Local weather, battle and inflation jolt reinsurers into motion

[ad_1]

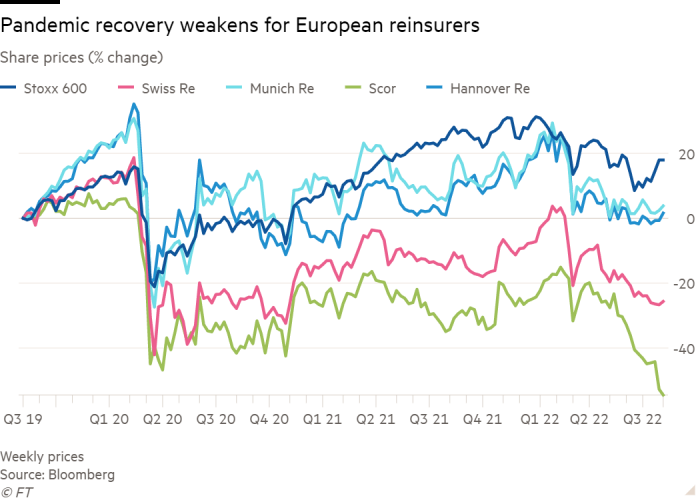

Life has not been simple for reinsurers up to now few years. Claims for pure catastrophes and pandemic-related losses have worn out a big a part of their earnings.

However the newest set of worldwide issues — battle in Ukraine, galloping inflation and the ever-increasing risks of climate change — have jolted them into motion. In some areas, they’re placing up the worth of protection, in others they’re retreating altogether.

“What appeared like . . . a gradual change is more and more wanting like a knee-jerk change,” stated Stephen Catlin, an trade veteran and chief government of insurer Convex.

Reinsurers play a significant function in commerce and the worldwide financial system, providing insurance to insurers to scale back the chance {that a} huge declare will wipe them out. This backstop in opposition to an entire vary of economic dangers — which is underpinned by $700bn in capital — offers insurers the arrogance to offer cowl to a a lot wider market.

Among the many largest reinsurance teams are the 4 main European gamers, Munich Re, Swiss Re, Hannover Re and Scor, in addition to the Lloyd’s of London market and Warren Buffett’s Berkshire Hathaway.

Swiss Re’s chief government Christian Mumenthaler advised the Monetary Occasions that “timid” value rises in pure disaster reinsurance in recent times had now accelerated after three years of upper prices from losses.

For contracts renewing in July, Swiss Re applied a 12 per cent rise in premiums throughout its property and casualty enterprise, which incorporates pure disaster cowl and different sorts of insurance coverage. “It’s very huge, as a result of it’s [across] the whole lot . . . I can’t bear in mind an increase like that,” stated Mumenthaler.

Executives attribute the market tightening to strong demand — fuelled by inflation driving up the worth of what’s being insured — and a fall in provide after investor strain prompted some reinsurers to drag again, particularly from the pure disaster enterprise.

There has additionally been diminished urge for food, they are saying, from institutional traders to tackle reinsurance dangers by way of insurance-linked securities, partly after losses on these types of investments and partly as a result of yields on bonds have elevated.

“We predict the [reinsurance] market is popping, we at the moment are seeing momentum,” stated Aki Hussain, chief government of Hiscox, one of many largest insurers on the London market, which has its personal reinsurance unit.

“Up to now 5 years [reinsurance] costs have lagged and now for the primary time they’re going up sooner than they’re for insurance coverage.”

One other think about rising costs at present is huge claims arising from Russia’s invasion of Ukraine. Insurers in areas resembling aviation now anticipate billions of {dollars} of claims from the homeowners of the lots of of planes left stranded by the battle.

Reinsurers lowering capability can create what is named a “laborious market”, the place demand considerably outstrips provide and costs surge.

Some executives are saying that these situations at the moment are current, citing latest exits by some reinsurers from the pure disaster enterprise. Huge Ukraine-related losses may persuade extra suppliers to chop their publicity.

After years of volatility and rising claims, New York-listed reinsurer Axis Capital declared in June that it was getting out of the property reinsurance enterprise, which incorporates pure disaster cowl. Chief government Albert Benchimol stated the “important and rising results of local weather change and the challenges confronted by the disaster reinsurance market” had pressured its hand.

A month earlier, France’s Scor stated it was on monitor to scale back its publicity to pure catastrophes by 15 per cent, whereas Axa stated its reinsurance unit had reduce its pure disaster publicity by 40 per cent initially of the 12 months.

Executives and brokers attribute a few of these strikes to investor strain on reinsurers. “Traders have stated we don’t need extra disaster danger,” stated Rod Fox, co-founder of reinsurance dealer TigerRisk. “That has trickled down.”

Many see 2022 as a turning level. In recent times, an “abundance” of property disaster reinsurance outstripped demand and held down charges, stated Lara Mowery, world head of distribution at reinsurance dealer Man Carpenter.

“Over the previous 5 years elevated disaster losses resulted in poor underwriting outcomes, which have now contributed to a discount within the provide of reinsurance capability,” she added. This, plus elevated demand, has made it simpler for reinsurers to push up costs, Mowery stated.

An indication that issues are altering got here in June, a busy time for renewals of property disaster reinsurance insurance policies targeted on the Florida market. An absence of capability was one issue that drove the price of reinsurance up by 20 to 30 per cent on common, based on TigerRisk.

Dealer Aon stated in a report on coverage renewals in June and July, that years of “above-average” pure disaster claims had diminished reinsurers’ urge for food for taking disaster danger.

“For the primary time because the US hurricanes of 2004 and 2005, property pure disaster capability contracted materially, and a few reinsurers wouldn’t write sure dangers . . . at any value,” it stated.

These searching for reinsurance in speciality areas resembling aviation and marine additionally needed to deal with the “most difficult renewal in a era, reflecting the potential for giant losses from the Russia-Ukraine battle”, Aon added.

Joe Monaghan, a senior government in its reinsurance broking division, stated the reinsurance sector “could also be quick approaching a real laborious market”.

The following key renewal season on January 1 — referred to as 1/1 — is being seen as a litmus check of the market. A rush to reprice insurance coverage and reinsurance for dangers resembling battle and political violence is already below approach, stated a number of trade executives.

Whereas some reinsurers step again, others could search to fill the hole. At a latest investor occasion, Munich Re stated it was ready to make the most of rising costs by writing extra reinsurance enterprise, based on an individual conversant in the discussions.

Nonetheless, a lot of the trade predicts reinsurance cowl will turn out to be dearer and more durable to seek out.

Going by way of the 12 months, main insurers will “realise they’ll should run extra danger, purchase much less reinsurance and it’s going to be rather more costly”, stated Catlin. “The [primary] market shall be life very otherwise at 1/1 than it does at present.”

The pure conclusion could be that the cost of insurance, which has already been rising for years in some markets, has nonetheless additional to climb.

Jérôme Haegeli, group chief economist at Swiss Re’s analysis arm, agreed that rising reinsurance costs are more likely to be handed on: “I might anticipate a knock-on impact.”

Source link