Credit score Suisse turns to ‘Uli the knife’ to chop financial institution unfastened from scandal

[ad_1]

Credit score Suisse administrators final month made the trek up the Swiss Alps for his or her annual off-site gathering within the spa city of Dangerous Ragaz, well-known for its therapeutic waters.

After a bruising few years through which the bank lurched from disaster to disaster, chair Axel Lehmann and the board had lastly selected a turnround plan.

The one query remaining was who would drive that change. That they had concluded that chief government Thomas Gottstein, who had his personal well being issues, was not the suitable man for the job.

That was settled on Wednesday with the promotion of Ulrich Körner, a former UBS government who joined final 12 months to run the asset administration division. He beat out two inside rivals, funding financial institution boss Christian Meissner and Francesco De Ferrari, head of wealth administration, individuals acquainted with the matter informed the Monetary Occasions.

Körner was picked due to his popularity for dispassionate cost-cutting and operational execution, the individuals stated, deemed important in a financial institution that has spiralled uncontrolled, unable to stem the movement of scandals and with its shares at a three-decade low.

Individuals near the 59-year-old Swiss government say he earned the nickname “Uli the knife” throughout his 11 years at UBS, the place he helped restore self-discipline within the wake of a rogue buying and selling scandal that led to losses of $2bn and the chief government’s ousting.

An individual acquainted with the matter stated Körner narrowly missed out on UBS’s prime job to Sergio Ermotti a decade in the past. When he takes over at Credit Suisse on Monday he can have the prospect to revive one other ailing Swiss lender. “He clearly has unfinished enterprise,” stated one former UBS colleague.

His activity is daunting. Throughout Gottstein’s two-year tenure, Credit score Suisse shares plunged 60 per cent and the financial institution was haunted by scandals previous and new.

It misplaced $5.5bn from the collapse of household workplace Archegos, remains to be making an attempt to recuperate $2.7bn of shopper cash after the failure of Greensill Capital, was fined for its function within the $2bn Mozambique “tuna bonds” scandal and have become the primary Swiss financial institution to be discovered responsible of a company crime after it was discovered to have laundered cash for a Bulgarian cocaine cartel run by a former skilled wrestler.

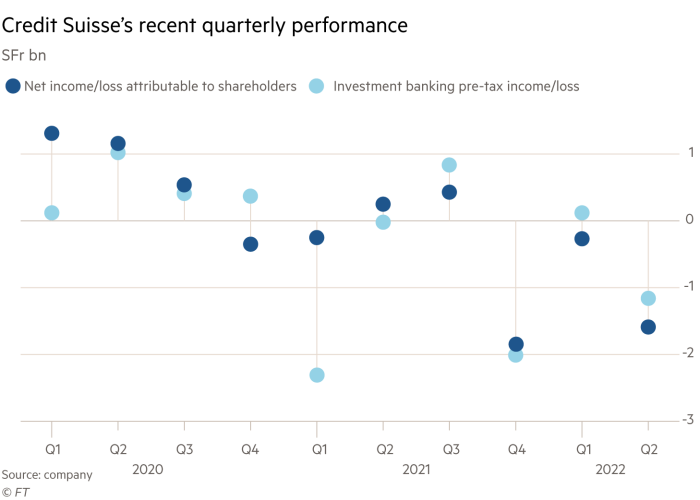

The monetary efficiency has been equally bleak. After making a SFr2bn ($2.1bn) loss within the fourth quarter final 12 months, it has misplaced an extra SFr1.9bn this 12 months. It has issued revenue warnings in six of the final seven intervals.

Gottstein’s departure means all however one member of the dozen-strong government board he put in in early 2020 is gone, or quickly will probably be.

“Whereas Mr Gottstein inherited quite a few issues, the way in which through which the agency reacted to those and the following technique adopted has left the financial institution in a weaker place with important franchise erosion throughout all divisions, most notably the funding financial institution,” stated Citigroup analyst Andrew Coombs.

Prime of Körner’s prolonged to-do record is a brutal cost-cutting train that may result in a much-diminished funding financial institution and strip out as a lot as 20 per cent of the financial institution’s annual spending to lower than SFr15.5bn.

Shareholders and Credit score Suisse’s 45,000 international workforce will probably be watching anxiously to see if Körner and Lehmann — who labored collectively at UBS — will have the ability to arrest the decline of a nationwide champion that has taken on Deutsche Financial institution’s mantle as world’s most scandal-prone lender.

Individuals acquainted with the brand new technique, which will probably be unveiled in additional element in October, stated one other focus can be slicing what is taken into account to be bloated and inefficient know-how and operational divisions.

