Europe and Asia intensify battle to safe gasoline provides

[ad_1]

The battle between Asia and Europe to lock in gasoline provides is stepping up a gear, heightening the dangers of an extra surge in costs that might add recent gasoline to the price of residing disaster.

Japan and South Korea, the world’s second and third-biggest importers of liquefied pure gasoline, wish to safe provides for the winter months and past, out of worry of being priced out later within the 12 months as Europe’s demand will increase, based on merchants.

The intensifying competitors from Asia comes at a time when LNG, which is shipped throughout the ocean in large tankers, is in excessive demand as Europe makes an attempt to interchange pure gasoline delivered by pipelines from Russia. Pure gasoline costs in Europe are already up virtually 5 instances from a 12 months in the past, which has sharply elevated power prices for customers and dealt a painful blow to utility firms.

“What we’re seeing is a little bit of a scramble to safe LNG cargoes by the tip of this 12 months and into 2023,” the chief government of an Asia-based gasoline firm mentioned, including that the transfer is sooner than ordinary. “It hasn’t fed by a lot into pricing but, however that may come subsequent as a result of the late purchaser would be the ones that may bear the burden on pricing.”

There was “pretty massive exercise” from Japanese and South Korean firms for so-called strip purchases of LNG “that might take it by November, December and January,” mentioned Toby Copson, international head of buying and selling and advisory at Trident LNG, a gasoline buying and selling firm.

A strip contract is shopping for or promoting of contracts in sequential months, with patrons and sellers capable of lock in costs for your entire timeframe.

Japan and South Korea “have a problem with power safety. They’re genuinely involved about what is going to occur quick, medium and long run,” Copson mentioned. “I feel this 12 months and thru into the primary quarter subsequent 12 months, you’re going to see constant competitors with [Europe and Asia] bidding the market up.”

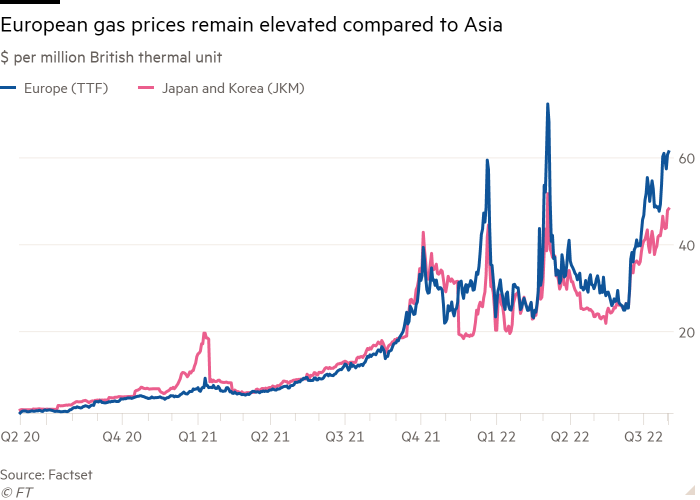

Asia had been the premium vacation spot for LNG, with China, Japan and South Korea being the world’s three largest importers. The benchmark worth in Asia, extra instances than not, has traded above the European worth.

However TTF, the European benchmark gasoline worth, is now significantly increased than its Asian counterpart as a result of Europe’s growing demand, because the area appears to substitute declining Russian gasoline. Since late July, Russian gasoline flows from Europe’s important pipeline Nord Stream 1 has tumbled to twenty per cent of its capability. Officers worry additional cuts forward.

Greater costs in Europe means buying and selling firms are extra incentivised to ship LNG cargoes there for increased revenue margins. Worth differentials are a lot that in some situations merchants underneath long-term contracts in Asia can sever an current contract, pay the penalty worth, however nonetheless make revenue in the event that they resell in Europe.

Europe and Asia are broadly competing to acquire LNG from the US. The nation exported 74 per cent of its LNG to Europe within the first 4 months of this 12 months, in contrast with an annual common of 34 per cent final 12 months, based on the Power Info Administration. Asia was the principle vacation spot in 2020 and 2021, it mentioned.

Whereas international locations similar to Japan and South Korea had been capable of face up to increased costs to some extent, money strapped creating Asian nations have needed to bear the brunt of the surging costs.

The present market dynamic means “there will probably be instances when Asia might want to pay over the percentages” to lure LNG cargoes, one dealer mentioned. Whereas the dealer has but to see any pricing exercise to that extent, “it’s not out of the query main as much as the winter” as uncertainties stay over Europe’s gasoline storage ranges and LNG provide from Russia’s Sakhalin-2 challenge.

The challenge accounts for 10 per cent of Japan’s LNG imports and is slated for nationalisation underneath Russian president Vladimir Putin’s orders.

Strikes from China, the most important importer of LNG, has been subdued within the international LNG market, but it surely stays the “joker” main as much as the winter, one other dealer mentioned.

Demand for gasoline has typically been low within the nation as a result of its financial slowdown as a result of coronavirus lockdowns, and it has “carried out an excellent job in massively lowering its reliance on spot LNG, to the purpose that the present LNG demand is sort of fully depending on contracted LNG,” mentioned Alex Siow, lead Asia gasoline analyst at consultancy ICIS. China can also be reselling LNG it doesn’t want, assuaging among the tightness within the international market.

However the dealer mentioned the market is nicely conscious of the chance that Chinese language firms “are available in on the final minute” to acquire LNG cargoes.

“As you method the winter, international locations like Japan and South Korea are going to wish to rebuild storage,” Samantha Dart, head of pure gasoline analysis at Goldman Sachs mentioned.

“If on high of that, China’s financial exercise begins to rebound extra visibly, you possibly can have a major shift within the LNG stability. If much less LNG is offered for Europe that implies that Europe must depend on extra home demand destruction consequently,” she mentioned.

Source link