Credit score crunch: how the price of dwelling disaster is pushing households to breaking level

[ad_1]

Russell Anderson is a person who has discovered to reside inside his humble means. After a power sickness pressured him to retire as a coach driver three years in the past, he managed to stretch his advantages to cowl his payments, together with lease and gas.

More and more, he has discovered that balancing act more durable to juggle. Anderson, who lives in rural Scotland, says the surging value of gas has made it too costly to drive to his nearest Aldi, the low-cost grocery store he can afford, that means he has to take a circuitous bus journey as an alternative.

When his cat fell sick unexpectedly, there have been extra payments to pay. “I went to the vets, spent £170, and he got here again much more sick,” says Anderson. He had nothing left to cowl the invoice that will have ensured the right dealing with of his pet’s stays after it was put down.

Anderson’s credit standing meant he was turned down by two business lenders. By likelihood, he noticed an advert for Glasgow-based neighborhood lender ScotCash on tv and, to his aid, was permitted for a £100 mortgage. He’s deeply appreciative. “They bent over backwards to assist me,” he says. “I’ve not bought quite a lot of debt, and I don’t must borrow some huge cash, however nobody else would lend.”

His story is one instance of the precarity now being confronted by individuals on low incomes throughout the UK. With the rising value of dwelling stretching budgets to their absolute capability, a single change in circumstance — from the tip of a relationship, a damaged equipment or the dying of a pet — will be sufficient to push a family to breaking level.

These with poor credit score have few choices once they want a small mortgage. One lifeline is neighborhood lenders, a small variety of non-profits who help these going through monetary exclusion from mainstream lending. However the sector is struggling to accommodate the rising demand. In contrast with business lenders, their funding pot is considerably smaller; additionally they adhere to standards on affordability for loans, which a rising variety of prospects are unable to satisfy.

“I might say we decline 90 per cent of candidates and that actually troubles me,” says Simon Dukes, chief government at not-for-profit loans supplier Truthful for You. “It’s more durable now for us to search out individuals to say ‘sure’ to as a accountable lender.”

These working within the sector say that they urgently want extra help to proceed working, not to mention to scale up and match the wants of a rising weak inhabitants. Many worry what’s going to occur this winter, with the Financial institution of England warning of a recession and the most important fall in family incomes for greater than 60 years as the value of vitality and on a regular basis meals gadgets soars.

“Regulation, funding and collaboration are tremendous essential as a result of it’s such a precarious sector,” says Sharon MacPherson, chief government at ScotCash. “Take into consideration what number of companies went bust throughout the pandemic: the longer term isn’t assured.”

For these turned away by non-profits, the options can carry extra threat. Buy now, pay later merchandise have confronted scrutiny over the stringency of their affordability checks and the final resort — unlawful lending by mortgage sharks — opens the door to exploitation.

With the MOT on his automobile due for renewal and the next vitality invoice looming, Anderson anticipates he might want to flip to ScotCash once more earlier than the tip of the yr to maintain his automobile on the street.

The worst is but to return

The historical past of not-for-profit lenders, together with credit score unions and neighborhood growth finance establishments, or CDFIs, dates again to the late 20th century, pushed by social actions within the UK and globally.

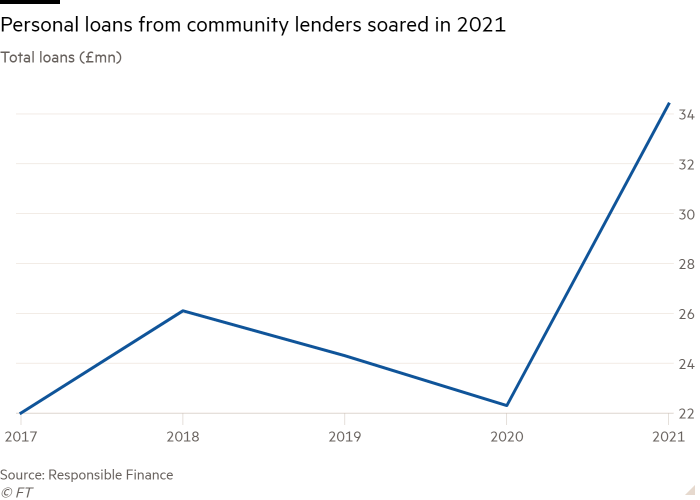

These community-focused lenders are funded by a wide range of sources, starting from grants to banks. Figures from Accountable Finance, the sector’s commerce physique, confirmed it had paid out £228mn in all kinds of loans in 2021 — a 32 per cent improve on the yr earlier than.

