Financial institution of England considers greatest price rise for greater than 25 years

[ad_1]

Financial institution of England policymakers will probably be below strain to step up the tempo of financial tightening after they meet this week, following the lead set by the European Central Bank and US Federal Reserve.

Andrew Bailey, the BoE governor, has made it clear that whereas a 0.5 share level improve in rates of interest is “not locked in”, it is going to be “among the many decisions on the desk” when the financial coverage committee makes its coverage choice on Thursday. The BoE has raised rates of interest in 0.25 share level increments since December however pledged in June to behave “forcefully” if wanted in response to extra persistent inflationary pressures.

If the MPC follows although, elevating the central financial institution’s benchmark price to 1.75 per cent, it is going to be the sharpest improve in borrowing prices for greater than quarter of a century.

Analysts say the choice will probably be finely balanced, as policymakers weigh relentless inflationary pressures towards the rising dangers of recession. However a rising variety of forecasters suppose the steadiness of opinion on the MPC will swing in favour of the primary 50 foundation level rise since its independence.

“After the ECB and the Fed delivered outsized hikes at their July conferences, the Financial institution of England is prone to really feel related strain,” stated Amarjot Sidhu, economist at BNP Paribas, whereas Philip Shaw at Investec stated the BoE “might worry a credibility downside whether it is perceived to be lagging behind its peers”.

The IMF, which slashed its world development forecasts this week, pointed to the UK as one of many nations the place the outlook for inflation had worsened most. It urged policymakers to take “decisive motion” even when it hit development, jobs and wages within the brief time period — arguing {that a} gradual strategy would merely result in a extra disruptive adjustment later.

“If the BoE continues to rise by 25 foundation factors per assembly, it will be outpaced by most different central banks,” stated Fabrice Montagné, economist at Barclays, including that the pound’s 3 per cent depreciation since April mirrored a notion by markets “that the UK is falling behind”.

Inflation, which reached 9.4 per cent in June on the CPI measure focused by the BoE, has up to now risen largely in step with the central financial institution’s Might forecasts. However the newest surge in gasoline costs means the BoE’s new projections are prone to present it climbing even additional into double digits than was already anticipated within the autumn, when the cap on regulated power costs will rise once more.

The MPC can’t do something about excessive power costs, however it is going to fear in regards to the knock-on and probably lasting results on enterprise and family behaviour — which it will possibly affect.

In the meantime, latest information counsel financial development has held up higher than the BoE anticipated within the second quarter of 2022. On the identical time, employment has continued to develop strongly, towards a backdrop of constant labour shortages which have underpinned speedy nominal wage development.

Policymakers stated in June that the “scale, tempo and timing” of any additional price will increase would replicate their evaluation of the financial outlook — and that they might be “notably alert” to any indicators of extra persistent inflationary pressures.

“The MPC is confronted with the prospect of upper and extra persistent inflation and an economic system that’s slowing however not crashing. So one other rise in rates of interest seems inevitable,” stated Andrew Goodwin, on the consultancy Oxford Economics. He’s amongst these economists who nonetheless suppose the BoE will stick with a extra standard 0.25 per cent improve, however acknowledged it might simply justify an even bigger transfer.

Policymakers may additionally be apprehensive that the tax-cutting pledges of Liz Truss, the frontrunner within the Tory management race, will result in a fiscal splurge later within the 12 months — forcing them to lift charges additional — though the BoE might solely issue this into its forecasts as soon as it had change into authorities coverage.

Alongside its choice on rates of interest, the BoE can be set to provide extra particulars of its plans to begin promoting a few of its gilt holdings, probably getting ready to vote in September and start gross sales the next month. Nonetheless, Bailey has signalled that the BoE needs rates of interest to stay its major instrument for tightening financial coverage, with a gradual unwinding of QE happening within the background.

The large query for buyers, although, is whether or not a bigger transfer from the BoE could be a one-off, or the beginning of an aggressive tightening cycle.

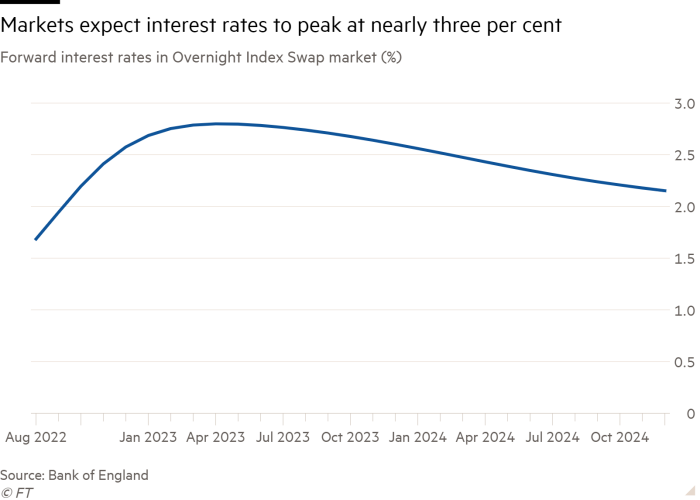

At current, merchants are betting that rates of interest will peak shut to three per cent early in 2023, implying a minimum of two extra 0.5 share level will increase by the top of this 12 months.

Most analysts suppose that is going too far, noting the BoE has repeatedly signalled that inflation would fall under its 2 per cent goal within the medium time period, if rates of interest rose in step with market pricing.

“Recession dangers are clearly mounting and that’s the obvious motive for the Financial institution to cease tightening by the autumn . . . by the fourth quarter, we’re prone to see the complete impact of the price of residing squeeze,” stated James Smith, economist at ING, including that whereas the rise in power and meals costs was “eye-watering”, broader inflationary pressures had been already beginning to cool.

Paul Dales, on the consultancy Capital Economics, is among the few forecasters to share market expectations that rates of interest will attain 3 per cent, however he too stated that regardless of extra aggressive strikes made by different central banks, a 50 foundation factors improve “will be the MPC’s prime pace”.

Source link