Rising markets hit by document streak of withdrawals by overseas traders

[ad_1]

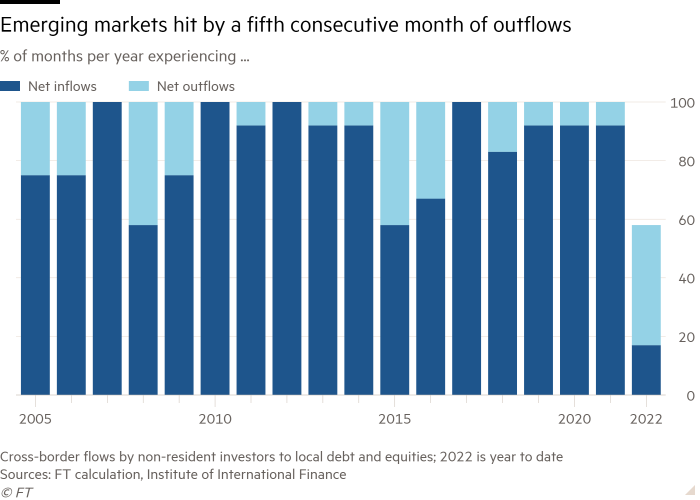

Overseas traders have pulled funds out of rising markets for 5 straight months within the longest streak of withdrawals on document, highlighting how recession fears and rising rates of interest are shaking growing economies.

Cross-border outflows by worldwide traders in EM shares and home bonds reached $10.5bn this month based on provisional knowledge compiled by the Institute of Worldwide Finance. That took outflows over the previous 5 months to greater than $38bn — the longest interval of internet outflows since data started in 2005.

The outflows threat exacerbating a mounting monetary disaster throughout growing economies. Prior to now three months Sri Lanka has defaulted on its sovereign debt and Bangladesh and Pakistan have each approached the IMF for assist. A rising variety of different issuers throughout rising markets are additionally in danger, traders concern.

Many low and middle-income growing international locations are affected by depreciating currencies and rising borrowing prices, pushed by price rises by the US Federal Reserve and fears of recession in main superior economies. The US this week recorded its second consecutive quarterly output contraction.

“EM has had a extremely, actually loopy rollercoaster 12 months,” stated Karthik Sankaran, senior strategist at Corpay.

Buyers have additionally pulled $30bn to this point this 12 months from EM overseas foreign money bond funds, which spend money on bonds issued on capital markets in superior economies, based on knowledge from JPMorgan.

The overseas foreign money bonds of at the very least 20 frontier and rising markets are buying and selling at yields of greater than 10 share factors above these of comparable US Treasury bonds, based on JPMorgan knowledge collated by the Monetary Instances. Spreads at such excessive ranges are sometimes seen as an indicator of extreme monetary stress and default threat.

It marks a pointy reversal of sentiment from late 2021 and early 2022 when many traders anticipated rising economies to get better strongly from the pandemic. As late as April this 12 months, currencies and different property in commodity exporting EMs resembling Brazil and Colombia carried out properly on the again of rising costs for oil and different uncooked supplies following Russia’s invasion of Ukraine.

However fears of worldwide recession and inflation, aggressive rises in US rates of interest and a slowdown in Chinese language financial progress have left many traders retrenching from EM property.

Jonathan Fortun Vargas, economist on the IIF, stated that cross-border withdrawals had been unusually widespread throughout rising markets; in earlier episodes, outflows from one area have been partially balanced by inflows to a different.

“This time, sentiment is generalised on the draw back,” he stated.

Analysts additionally warned that, not like earlier episodes, there was little rapid prospect of worldwide circumstances delivering EM’s favour.

“The Fed’s place appears to be very completely different from that in earlier cycles,” stated Adam Wolfe, EM economist at Absolute Technique Analysis. “It’s extra keen to threat a US recession and to threat destabilising monetary markets to be able to carry inflation down.”

There’s additionally little signal of an financial restoration in China, the world’s largest rising market, he warned. That limits its means to drive a restoration in different growing international locations that depend on it as an export market and a source of finance.

“China’s monetary system is underneath pressure from the financial droop of the previous 12 months and that has actually restricted its banks’ means to maintain refinancing all their loans to different rising markets,” Wolfe stated.

Sri Lanka’s default on its overseas debt has left many traders questioning which would be the subsequent sovereign borrower to enter restructuring.

Spreads over US Treasury bonds on overseas bonds issued by Ghana, for instance, have greater than doubled this 12 months as traders value in a rising threat of default or restructuring. Very excessive debt service prices are eroding Ghana’s overseas foreign money reserves, which fell from $9.7bn on the finish of 2021 to $7.7bn on the finish of June, a price of $1bn per quarter.

If that continues, “over 4 quarters, all of a sudden reserves will probably be at ranges the place markets begin to actually fear,” stated Kevin Daly, funding director at Abrdn. The federal government is sort of sure to overlook its fiscal targets for this 12 months so the drain on reserves is about to proceed, he added.

Borrowing prices for giant EMs resembling Brazil, Mexico, India and South Africa have additionally risen this 12 months, however by much less. Many giant economies acted early to struggle inflation and put insurance policies in place that defend them from exterior shocks.

The one giant EM of concern is Turkey, the place authorities measures to help the lira whereas refusing to boost rates of interest — in impact, promising to pay native depositors the foreign money depreciation price of sticking with the foreign money — have a excessive fiscal price.

Such measures can solely work whereas Turkey runs a present account surplus, which is uncommon, stated Wolfe. “If it wants exterior finance, finally these methods are going to interrupt down.”

Nevertheless, different giant rising economies face comparable pressures, he added: a reliance on debt funding signifies that finally governments must suppress home demand to carry money owed underneath management, risking a recession.

Fortun Vargas stated there was little escape from the sell-off. “What’s shocking is how strongly sentiment has flipped,” he stated. “Commodity exporters had been the darlings of traders only a few weeks in the past. There are not any darlings now.”

Further reporting by Kate Duguid in London

Source link