Faisel Rahman based east London-based Truthful Finance in 2005, impressed by his expertise working in microfinance in Bangladesh, the place it helped cut back poverty. “Every little thing true about monetary exclusion in Bangladesh is identical in London,” he says. “You want knowledge to evaluate it successfully and you need to be versatile, responsive and personable.”

Rahman has observed that the type of buyer making use of for loans has modified over time. Between 2005 and 2010, it was primarily these receiving advantages. By 2015, the dominant group have been these with variable incomes, together with gig financial system staff and people on zero-hours contracts. Many typically have lower than £50 on the finish of every month.

Whereas a big proportion of consumers reside in disadvantaged areas and have a median earnings of £15,000, Rahman emphasises this isn’t common. A buyer incomes £65,000 turned to Truthful Finance to assist repay payday loans after a missed cost.

The total influence of the price of dwelling disaster is but to emerge, says Rahman. Within the UK, inflation hit a 40-year excessive of 9.4 per cent in June, with the Financial institution of England predicting it would peak at 13 per cent by the tip of the yr, pushing up costs additional. Truthful Finance’s evaluation means that later this yr some prospects will likely be unable to cowl their payments and could have a destructive price range even with recommendation on the way to handle their cash.

Maggie, one other ScotCash buyer, noticed her meals invoice surge when her fridge-freezer broke in April, forcing her to buy each day and spend extra general. She came upon about ScotCash by means of her native authority in 2018, they usually lent £500 to help her. Maggie, who suffers from critical well being situations that prohibit her mobility, has taken occasional loans from the lender since then.

The issue is exacerbated by what campaigners and neighborhood lenders name the “poverty premium”. MacPherson says essentially the most weak typically pay extra for gas due to pre-paid meters, or can not afford insurance coverage. A quantity shouldn’t have their very own financial institution accounts or financial savings. “They haven’t any leeway in any way for placing cash away,” she says. “Including £2 or £3 further on to a prepayment card for gas means not having the ability to put it aside.”

Those that flip to neighborhood lenders are additionally least prone to entry the rising variety of apps designed to assist prospects make their cash go additional comparable to budgeting instruments.

“In our expertise, prospects are gradual adopters of those merchandise,” says MacPherson. “When you might have little or no cash and something might tip you over the sting, you need to defend that as a lot as you may.” For individuals who can not entry loans, non-profit lenders play an essential position in offering monetary recommendation, she added, together with by providing a digital advantages checker: “75 per cent of persons are not claiming the advantages which they’re entitled to,” she says. “It’s a double whammy alongside the elevated value of dwelling.”

Credit score unions, which depend on deposits from members’ saving accounts to make loans and have a cap of about 43 per cent APR set by the federal government, are additionally going through an uptick in demand.

In Might, digital lending market Freedom Finance mentioned {that a} document 1.9mn individuals within the UK have been now members of credit score unions with whole loans to members by the tip of 2021 reaching £1.74bn, one other all-time excessive. However their lending is capped by the sum of deposits they maintain.

“The credit score union motion within the UK could be very small in contrast with the US,” says Robin Fieth, chief government of the Constructing Societies Affiliation, which represents quite a few credit score unions. “They’ve restricted capability to be the answer.” BSA members had warned him that it might solely show harder in winter, when heating demand is much greater.

The significance of non-profit lenders has grown as business avenues have shrunk. In recent times, the Monetary Conduct Authority clamped down on so-called “non-standard finance suppliers” that flourished after the 2008 monetary disaster however drew criticism for his or her steep prices.

Maggie says she has used Provident Monetary, previously the UK’s largest doorstep lender (which promote loans and acquire repayments from a buyer’s house), however ended up repaying almost double the quantity she borrowed. Provident shuttered its client credit score unit final yr.

The variety of lively high-cost, short-term lenders within the UK fell by virtually one-third between 2016 and the third quarter of 2020, in accordance with the FCA’s figures.

“We all know provide out there has lessened as a result of we’ve seen elevated scrutiny and quite a few lenders with poorly designed merchandise being challenged which is, frankly, a very good factor,” says Brian Brodie, chairman of Freedom Finance. “The unintended consequence is that fewer persons are capable of entry finance.”

Mortgage sharks

One problem throughout the sector stays a patronising and infrequently moralistic angle in direction of these with out excellent credit score scores, say professionals working within the sector. Whereas individuals on greater incomes can entry overdrafts or bank cards with aggressive charges to higher handle their cash when instances are robust, these dwelling hand to mouth haven’t any such security web.

“Prospects are financially savvy — there’s a typical drawback of individuals equating earnings with intelligence,” says Rahman. “They don’t should be advised the way to do issues, they want a good choice.”

