bankruptcies. The state of affairs is like Covid; it’s fully new, now we have by no means been by means of this because the Seventies,” mentioned Jérôme Legras, head of analysis at funding firm Axiom. “When one thing is unpredictable, markets have a pointy danger aversion.”

One portfolio supervisor at Capital Group led a €7bn sell-off in European bank stocks this 12 months on fears that the area’s economic system had turned and lenders could be saddled with huge losses and elevated prices as a result of inflation.

Financial and political dangers — resembling in Italy, the place prime minister Mario Draghi’s resignation has brought on a disaster that has unfold to the federal government bond market and banking system — have continued to mount.

“Recessions in each the US and Europe look more and more possible . . . [and] historical past tells us that the European banking sector’s earnings usually drop 50 per cent,” mentioned Autonomous analyst Stuart Graham.

“Present sentiment is overwhelmingly bearish,” he added. “Traders see loads of issues to fret about — principally a ‘Russia switches off the gasoline’ pushed recession, but additionally Seventies stagflation, financial institution taxes and so on — and few if any constructive catalysts.”

Nevertheless, there may be little proof of buyer misery up to now and far of the tens of billions in Covid-related unhealthy debt reserves stay in place prepared to soak up losses. European banks which have reported second-quarter outcomes have, for probably the most half, overwhelmed expectations, regardless of warnings of financial ache to return.

“The indicator that issues most for banking asset high quality is general employment. We have to see how that performs out, but when the labour markets proceed to carry up as economists anticipate, credit score high quality ought to stay resilient,” Santander’s govt chair Ana Botín instructed the FT.

Barclays added no further reserves to cowl unhealthy loans within the UK within the second quarter. Finance director Anna Cross instructed the FT that “prospects are appearing in a really rational manner”, for instance by repaying their bank card balances swiftly.

“We’re seeing an actual construct up of financial savings by customers and corporates and a pay-down of unsecured debt, so they’re going into this setting in significantly better form than pre-pandemic,” she added.

One other UK financial institution govt mentioned “we see no indicators of pressure in our portfolio but. The earliest is normally an uptick in folks solely making minimal funds on bank cards, however while that is transferring up a bit, it isn’t again to pre-pandemic ranges.”

The BoE and ECB have already written to banks warning them towards treating distressed prospects harshly and the business is eager to not lose goodwill it generated during the Covid crisis.

There may be additionally the potential for extra extraordinary authorities help for these struggling — as was launched throughout the pandemic — which is able to cushion banks’ publicity to insolvencies.

“Most definitely there might be subsidies to companies struggling from vitality disaster, assured loans and so on,” mentioned Axiom’s Legras. “I believe the general public sector’s response might be useful for banks.”

Straightforward targets

Nevertheless, a widespread concern amongst financial institution executives is that greater earnings will appeal to new levies. Spain has proposed a windfall tax of 4.8 per cent on banks’ charges and curiosity expenses, designed to recapture a few of the advantages from greater charges.

When introduced it wiped billions from the valuations of the nation’s 5 largest lenders resembling Santander and BBVA. Hungary has taxed its banks whereas Poland is placing a moratorium on mortgage repayments to assist out struggling householders.

“Banks are simple targets and the prospect of much more taxes is horrible for banks’ [valuation] multiples,” mentioned a hedge fund supervisor that specialises in European financials. “Blaming massive companies is at all times a confirmed path in a recession to deflect from a authorities’s personal coverage failures.”

Bruno Le Maire, the French finance minister, instructed the FT in a recent interview he has not dominated out windfall taxes subsequent 12 months and that “the burden of inflation have to be equitably shared between the state and enterprise”.

The UK already has each a financial institution levy and a 3 per cent surcharge on financial institution earnings, just lately decreased from 8 per cent, however susceptible to being reset if the Treasury wants money.

Regulators are additionally transferring to chop off one other potential rates-linked windfall.

The ECB is examining the way it can stop banks incomes billions of euros of additional revenue from its €2.2tn subsidised lending scheme, which was began to keep away from a credit score crunch throughout the pandemic. Some analysts had estimated that lenders might earn a collective €24bn by depositing low cost debt again with the central financial institution to learn from the present greater charges than when the loans had been issued.

However, whereas there stays a lot debate over the profitability of the European monetary system, few are involved about its solvency. Latest stress assessments point out most lenders might shoulder even excessive financial pressure after being compelled to construct substantial capital buffers after the 2008 disaster.

Some even see surviving one more disaster as a possibility for banks to shake off the persistent negativity surrounding them.

“A ‘good recession’ may even be a longer-term constructive for the sector,” mentioned Graham. “If the European banks can climate it with no worse than 25-50 per cent hits to earnings, no main fairness raisings, no regulatory blanket ban on payouts and restricted financial institution bashing and monetary repression, this may lastly lay to relaxation a few of the lingering doubts harboured by many traders.”

“However that’s the stunning factor about European banks — you possibly can at all times discover loads of issues to worry about.”

Extra reporting from Owen Walker and Siddharth Venkataramakrishnan

Source link