Area raises cash from Peter Thiel and David Petraeus for its decision-making AI – TechCrunch

[ad_1]

Can AI automate enterprise decision-making? It’s an exceptionally broad and difficult job — assuming it’s throughout the realm of chance. However that’s what startup Arena claims to do, fueled by a spherical of funding ($32 million) led by Initialized Capital and Goldcrest Capital together with Founders Fund, Flexport and a colourful solid of characters, together with retired basic David Petraeus, Peter Thiel, and Y Combinator CEO Michael Seibel.

New York–based mostly Area is the brainchild of Pratap Ranade and Engin Ural, who co-founded the corporate in 2020. The 2 had been impressed to construct a platform that might, leveraging predictive algorithms, assist companies formulate methods to navigate “unsure” environments — like a world pandemic.

Ranade, who attended Stanford and Columbia, was beforehand an affiliate accomplice at McKinsey and co-founded web-scraping startup Kimono Labs, which was acquired by Palantir in 2016. Ural was an app developer at Goldman Sachs earlier than becoming a member of Palantir as an engineer, the place he met Ranade.

Area’s companies are wrapped up in a variety of hyperbolic language, however they’re comparatively easy in execution. One of many startup’s instruments makes use of AI methods to simulate an financial system, testing out hundreds of thousands of product pricing configurations to reach at an optimum mannequin for an organization. It brings to thoughts the AI Economist, a Salesforce-developed analysis surroundings that equally runs hundreds of thousands of simulations to give you believable fiscal coverage.

Past pricing, Area can ostensibly simulate issues like stock administration. Ranade additionally claims it may well account for “deviations” within the financial surroundings, like headwinds stemming from snarled provide chains, in making suggestions to prospects (i.e., execs).

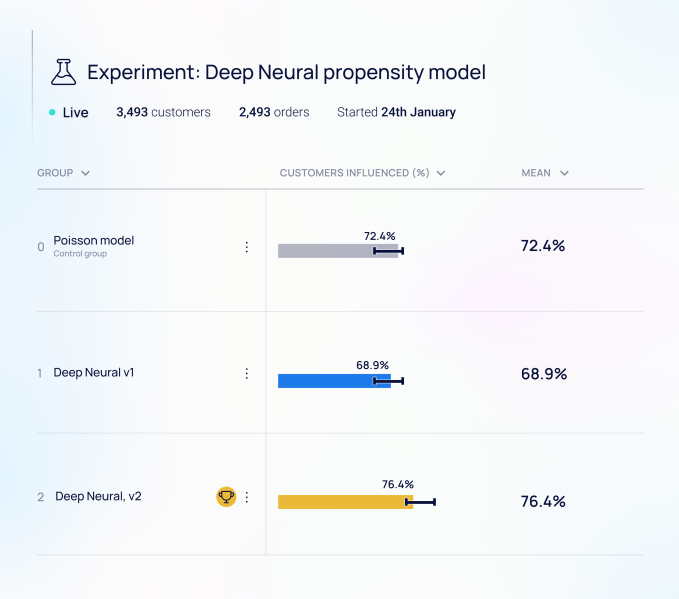

Picture Credit: Area

“With out Area, enterprises historically method such selections in a number of methods: Hiring giant groups of individuals to make these selections, shopping for choice help software program to assist individuals in operational roles make data-driven selections, or do nothing and proceed pushing via with conventional processes,” Ranade informed TechCrunch by way of e-mail. “Every of those approaches has benefit, however they’re a far cry from the complete promise of AI: actually clever machines that function autonomously, on our behalf, to raise human potential.”

Area purchasers feed the platform information like SKU-level gross sales, pricing, stock on the location stage and shopper conduct throughout e-commerce gross sales. Area augments that information with context from what Ranade calls the “demand graph,” which supplies broader, real-time market alerts. Collectively, these inputs are used to create the aforementioned simulations, which in flip produce fashions for pricing, stock and advertising and marketing which are then fine-tuned world information.

“As we speak, when essentially the most refined, data-centric business-to-business corporations run a promotion, information scientists analyze previous information to find out one of the best sort of promotion to run for a selected product in a selected market. They then load the promotion into their enterprise useful resource planning system, and weeks after, will analyze its efficiency,” Ranade stated. “With Area, this whole course of is autonomous … Underneath the hood, Area’s AI actively adapts to altering value elasticity and personalizes to buyer conduct, making changes because it learns in real-time to drive backside line influence.”

Ranade makes the outstanding declare that Area’s prospects — which embody Anheuser-Busch InBev and different “choose” Fortune 500 manufacturers in e-commerce, automotive, manufacturing and monetary companies — have been in a position to decrease the prices of products and companies and make their provide chains extra resilient due to its know-how. It’s unclear to what extent that’s true. However for what it’s price, Ranade says that Area is at the moment making “hundreds of thousands” of choices throughout each digital and bodily channels.

“We’ve discovered that Area drives a step change in worth as a result of we’re not solely introducing a brand new paradigm of decision-making for the enterprise, but in addition assembly C-suite and their corporations’ current infrastructure the place they’re,” Ranade stated. “The pandemic was truly a reaffirming second for us. Our know-how is expressly designed to deal with shocks — instances the place previous information not represents the longer term. The pandemic confirmed that our know-how drives vital, measurable outcomes for our prospects, particularly in extremely risky choice environments.”

Picture Credit: Area

The closing of Area’s Sequence A at the moment marks the corporate’s first exterior elevate, Ranade tells TechCrunch. The enterprise had grown “profitably” up so far. However Ranade and Ural believed that going the enterprise route would permit them to broaden Area’s core know-how whereas rising into industries akin to manufacturing, renewable power and monetary companies.

It’ll actually want a considerable warfare chest to compete within the rising marketplace for information analytics merchandise. O9 Options, which applies analytics to the availability chain and stock planning and administration, just lately raised $295 million in a funding spherical that values the corporate at $2.7 billion. Unsupervised, Pecan.ai and Noogata compete extra instantly with Area, delivering instruments designed to make predictions about metrics like buyer lifetime worth, churn and retention, gross sales and on-time deliveries.

xCash flows freely the place it issues enterprise analytics — the worldwide large information and enterprise analytics section may very well be price almost $700 billion by 2030, depending on which analyst you place your religion in. However the problem for distributors like Area is convincing potential prospects that they’ll ship on their guarantees. A recent NewVantage Companions survey discovered that many established corporations proceed to wrestle of their efforts to change into “data-driven,” with lower than a 3rd saying that they’ve a “well-articulated” information technique. For a lot of — significantly small- and medium-sized companies — the return on funding remains unclear.

Area’s headcount stands at 50 individuals at the moment, 90% of whom are members of the engineering, information science and product improvement employees on the startup’s downtown workplace. Ranade didn’t reply to a query about whether or not Area plans to rent throughout the subsequent yr.

Source link