Charities have warned that purchase now, pay later is rising as one space of concern. Suppliers of the short-term credit score have confronted questions round how completely they verify a consumer’s means to afford loans, with considerations that customers can load up debt throughout a number of suppliers. “Out of each 10 individuals we see, 5 – 6 are utilizing purchase now, pay later,” says MacPherson. “We’ve seen an explosion in that kind of product, each for retail customers but additionally each day wants, which is actually unsustainable.”

Whereas the federal government has dedicated to regulating the sector, it’s only anticipating to introduce new legal guidelines by the middle of 2023. After that, the FCA must seek the advice of on guidelines.

Extra disturbing is {that a} rising variety of households are weak to mortgage sharks or unlawful lenders. The determine has elevated from 310,000 in 2010 to 1.08mn in 2022, says Cath Williams, a supervisor within the authorities’s England Illegal Money Lending Team.

“The principle cause individuals flip to them has all the time been on a regular basis bills — traditionally that’s been washing machines and college uniforms,” says Williams. “However increasingly persons are saying it’s to place meals on the desk or pay the electrical energy meter.”

In lots of circumstances, victims imagine they’re borrowing from a buddy, says Williams, till they’re unable to satisfy their repayments. And mortgage sharks are getting extra tech savvy with their strategies of intimidation. “One unlawful cash lender who was prosecuted final yr was utilizing altered Snapchat photos, with the implication that they might come round and knock on victims’ doorways,” she says.

For these affected, escaping the clutches of an unlawful cash lender takes time. “The entire journey of realising that this isn’t a buddy, then realising that that is one thing they need assistance to get out of — realising that it’s a mortgage shark — after which making a telephone name to us is a three-year course of,” she says.

Williams, whose crew works intently with credit score unions, says they can’t deal with demand and the numbers they flip away are rising. “As that goes up, there’s a concern by way of the place individuals go — generally it’s household and pals . . . however sooner or later down the road they could flip to unlawful cash lenders, perhaps as gas costs go up.”

Case for funding

There isn’t any single resolution to defending the non-profit lending sector, however lenders agree that making certain a larger of amount of cash is obtainable is a primary step. One pathway is the dormant belongings fund, a pot value £880mn from monetary belongings together with financial institution accounts, pension schemes and securities which were untouched for an extended interval.

These belongings, administered by the Division for Digital, Tradition, Media and Sport, are at the moment being spent on monetary inclusion, alongside social funding and youth initiatives, with quite a few neighborhood lenders benefiting from the venture. In July, the federal government launched a session into what causes needs to be funded.

Dukes says Truthful for You has been capable of “develop its social influence considerably” because of Dormant Property funding in 2020. “The present value of dwelling disaster makes the case for funding in monetary inclusion much more urgent,” he says. Theodora Hadjimichael, chief government of Accountable Finance, echoed Dukes’ sentiment, whereas highlighting the disparity in funding between fintechs and the non-profit sector.

“When you take a look at how a lot has been invested into purchase now, pay later, and the way a lot has been invested into high-cost business lenders, it’s eye-watering in contrast with CDFIs,” she says. “The extra the federal government prioritises monetary inclusion for dormant belongings, the higher.”

MacPherson additionally known as for extra native authorities to get entangled. ScotCash is funded by Glasgow Metropolis Council and Glasgow Housing Affiliation, now Wheatley Houses Glasgow. “It may be actually arduous to maintain forward of the curve of fintechs and making certain that you just’re related to prospects,” she says. “We completely want authorities to construct capability of the sector.”

Tulip Siddiq, shadow financial secretary to the Treasury, says the Labour occasion would search to reform laws across the sector if elected. “Labour has pledged to double the scale of the co-operative and mutual sector,” she says. “This can require regulators, such because the FCA and Prudential Regulation Authority, to have an specific remit to report on how they’ve thought of particular enterprise fashions, comparable to mutuals, whose wants are too typically ignored.”

The Treasury says it’s supporting households with a £37bn bundle, together with a direct cost of £1,200 to 8mn of essentially the most weak households. “We’re additionally backing Fair4All Finance with virtually £100mn of presidency funding this yr — a document quantity — to help their work on monetary inclusion, together with serving to individuals to entry inexpensive credit score,” it says.

Rahman says laws to encourage mainstream lenders to help native communities would make a optimistic distinction. In 1977, the US enacted the Neighborhood Reinvestment Act to make sure that banks made loans in neighbourhoods the place they took deposits. “We don’t want the identical [legislation as the US] nevertheless it’s loopy that there is no such thing as a obligation for banks to be concerned in tackling exclusion or accountable to the communities they’re in,” he says.

“When you imagine that monetary exclusion is an issue, you need to imagine that there’s a greater method of doing this.”

Source link