The change in management was introduced similtaneously the financial institution reported a 3rd consecutive lossmaking quarter. The SFr1.6bn group-wide loss, considerably worse than the SFr206mn anticipated by analysts, was pushed by a SFr1.2bn hit from Credit score Suisse’s funding financial institution, the supply of lots of its latest woes.

Credit score Suisse’s newest strategic assessment — its second in lower than a 12 months — goals to slim the funding financial institution to concentrate on capital-light advisory work to help the group’s three different enterprise strains: wealth administration, asset administration and the Swiss home financial institution.

The plan is being hashed out with help from advisers at Centerview Companions, whom the financial institution’s earlier management had recruited to plot a extra sustainable technique.

The transfer dangers alienating funding bankers. Meissner, head of the division, is planning to step down after an interim interval, regardless of having joined little greater than a 12 months in the past, the FT reported on Tuesday.

Körner and Lehmann have stated they’re contemplating an exit or sale of the financial institution’s securitised merchandise enterprise, which was once one its most worthwhile. However analysts cautioned that whereas revenues are fast to vanish as buying and selling items are shut down, the prices stick round for for much longer.

“We anticipate exit prices from this enterprise, which has $20bn of risk-weighted belongings and $75bn of leverage publicity, may very well be sizeable,” stated Citigroup’s Coombs. Third-party capital is being sought “presumably to cut back the magnitude of exit and restructuring prices, however we query who would step in and the way this relationship would work”.

Credit score Suisse traders have lengthy known as on the group to drag again from funding banking, saying its returns don’t justify the prices of working the enterprise or the frequent scandals.

“We’re inspired that administration is taking steps to grasp the inherent worth in Credit score Suisse by bettering upon their strengths and shedding their weaknesses,” stated David Herro, vice-chair of US asset supervisor Harris Associates, the financial institution’s largest shareholder.

Vincent Kaufmann, chief government of Ethos Basis, which represents shareholders proudly owning about 5 per cent of Credit score Suisse inventory, stated scaling again the funding financial institution was lengthy overdue and mimicked UBS’s profitable shift to wealth administration a decade earlier.

“Having two former UBS executives now working Credit score Suisse is an acknowledgment that UBS made the suitable turnround 10 years in the past,” he stated. “They’ll change technique and management, however the true change must be on tradition. They should present it’s working.”

Nevertheless, one other top-10 shareholder gave a much less optimistic evaluation.

“My view is the corporate is listless, it has no efficient management,” the particular person stated. “My forecast is that the financial institution will probably be offered. This won’t work out and the regulator will drive a transaction.”

Some hint Credit score Suisse’s issues again a long time to its try to interrupt into Wall Avenue by constructing a stake in First Boston, taking majority management in 1988 and branching out from its Swiss non-public banking roots. It was then run by a collection of US funding bankers together with John Mack and Brady Dougan.

“Twenty years in the past we misplaced our soul. We wished to play within the NBA, that’s how we noticed funding banking,” stated one veteran wealth supervisor. “And never solely did we purchase an funding financial institution, who have been the following CEOs? All of them got here from there — what do they learn about non-public banking? Banana bushes will not be going to provide cherries.”

“We have to return to the essence of our core enterprise and regain our soul,” he added. Nevertheless, there’s “little room for strategic manoeuvre at the moment with the capital place, enterprise combine, legacy misconduct points, provisions and the lack of huge human capital”.

The financial institution sought a brand new course in 2015, recruiting insurance coverage government Tidjane Thiam. After a promising begin the place he set about de-risking the funding financial institution and shifting the strategic focus to wealth administration in Asia, he turned mired in a company spying scandal that undermined his turnround and finally value him his job.

Credit score Suisse then recruited former Lloyds chief government António Horta-Osório for a contemporary begin. However he lasted lower than a 12 months as chair, quitting in January after dropping the boldness of his board when it emerged he had breached Covid-19 quarantine guidelines to attend sports activities occasions together with his household and used company-funded non-public jets for private journeys.

Internally, many in Zurich hope the sober Körner will deliver an finish to such lurid scandals and handle a cavalier strategy to threat administration that has characterised its latest previous.

“Credit score Suisse has all the time been too small to compete with Wall Avenue, so we have now taken dangers which can be too nice,” stated a Credit score Suisse compliance skilled, citing final 12 months’s twin crises of Greensill and Archegos.

“A few of them repay for some time. However it’s like Russian roulette — the sixth bullet all the time kills you.”

Source link