AMD has surged these days amid geopolitical tensions, a CHIPS invoice and earnings. Is it a purchase?

[ad_1]

Justin Sullivan

Superior Micro Units (NASDAQ:AMD) sits on the intersection of a number of catalysts, creating crosscurrents that traders would possibly discover tough to navigate. Most just lately, the inventory slipped within the wake of the semiconductor maker’s quarterly outcomes. Nevertheless, shares instantly bounced again in Thursday’s motion, placing them on monitor for his or her sixth larger end prior to now seven periods.

Among the many different elements impacting investor decision-making, international tensions between China and the U.S. threaten to additional exacerbate a chip provide disaster. Partially in response to this hazard, Washington is engaged on a CHIPS invoice meant to encourage U.S.-based manufacturing.

Given this macro backdrop, is AMD a purchase even after its current upswing?

Earnings, Geopolitics & Laws

Earlier this week, AMD (AMD) reported robust Q2 earnings. Shares dipped within the speedy aftermath, nonetheless, dragged down by issues in regards to the firm’s guidance.

For the newest quarter, the corporate earned $1.05 a share on $6.55B in income. This was aided by 83% progress in knowledge heart gross sales. The chip large additionally noticed energy within the firm’s shopper section, which incorporates PC processors, as gross sales rose 25% year-over-year to $2.2B.

Turning to the macro points, strain continues to mount on the semiconductor market with China and the U.S. centered on Taiwan, the house to Taiwan Semiconductor (TSM), a pivotal piece within the chip world. House Speaker Nancy Pelosi went to Taiwan this week, the place she met with semiconductor trade leaders.

Including additional gasoline is the current CHIPS Act that has been handed on a bipartisan foundation and is anticipated to enter regulation. The invoice will embody $52B in subsidies for home manufacturing and a beforehand reported funding tax credit score for chip crops. The invoice not solely will lend assist to AMD however to others together with NVIDIA (NVDA) and Intel (INTC).

AMD has been on tear just lately, though this has solely reduce losses it posted earlier within the 12 months. Shares are down about 30% for 2022. Nevertheless, over the previous 16 buying and selling periods, the inventory has surged about 36%.

The inventory has resulted in constructive territory in 13 of the final 16 buying and selling days. In the meantime, the inventory has climbed an extra 6% in Thursday’s intraday buying and selling.

AMD has underperformed its INTC for many of 2022. Nevertheless, the current surge has allowed the inventory to catch as much as its closest rival. For the reason that starting of July, AMD has climbed about 33% (not together with Thursday’s positive factors). INTC is principally flat throughout that point, inflicting some traders to surprise if that inventory has develop into an undervalued buying opportunity.

Is AMD a Purchase?

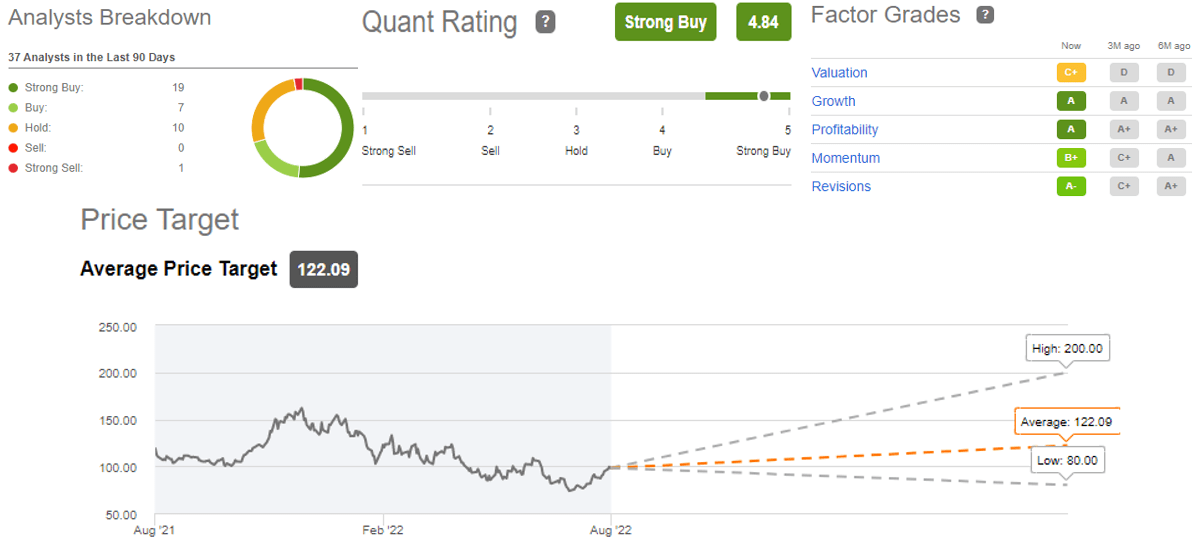

The overwhelming share of funding analysts on Wall Road view AMD from a bullish perspective. Solely one of many 37 analysts surveyed by Seeking Alpha have labeled the inventory as a Sturdy Promote, with one other 10 seeing it as a Maintain.

In any other case, the analyst neighborhood has expressed optimism. This takes the type of 19 Sturdy Purchase scores and 7 Purchase opinions.

The typical worth goal sits at $122.09 a share, which is roughly $20 larger from the inventory’s present $102 a share worth. The outliers see the inventory as excessive as $200 a share and as little as $80 a share.

Seeking Alpha’s Quantitative Ratings additionally level to a bullish outlook, culminating in a Sturdy Purchase sign. The system of grading quantitative measures provides AMD an A for each progress and profitability. The inventory will get a B+ for momentum and a C+ for valuation.

See a whole breakdown of AMD’s scores beneath:

Looking for Alpha contributors concur with the bullish stance. As an example, Stone Fox Capital labeled the company as a Strong Buy, stating “After one other booming quarter, Superior Micro Units ought to lastly commerce again above $100 for good.”

Moreover, Steven Cress, head of quantitative methods at Looking for Alpha, sees optimistic indicators for AMD. He stated: “Regardless of Info Expertise being -18.2% YTD, beaten-down progress shares with nice fundamentals and engaging valuations stand to learn.” Cress feels that Superior Micro Units is one of these stocks.

Source link